SuccessStories

At FinEdge it was always reinforced that these investments are linked to my goals and meant to be utilised a few years down the line

I started investing through FinEdge around 9 years back and back then had limited understanding on aspects of my personal finance. I wanted to start with my investments as at that point of time it seemed like the right thing to do. However, through this period of investing I realised that to invest is the easiest thing to do but to stay invested can sometimes be tough.

When I got into a detailed discussion with my Investment Manager, I started getting more clarity and understanding on my own personal finance. I created a goal for purchase of my house in Bangalore and started investing towards it.

Like I said, to stay invested had not been easy. At times I used to be concerned with the up and down movement in the markets. It was the goal focus approach of FinEdge that helped me here. I was able to not let these swings affect me much. Also, it helped that at FinEdge it was reinforced that these investments are linked to my goals and meant to be utilised a few years down the line so short term market movements are irrelevant.

In 2021 we were able to finalise our property in Bangalore. My investment manager helped me through the entire redemption process and by February of 2022, I was able to complete my house purchase. Bangalore real estate is expensive and I had to also avail a home loan to complete the purchase.

I am happy that we live in our own house now and I have already started saving for my next few goals- prepayment of house loan and my daughter’s higher education. I feel happy to be in control of my personal finance and more importantly my goals.

Pratheesh Gangadhar

Texas Instruments India

Software Development Manager

Bangalore

Planning for my goals through FinEdge has been one of the best decisions that I had taken

Despite living in Goa, located far away from one of the best financial advisors now in Gurugram for managing my investments, it proves that geographical distance between advisor & investor does not matter. Back then in early 2012, we did not have many financial advisors in Goa. I started investing through FinEdge which was systematic as it was goal based. The most important thing of my interaction back then was the fact that I was highlighted the importance of investing for goals with milestones that I had in life.

I was able to calculate the value of my goals to begin with, and post that I started investing for it which was my daughter Shrisha’s expenses towards higher education & marriage, followed by my life after 60 years i.e. retirement & health. Initially, to me the goal looked far away and I was concerned how I would keep up with the discipline of investing for them. But my periodic interactions with my investment managers @FinEdge made me feel comfortable & confident of achieving them as planned.

In 2016, the first instalment of my daughter’s education fee was due. This was the goal I was saving money for and I was able to redeem my investments for this purpose systematically. Subsequently, I have been able to withdraw money at regular intervals for Shrisha’s education. She graduated in 2019 with her post graduate degree (M.E.) in Computer Science Eng (Specialisation in information security) from a BITS PILANI, Hyderabad campus.

In early 2023, we got her married and I was very happy and at the same time relieved as I could execute as I had planned well in advance for her marriage too. For most of these milestones, I had pre-planned my investments and that always gave me peace of mind. Further, reinforcement to maintain discipline came from my various Investment Managers at FinEdge who helped me throughout building my Financial Portfolio.

And finally, I am leading a retired man’s life travelling and seeing new places along with my life partner. Planning for my goals through FinEdge has been one of the best decisions that I have taken.

In a nutshell, the Financial Portfolio structured & managed by FinEdge gave me the financial edge to plan my Goals.

Sham Ramesh Wagle

Goa

As a single mother and to manage my finances well, it did require foresight and meticulous planning. FinEdge did just that!

In the midst of the pandemic in 2020 as chaos reigned supreme, I reached out to FinEdge to start off with a goal-based investment plan for my child’s higher studies. Interestingly, I did this as soon as I had applied for an adoption. My adoption formalities were in process but my child would only be with me in a couple of years, due to the time it takes for the process to come to conclusion. My discussions with my investment manager at FinEdge mostly revolved around my goal to secure my ‘yet to arrive’ daughter’s education :)

After waiting patiently my little girl - Inayat arrived at her new home. She has turned one and my disciplined investments are making sure that her future will be bright. At FinEdge, I was made to understand the importance of tracking essential financial indicators for a healthy financial life. Now I track all my financial ratios closely and have started investing for my retirement too. Through my discussions with my Portfolio manager at FinEdge, I am confident that I am on track to retire with a sizeable corpus in 22 years.

