Retirement Planning

4 out of 5 Indians will end up outliving their Retirement Savings

To be part of the 20% who will retire comfortably, you need to start early, be disciplined, prioritize your retirement and take measured risks by investing into growth assets. The good news is, you probably have time on your side - and time is your best friend when it comes to wealth creation through compounding. Speak with an expert on your customized retirement plan today.

What is Retirement Planning?

Retirement Planning is the disciplined accumulation of a planned amount of money, by a specific target date. This money must be sufficient to provide you with an inflation-proof income that will comfortably outlast you, as well as your dependent partner. In addition, this fund must be large enough to take care of medical emergencies, allow you to travel, as well as enjoy the free time you will have at hand once you stop earning!

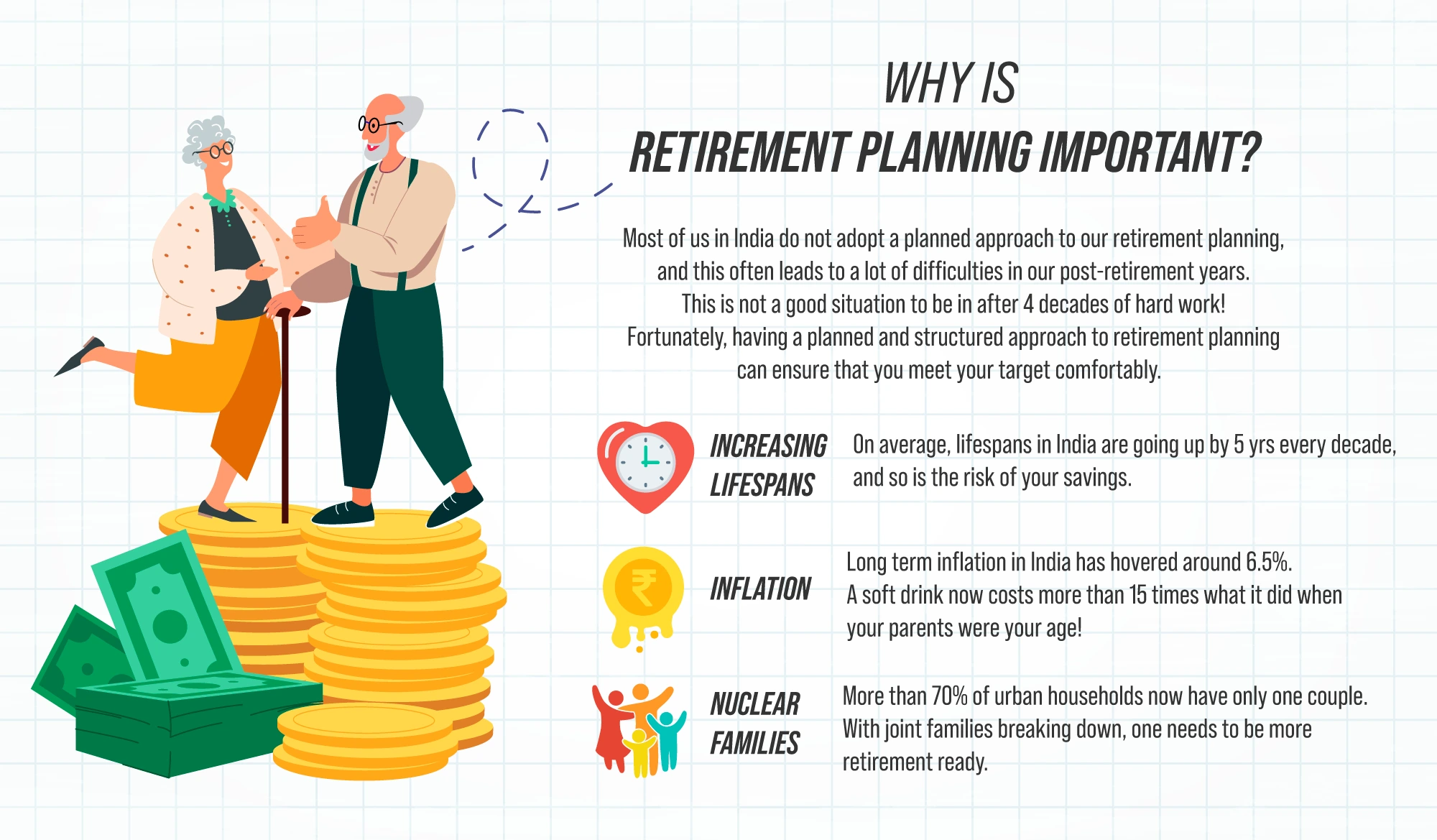

Why is Retirement Planning Important?

Most of us in India do not adopt a planned approach to our retirement planning, and this often leads to a lot of difficulties in our post-retirement years. This is not a good situation to be in after 4 decades of hard work! Fortunately, having a planned and structured approach to retirement planning can ensure that you meet your target comfortably.

Start your Retirement Planning today!

Retirement Planning – things to keep in mind

Time is you friend – start early

Retirement Planning is one goal in which you can truly reap the benefits of compounding. Even if you start at the age of 30, you will have three decades to build up a solid corpus for your retirement. The earlier you start, the lesser you will need to put away over time.

Crunch the numbers – don’t make guesses

Factors like inflation, retirement age, life expectancy and currently saved up retirement assets must be considered while drafting a retirement plan. Although the plan can always be revised later, it is very sensible to set up a clear goal post instead of relying on some arbitrary number like 1 Crore or 5 Crores.

Leverage the power of step-ups

