Active vs Passive Mutual Funds

Where should you invest?

On a 5 year basis, only 96% of large cap funds have under-performed their benchmark...

However, 86% of small cap funds, 45% of mid cap funds and 42% of flexi cap funds have successfully beaten their underlying benchmarks.

Choose wisely!

Attain Financial Freedom

Active or Passive?

The debate on Active vs Passive mutual funds has raged on for quite some time now. While the proponents of actively managed funds swear by their ability to outperform indices and call passive investing “lazy”, the supporters of passive funds point out that a very large number of so called actively managed funds have been unable to beat their underlying benchmarks over 3 and 5 year bases, despite charging hefty fees to investors.

As is the case with most things, the truth lies somewhere in between!

The main performance problem lies within the sphere of large cap and large & mid cap funds. This isn’t really the fund-manager’s fault – in 2018, SEBI narrowed the definition of large cap stocks to include only the top 100 listed companies (by market capitalization). Now, with their range of motion made so narrow, it becomes very difficult for any fund manager within this space to

make any exceptional stock bets that can truly end up outperforming indices. Moreover, the top 100 stocks are very heavily traded and have very high information symmetry, so getting into a trend ahead of time is exceptionally difficult.

A lot of large cap fund mangers are also guilty of ‘indexing’, that is – making sure that their portfolios are very closely aligned to the underlying benchmark, in order to avoid the possibility of any drastic underperformance. The unfortunate side effect being that by doing this, they are also giving up any scope of generating outperformance!

The choice for large cap investors is quite simple – switch to passive index funds such as a NIFTY or NIFTY NEXT index linked fund. You will end up saving costs without compromising on returns.

But wait! Actively Managed Funds are a critical part of your portfolio as well…

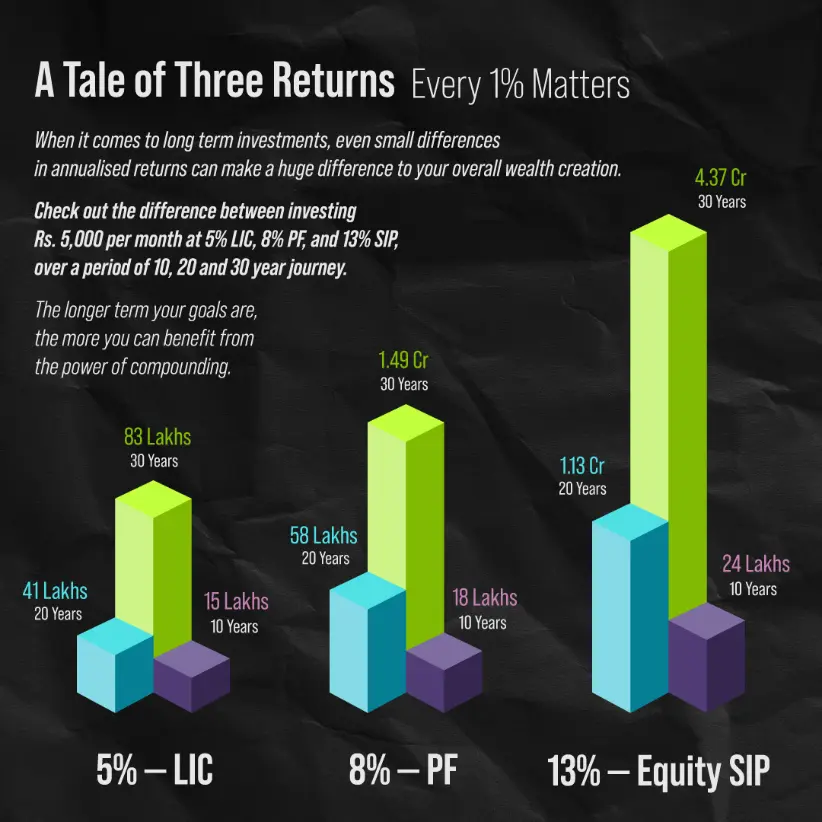

It is a well-known fact that when it comes to your long term goals, every 1% incremental return can make a huge difference to the end result. This is evidenced with investors who, for instance, choose to channelize their long term retirement funds purely into low risk assets like LIC and PPF. The difference can be in crores of rupees even when saving small amounts like Rs. 5,000 per month!

So, it also follows that when it comes to goals that are 10,15 or 25 years away, the endeavour should be to take measured risks in order to achieve that extra 2-3% CAGR that can make a huge difference to the amount of wealth created. For instance, investing in an actively managed small cap fund vs a small cap index fund is a good decision because actively managed small cap funds outperform passive funds on a 5-year basis, more than 80% of the time. The same applied for categories like mid cap, flexi cap funds, thematic funds and value funds. You can potentially earn higher returns than the underlying benchmark in these categories.

Whether you’re investing into active or passive funds, your investing behaviours will decide your returns in the end!

None of today’s Investment management platforms are geared towards build ‘resilience’ among investors by helping them manage their behavioural biases. Numerous studies have shown that when it comes to earning long term returns from non-linear investment asset classes, behaviours play a more important role than anything else - so this is a huge gap. Yet, pretty much all of the industry’s digitization efforts thus far have been geared towards onboarding clients quickly and effectively, while little attention has been given to how a 10,20- or 30-year investing journey will be effectively managed! After all, there is no easy solution to this because it requires a 180 degree shift in the way an advisor operates.

Our wealth creation platform – Dreams into Action (DiA) solves this problem effectively by negating the ‘returns centric’ mindset and transitioning investors to a ‘goal centric’ mindset. Users of DiA are a lot less likely to worry about market movements or succumb to common biases that plague investors who are fixated on returns. DiA-led investors remain invested longer, and are less prone to panic redemptions or fence sitting. Also, since DiA is a collaborative platform, it leaves room for Investment Managers to double-hat as behavioural coaches and hand hold you through 3-4 market cycles, post which you yourself become a lot more adept at managing your own emotions and behaviours!

Irrespective of the fund that you invest into, make sure that you follow these best practices to ensure that you create wealth from your investments! Without a proper process and management of investing behaviours, it wont matter whether you are investing into an active or a passive fund, because you wont remain invested long enough for it to make a difference!

Attain Financial Freedom