As a single mother and to manage my finances well, it did require foresight and meticulous planning. FinEdge did just that! On their platform, I was able to view and personalise my investing journey keeping my unique requirements in mind. Great responsibility rests on a single parent and especially a mother, and that’s where I felt that FinEdge added great value. I was not only given investing insights but behavioural insights too for a successful investing journey. I believe that the journey of investing is long and one should have a trusted partner who would be able to guide and navigate you through the ups and downs of the markets.

I am happy to have chosen FinEdge as that partner and hope my experience with them builds from strength to strength!

Shabani Hassanwalia

The Third Eye at Nirantar

Chief Editor

Delhi

Finedge’s foresight turned my long-term plans into stress-free milestones.

Finedge’s foresight turned my long-term plans into stress-free milestones.

Transitioning from a corporate salaried job to becoming an entrepreneur could have been far more challenging had I not been associated with Finedge. Their timely investment advice during my corporate years and a clear strategy for my daughter’s education, wedding expenses, and retirement made all the difference.

Thanks to their foresight and disciplined early-stage planning, I could handle my daughter’s educational expenses with ease and manage her wedding comfortably despite rising costs things I might have otherwise overlooked without their guidance.

Despite changes in advisors over the years, Finedge ensured seamless continuity. Each advisor picked up effortlessly from where the predecessor left off, maintaining the same structured approach and long-term vision that has been invaluable in achieving my financial goals.

Gururaj Laxmanan

Self-Employed

Bangalore

I have become focused and disciplined towards my investments and have decided to keep my liabilities in control

In the software industry, we work long hours, which is not very helpful when it comes to taking out time for our own personal finances. I needed a professional expert to understand my financial health and to let me know if I need to take any corrective measures regarding my finances.

It was then that I was referred by a friend to FinEdge. Earlier I had been only investing in an Insurance Policy. During discussions with my Investment Manager on my investment plan, I was told that treating insurance as an investment could be detrimental to my overall portfolio.

I also had liabilities to cater for. I had been paying almost 60% of my monthly income in form of EMIs for my Home loan, car loan and a personal loan. Also, I concluded that my retirement is a key goal and I have not been paying much attention towards creating a fund for it. So the problems were many.

My investment manager made me prioritise paying off my loans and getting rid of my liabilities first. So we prepared a plan for prepayment of my loans. With his help, I was also able to prioritise my other two goals which are retirement and my children’s education. I understood that it is never too late to start the journey of goal achievement as long as the right processes are followed.

Now, I have become more focused and disciplined towards my investments to achieve my goals and have decided to keep my liabilities in control. Thanks to FinEdge, I have started walking on the path towards my goals which is battle half won.

Kurupati Venkata Sunil

Dell Computers

Senior Principal Software Engineer

Bangalore

FinEdge has been instrumental in providing timely advice and making necessary adjustments to keep me aligned with my goals.

I'm Madhumathy Sundararaj, working as the Director of Recruiting at Tekarch, and I reside in the city of Coimbatore. Let me share with you my journey with FinEdge.

I am a young mother to my 8 year old son, Arjjun. My primary focus has been to securing his future, and for that I knew that I had to save and invest wisely. In the midst of it all and due to a life event, I had to stop my investments temporarily. However, I was determined!

And so I once again aligned my investments to my goals and objectives. My first and foremost goal was to ensure that Arjjun's higher education would be well funded. Together with FinEdge, we made an investment plan for this goal achievement. I was so happy to see my investments take shape and in sync with my son’s future. I also realized the importance of planning for our own retirement. With FinEdge's expertise, we started building a retirement fund, ensuring that our financial future would be secure too.