Because Retirement Planning is a goal in which the target will be large, it’s normal to feel daunted at first. However, the good news is that you can start with what is comfortable and step up your monthly savings on auto pilot. Over time, this can make a huge difference to your wealth creation.

Take Measured Risks

The best way to save for your retirement is to start small, start early, and go aggressive! In case you are a naturally risk averse person, you should work with a professional expert to understand risk and reward, and to set up a great investing process that will reduce risks over time. Remember, the difference between 8% and 13% can be a 3X higher retirement corpus when your goal is 30 years away!

Frequently Asked Questions – Retirement Planning

Should I invest in LIC and PPF for Retirement Planning?

Although something is definitely better than nothing when it comes to saving, both LIC and PPF are actually poor choices for retirement planning. Ideally, you should invest into aggressive small and mid cap funds for your retirement, after a careful understanding of risks and setting expectations properly.

Which is the best retirement plan in India?

Unfortunately, if you were to search for ‘best retirement plan in India’ online, the top results would be pension plans by life insurers as they would have monopolized paid searches for this term. Be careful not to invest into these plans as they do not provide great long term returns.Even the so called good pension plans in India will provide FD-like returns over a long timeframe. Instead, work with a qualified expert on setting up a retirement planning goal and investing for it systematically. Preferably, choose high risk/high return funds that would maximize your rupee cost averaging and compounding benefits.

How to maximize retirement savings?

To maximize retirement savings, make sure that you do not delay your retirement planning. Every passing year can have a huge impact on your final corpus. Also, avoid low yielding investments and focus on taking measured risks in aggressive mutual funds through the SIP route. Even the best pension fund in India cannot compare to the wealth creation potential of equities in the long run.

