Best Investment Planning Platform for Mumbai’s Smart Investors

Mumbai, the financial capital of India, is much more than just a bustling metropolis. It is the gateway to India’s trade and commerce, contributing significantly to the country’s economic progress. With satellite cities of Navi Mumbai, Thane and Dombivili becoming centres for growth, Mumbai and the Greater Mumbai region has become a formidable economy in itself.

Known for its fast-paced lifestyle, the city of Mumbai hosts not only the largest stock exchanges in the country but also some of the biggest financial institutions, multinational companies and entrepreneurial ventures. Some of the names headquartered in Mumbai are Reliance Industries, Tata Sons, ICICI Bank, HDFC Bank and many more.

But managing wealth efficiently becomes challenging in this fast paced city. With rising aspirations, lifestyle expenses and an abundance of opportunity, a financial planner in Mumbai will help in building sustainable wealth over the long term. In this context, having an investment expert becomes not just a luxury but a necessity. Let's explore why Mumbai is at the heart of wealth creation and why partnering with the right investment platform can be a game-changer for investors.

Why FinEdge is the best Investment Platform for 'Mumbaikars'

Why FinEdge | Customised Investment Plan | Best Financial Advisor

Your Investing Experts

Mumbai: The Gateway of Business, Trade and Commerce

Historically, Mumbai has been at the forefront of India’s economic expansion. Its strategic location makes it a gateway for international trade, with one of the busiest ports in the world handling goods from across the globe. The city is home to the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), both of which form the backbone of India’s financial markets. Mumbai’s economy thrives across multiple industries, including banking, finance, textiles, pharmaceuticals and technology. The media and entertainment are other mainstay industries of Mumbai. With glitz and glamour at the forefront, Mumbai attracts talent from across the country to make their dreams come true in the City of Dreams.

The city’s role in India’s economy is also worth mentioning—accounting for nearly 6% of the country's GDP and contributing to about 33% of income tax collections. Its cosmopolitan nature attracts people from all walks of life, leading to a vibrant culture of innovation and entrepreneurship. With great economic opportunity, however, comes the need to create and manage wealth to keep pace with the city's increasing lifestyle and inflating expenses. Being the most expensive city in the country, Mumbai is also becoming one of the most expensive cities in the world and this fact needs immediate attention to secure one’s financial future.

Importance of a Financial Planner in Mumbai

In a city where life moves at lightning speed, household Investment planning and personal finance often take a back seat. Like anyone who goes for a physical health check to a doctor, a similar financial health check from an expert is equally important. The financial health check would look into areas of household finance that would need immediate attention and rectification. An example of this is to understand personal financial health ratios. Your Saving to Surplus ratio would suggest the percentage of monthly surplus being invested through an auto mode like a Systematic Investment Plan (SIP). The Debt to Income ratio suggests the amount that is being paid as EMIs in relation to your monthly salary. If these ratios depict an adverse scenario for your household finances, corrective measures can be employed with the help of an investment expert.

It is also important to note that with career growth, enhancing lifestyle and emerging family responsibilities, individuals may find it difficult to focus on long-term wealth creation.

An investment expert is not just an expert on various investment asset classes like Direct equity, Mutual Funds, Bonds etc but also plays an important role in keeping you on track with your long-term objectives. Investment experts are crucial in this scenario because they bring a structured, goal-based approach. They understand the importance of staying invested during market ups and downs while helping individuals stay on course towards achieving their financial goals. In Mumbai’s dynamic environment, it is essential to have an investment expert who can align investments with personal goals, whether it is buying a house, funding your child’s education or planning for retirement.

A good investment expert offers personalized strategies that align with your financial goals, risk appetite, and investment horizon. They also help you optimize tax benefits and make informed decisions during critical life events like buying a home or planning for children’s education. Having the right financial planner in Mumbai ensures that your wealth grows steadily even in unpredictable markets, which is vital for anyone living in a high-expense city.

A recent example of when an expert has been of most value to investors is during COVID pandemic. The markets had fallen almost 40% in 3 months which led to widespread panic amongst the investing community. An investor who was supported by an expert would have been reminded of his goals rather than temporary corrections in the market. Once the markets recovered and went through a bull run, the investors were able to create sizeable portfolios by staying invested and not getting swayed by irrational market fluctuations.