It hasn't always been smooth sailing. The COVID-19 pandemic brought about some career changes, and I switched organizations during that time. However, one thing remained constant – my commitment to my SIPs (Systematic Investment Plans). I understood the significance of not breaking these investments, knowing that discipline and consistency is the key to my success to achieve my goals. My husband has been my biggest support system during that time when I couldn’t afford to continue the SIPs, he filled in and till date he’s religiously making sure the SIPs are taken care of first. FinEdge has been instrumental in providing timely advice and making necessary adjustments to keep me aligned with my goals. With them, I've always felt like a valued client.

I look forward to reach the finish line of my investing by achieving my goals with able support from FinEdge!

Madhumathy Sundararaj

Tekarch

Director - Recruitments

Coimbatore

I feel that I am more aware of what it takes to invest long for your goals

I had been investing for sometime but was mostly on an adhoc basis. Most of my investment decisions were influenced by my friends or family. As the markets were looking on the upside, I was mostly happy with my investments and on an ongoing basis kept investing randomly.

Until March 2020, when COVID hit the markets and I saw my portfolio value come down drastically. I was not prepared to see losses in my investments. And that’s why I decided that I would stop all my investments and redeem everything even if it was at loss.

It was then that my investment manager spoke about my goals and how it was important to stay focused on them. My goals at the time were to plan for my retirement and my daughter – Myra’s education. I stuck on and stayed invested. My good fortune that markets were back in the positive in no time and my losses, turned profitable. Staying patient was rewarding as I was able to see the longer term picture.

Today in addition to my existing goals, I have added 3 more goals that I would want to achieve by investing, which includes my new born daughter – Inaya’s education. Infact, before I take any financial decision, I consult with my investment manager to find out how it would affect the achievement of my future goals.

Now I feel that I am more aware of what it takes to invest long for your goals. My investment manager has been by my side and has been most reassuring when it was most needed. Thank you.

Vikrant Verma

Zones Corporate

Project Manager

NOIDA

My trust in FinEdge has grown substantially over the years

I began my investment journey with FinEdge back in 2014, and little did I know that this decision would prove to be a game-changer during a challenging period in my life. Life is unpredictable, and in 2020, I faced the looming possibility of a job loss. It was a stressful time, but FinEdge stood as a pillar of support throughout this ordeal.

One of the key reasons I appreciate FinEdge is their unique approach to investing, which they aptly term as the "Bionic" investing model. Instead of replacing human touch with technology, they believe in using technology to empower investors, and my experience with them has reaffirmed this belief. My portfolio manager, in particular, played a pivotal role during this turbulent phase.

When I approached my portfolio manager with my concerns, I was met with a remarkable level of understanding and empathy. He didn't just offer me a canned solution; instead, he took the time to truly understand my situation. His suggestion to decrease my SIP (Systematic Investment Plan) amount was a practical one. This adjustment allowed me to maintain a comfortable balance in my bank account, ready to tackle any unforeseen expenses that might arise during this uncertain period.

What truly sets FinEdge apart is their flexibility. I was also able to withdraw portions of my investments whenever I felt the need, providing me with a sense of financial control during my toughest times. This support and adaptability allowed me to maintain financial independence and self-sufficiency during a period when many might have needed to seek external financial assistance. As a result, I am now actively building an emergency corpus for myself, ensuring that I am better prepared for any future uncertainties.

My trust in FinEdge has grown substantially over the years, and I have wholeheartedly recommended their services to numerous friends who were looking to kickstart their investments. The fact that these friends have expressed their gratitude to me for introducing them to FinEdge speaks volumes about the outstanding work this platform is doing. In a landscape where trust and mutual respect in financial services are often lacking, FinEdge stands out as a beacon of integrity and support. They have not just earned my trust; they have become an integral part of my financial journey.