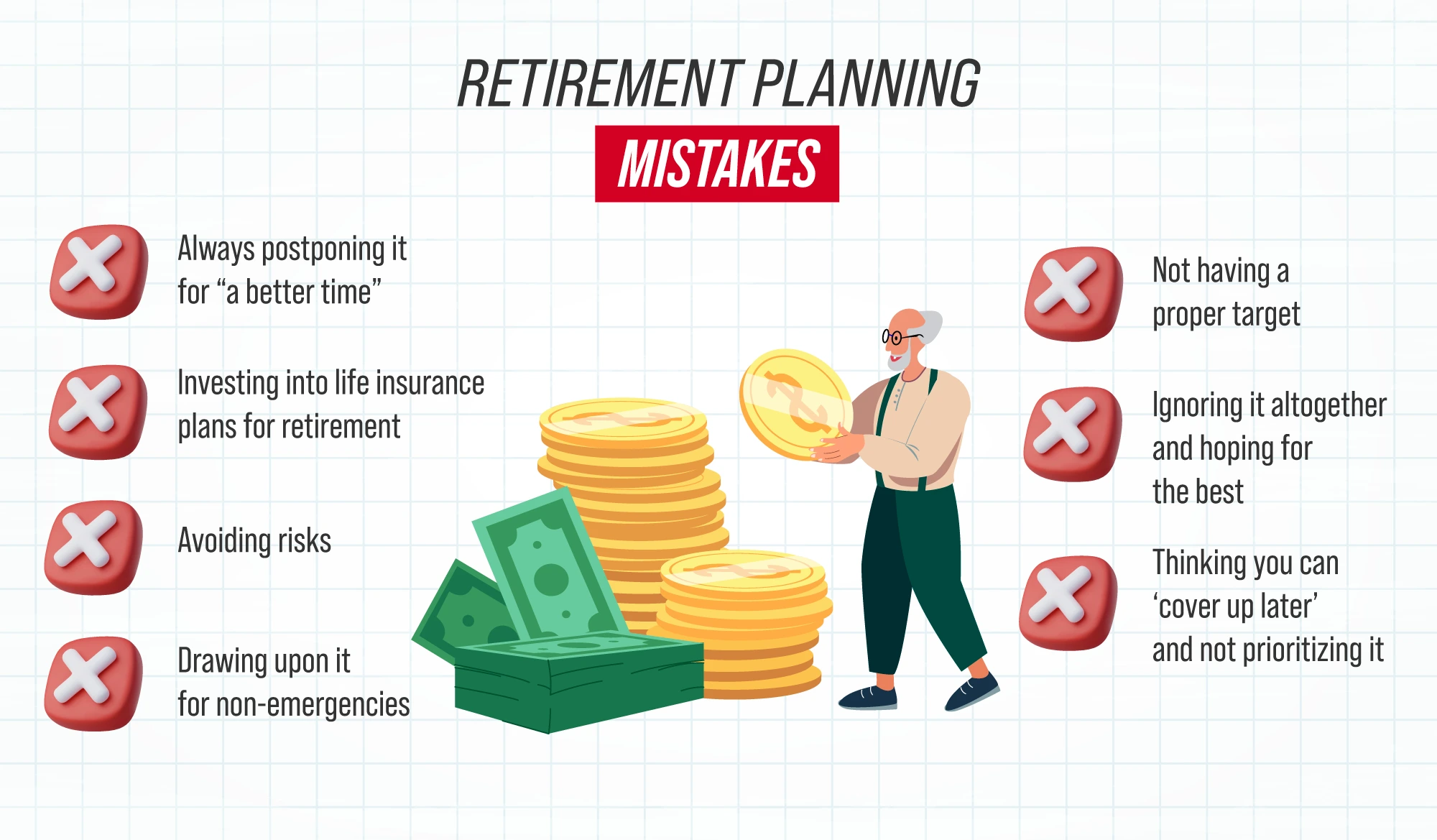

What is the most common Retirement Planning mistake?

The most common mistake would be to delay your retirement planning investment or to approach your retirement in an ad hoc manner. This is actually very normal because the goal is 20 or 30 years away, and it is a natural human tendency to not attach much significance to a payoff that is so many years away.

What is the role of Mutual Fund SIP’s in Retirement Planning?

Mutual Fund SIP’s can play a very important role in Retirement Planning and are the investment for retirement. Their unmatched flexibility allows you to tailor make your retirement savings plan to any goal tenor. Also, they give you the option to start off small and step up our monthly contributions automatically. What is important is that you continue your investments in a disciplined manner for the long term, without falling prey to behavioural biases.

Should I invest into NPS for my retirement?

The NPS is definitely one of the better retirement plans for individuals compared to fixed income instruments or life insurance. However, the mandated cap on equity allocation as well as the forced annuity purchase with part of the final proceeds makes it a sub optimal option. Mutual Funds are the best investment plan for retirement in India.