How to Choose the Right Financial Planner in Mumbai

Choosing the right financial planner in Mumbai involves several considerations. Look for professionals with a deep understanding of the city’s financial ecosystem and a focus on long-term wealth creation. Check their track record, client testimonials specifically reviews on public platforms like Google and certifications to ensure credibility.

The investment manager should also offer a goal-based approach, focusing on your financial aspirations rather than just selling products. Transparency in communication and ease of access are equally important—especially in a city where every minute counts. Make sure your investment manager is equipped with technology platforms that offer seamless tracking and real-time updates to stay connected with your investments.

Why FinEdge’s "Dreams into Action" Investment Platform Is the Perfect Fit for Investors in Mumbai

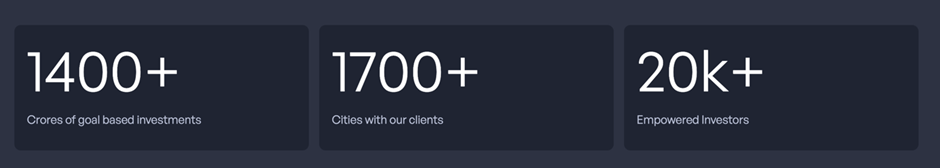

FinEdge brings a perfect blend of hyper-customisation, technology and goal-based investing, making it the ideal investment platform for the people of Mumbai . With its "Dreams into Action" platform, FinEdge offers personalized investment solutions specific to individual financial goals. Whether you’re planning to buy a home, save for your child’s education or build a retirement corpus, the platform ensures that every investment aligns with your goals and objectives.

The importance of long-term wealth creation in Mumbai’s ever-evolving financial landscape is important and we at FinEdge believe that one must stay invested for long and be highly goal focused to achieve that. The platform combines expert-managed portfolios with a user-friendly interface, allowing investors to track progress, rebalance portfolios, and stay on course toward achieving their goals. With a focus on creating sustainable wealth, FinEdge empowers individuals to navigate the fast-paced life of Mumbai without compromising on their financial future.

In conclusion, Mumbai’s dynamic environment offers unparalleled growth opportunities, but it also demands investing for the future. With the right investment strategy and a trusted partner, individuals can turn their dreams into reality and be financially secure. As the gateway to India’s trade and commerce, Mumbai is truly a city of possibilities—where every smart investment counts toward building a prosperous future.

What Our Clients Say About Us

"Really good people and they give very good advice regarding financial investments."

"My financial advisor Ms. Anshu has been exceptional, providing clear, personalized advice that has greatly improved my financial strategy. Her expertise and dedication give me complete confidence in my financial future." Thank you FinEdge!!

"I had long relationship of 9 years, for my financial growth and right advice. I am happy on the overall service and guidance they are provides for the financial planning and growth."

"There's a long and Very beautiful relationship with FinEdge. I must say that I never even get any reason to be disappointed. I always strongly recommend Finedge to my near and dears if anyone need a trusted advisor. I am 100% satisfied with their way to advise and support. Always ready to listen my query and resolve asap without any unnecessary delay. Earlier I was in touch with Deepika & Now Akshat is there. With both of them, I felt equally comfort & trusted connection. I am always thankful for their support Very ethically. Would love to be with FinEdge for long and long time"

"I got a recommendation from one of my friends for FinEdge who is already associated with them for more than 5 years. Now its been more than a year and I’m highly satisfied with my portfolio with them as it outperformed my existing portfolio! I’ve been guided by Kritika. I must say these people are highly professional and focused to their clients’ requirements. They will fully understand our short term and long term needs first and then create an investment plan based on the risk one can take. They are always available to guide us and clear any doubts as and when required!"

Your Investing Experts

Related Articles

Why Pune Needs Investment Experts Who Understand Long-Term Wealth Creation

Consult with the best financial advisor in Pune for financial planning and strategies. Get expert advice from certified financial planners.

Why Bangalore Professionals Need Investment Experts to Manage Their Portfolio

Consult with the best Portfolio Managers in Bangalore for investment planning. Invest for your goals through experts.