In conclusion, my experience with FinEdge has been nothing short of exceptional. They have not only provided me with a robust investment strategy but have also demonstrated unwavering support during challenging times. If you are seeking a seamless, convenient, and paperless investment experience, backed by a team of dedicated professionals who genuinely care about your financial well-being, then FinEdge is the platform you can trust

Rajesh Kumar (M.Tech IIT Roorkee)

Prabha Energy Ltd

Deputy General Manager

Dhanbad

“They do what’s right for me. They don’t recommend investments that don’t align with my goals, always prioritizing my best interest.”

My association with FinEdge has remained positive both in terms of my investments and the relationship I share with my Portfolio Manager. FinEdge has been an important partner to me and I would like to say that they do what is right for me. They don’t sell investments that don’t align with my goals, prioritizing my best interest.

My trust in FinEdge has grown and they have become partners for my goals and their achievement. My relationship with my portfolio manager has remained strong and I do share a level of trust with him. I particularly like the process followed by FinEdge for investing as I feel is well researched and adds value to me.

My association with FinEdge has remained positive both in terms of my investments and the relationship I share with my Portfolio Manager. FinEdge has been an important partner to me and I would like to say that they do what is right for me. They don’t sell investments that don’t align with my goals, prioritizing my best interest.

My trust in FinEdge has grown and they have become partners for my goals and their achievement. My relationship with my portfolio manager has remained strong and I do share a level of trust with him. I particularly like the process followed by FinEdge for investing as I feel is well researched and adds value to me. Their investment platform called ‘Dreams into Action’ has been a very enjoyable experience. I have been able to visualise my investment roadmap so clearly on this platform. It has helped to me to set my objectives right and build an investment plan to meet these objectives.

I consider FinEdge more than a financial advisory firm, but a constant part of my life, always ready to offer a helping hand, provide sound advice and offer support in matters when needed. With FinEdge, I've found not only financial guidance but also lifelong friends!

Ankur Arya

Merchant Navy

Captain

Gurgaon

The FinEdge platform has helped me to take better control of my finances. It has also increased my financial awareness and along with it understanding of having a plan to achieve my goals.

Glad to be part of FinEdge Family. I have been associated with FinEdge for a couple of years now, and the experience so far has been fantastic. They have an excellent and knowledgeable team and they use top notch technology to improvise the experiences for their clients.

My investing journey with them changed when my relationship manager introduced me to their investing platform called ‘Dreams into Action’. Thanks Paras..!! It has been an eye opening experience to see my financial situation presented in front of me and that too real time.

This platform has helped me to take better control of my finances. It has also increased my financial awareness and along with it understanding of having a plan to achieve my goals.

What sets the platform apart is its ability to present different situations and scenarios of my Investments and guiding me accordingly on my financial path. The platform provides insights and recommendations, helping me to make informed decisions aligned with my goals. Thanks Again Paras, with you as my relationship manager I am rest assured that my finance is in safe hands.

Thanks FinEdge..!! Keep Rocking!

Manish Kumar

WNS Global Services

Associate Vice President

Bangalore

“I couldn't be happier with how my investing journey has turned out, all thanks to FinEdge and their incredible platform, Dreams into Action

I couldn't be happier with how my investing journey has turned out, all thanks to FinEdge and their incredible platform, Dreams into Action. Right from the beginning, I was determined and goal oriented, with a clear vision of what I wanted to achieve - saving for my children Bindra and Yuvraj's education and securing my retirement. Yuvraj's recent selection into the CSE program at IIIT Diu, was a moment of immense pride for our family. It was a testament to his hard work and dedication, and I couldn't have been happier. This success was not just his alone but was a result of our collective effort and sound financial planning.

For the coming year, Bindra is aiming high, with her sights set on the combined BBA+MBA program at IIM Indore. Her determination and focus are truly commendable, and it's heartening to see both my children pursue their dreams with such zeal. Throughout this journey, I have remained extremely focused in my commitment to our family's financial goals. I knew that achieving these milestones would require disciplined investing and careful financial planning. That's where FinEdge's Dreams into Action platform came into the picture.

I can't praise FinEdge's Dreams into Action enough for its role in our success story. It is a user friendly and a comprehensive investing platform that aligns perfectly with my financial goals. It helped me create an investment plan that catered to my specific needs of my children's education and my retirement. Infact, I was able to purchase a high end SUV last year based on a goal that I had planned for on this platform.

One of the most impressive features of Dreams into Action is the flexibility it offers. As our financial situation evolved, I could adjust my investment portfolio accordingly, ensuring that we always stayed on track to meet our goals. FinEdge's platform also provided me with regular updates and insights into my investments, giving me the confidence that I was making the right choices. The expert advice and support from their team have been invaluable, guiding me through every financial decision.

Today, as I see my children working diligently towards their dreams, I know that their bright futures are secured, thanks to our focused approach and the support from FinEdge. I would encourage anyone with clear financial goals to explore FinEdge's Dreams into Action. It has been an integral part of our success story, and I have no doubt it can help others achieve their financial aspirations too. My investment story says that with dedication, discipline, and the right partner, you can turn your dreams into reality!

Girish Kumar CSP

Silox India Private Ltd.

AGM HR, Admin & Security

Jambua, Gujarat

How FinEdge helped me………..to stay invested and trust the process!

Back in 2016, based on a friend’s recommendation I started investing through FinEdge.

I invested through SIP’s and I aligned those investments towards my goal of buying a Villa for my retirement. Everything was smooth until 2020 when news about COVID started appearing. I started considering moving out of equity to protect my investments. My investment manager advised me that it would be detrimental to time the market.

Rather, he structured a plan of de-risking my portfolio and simultaneously starting Systematic Transfer Plans (STP) so that I do not sit out of the market. Whenever I was troubled by global events, FinEdge was always ready to take my views and offered recommendations best suited to my unique needs and my risk appetite.

Thanks to FinEdge, I’m a strong believer that discipline is a critical factor in investing and so is long term vision!!

In early 2023, my investing experience with FinEdge went a notch up when we redeemed a part of my portfolio to buy my villa in Chennai. My objective achieved!

I can strongly recommend FinEdge for their domain expertise, use of technology and strong processes that have made a significant contribution to my financial life.

R Ganesan

Partner in Top Consulting Firm

Faridabad

India’s best investing platform

Google Reviews

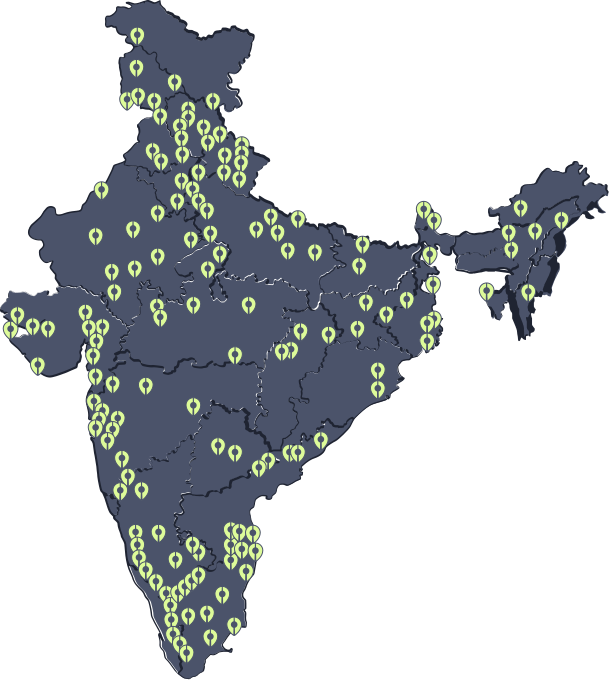

Clients Trust Us In More Than 1700 Locations In The Country

Top Companies Where Our Clients Work

- Govt of India

- Tata Group

- Amazon

- HDFC Bank

- Infosys

- Oracle

- Accenture

- Cognizant

- SBI

- Armed Forces

- Reliance Group

- Genpact

Immersive investing