Top Mutual Funds 2025: Why Chasing Returns Doesn’t Build Wealth

- A data-backed look at 2023–2024 top-performing funds and why rankings keep changing

- Insights into why chasing short-term returns reduces wealth creation

- Expert framework for selecting mutual funds aligned with personal goals

- Updated 2025 perspective on long-term versus short-term investing

Each year, investors search for the “best mutual funds to invest in,” hoping to replicate past success. Yet, data shows that chasing last year’s winners rarely leads to wealth creation. True success lies in discipline, patience, and following a process, not prediction.

Why “Top Mutual Fund” Searches Can Mislead Investors

Every January, search engines fill up with queries like “Top Mutual Funds 2025”. The intent is simple, to find the “winning” funds that will outperform this year.

But markets don’t work that way.

Top performers change each year due to economic cycles, sector shifts, and investor sentiment. The real question isn’t “Which fund performed best last year?”, it’s “Which investment process can help me stay invested long enough to benefit from compounding?”

Consistent wealth creation doesn’t come from predicting short-term returns. It comes from investing resilience, the ability to remain invested, regardless of market noise.

Top Performing Mutual Funds: 2023 vs 2024

Let’s look at how quickly fund rankings can shift.

Top Performing Mutual Funds of 2023

|

Fund Name |

Category |

Returns |

|

Small Cap |

35.89% |

|

|

Small Cap |

34.36% |

|

|

Small Cap |

34.31% |

Top Performing Mutual Funds of 2024

|

Fund Name |

Category |

Returns |

|

Sectoral/Thematic |

53% |

|

|

Large & Mid Cap |

49% |

|

|

Focused Fund |

46% |

Notice how the top-performing categories changed entirely from small caps in 2023 to thematic and large-mid cap funds in 2024.

This volatility shows that “predicting the next winner” is an impossible and often counterproductive task.

Even within a single category, leadership can rotate rapidly, making last year’s “best” fund an average performer this year

Why Selecting the “Top Fund” Doesn’t Guarantee Long-Term Success

1. Chasing Returns Leads to Poor Timing

Investors who constantly switch funds based on short-term outperformance often buy high and sell low. This behaviour erodes returns over time and widens what’s known as the “behaviour gap”, the difference between investment performance and investor performance.

2. Performance Cycles Change Annually

Different fund categories outperform in different market conditions.

In one year, small caps may dominate; in another, large caps or sectoral funds take the lead.

Relying on short-term data can distort your long-term portfolio balance.

3. The Real Driver: Investing Resilience

Your success doesn’t depend on discovering the top fund, it depends on staying invested through cycles. Investors who resist the urge to switch funds frequently tend to benefit from the compounding effect that unfolds over time.

4. Process Over Prediction

Wealth creation is the outcome of a structured process, defining goals, setting expectations, reviewing periodically, and staying disciplined.

Focusing on process ensures long-term consistency, while focusing on predictions only amplifies anxiety.

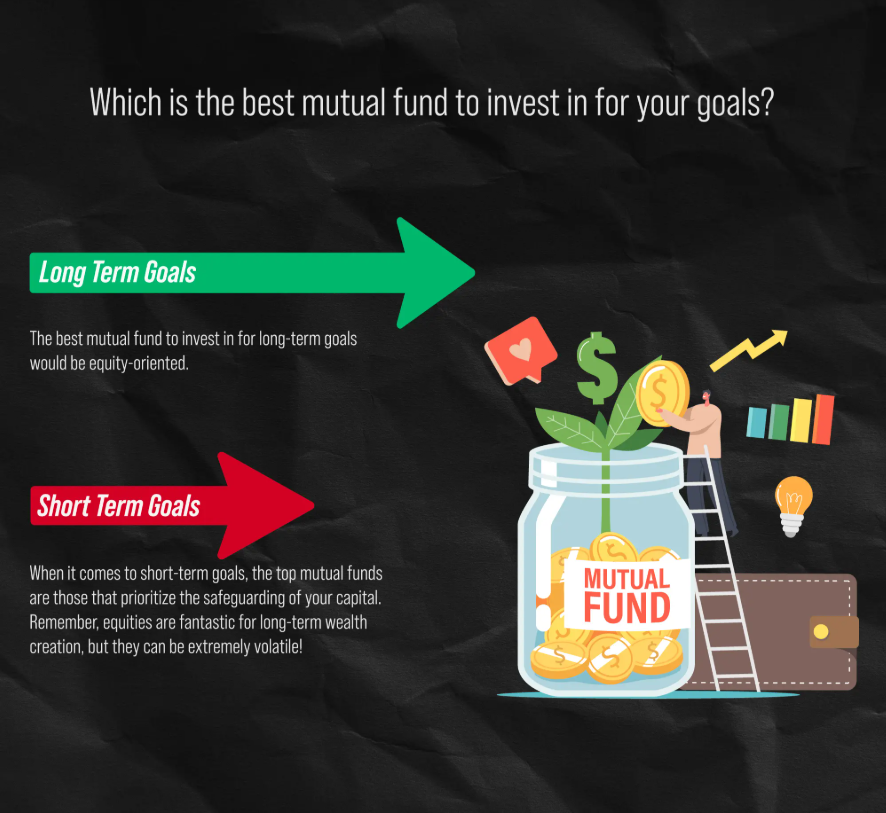

Which Mutual Funds Are Best for Your Goals?

For Long-Term Goals

Equity-oriented mutual funds work best for goals that are five years or more away, such as retirement or children’s education.

However, investors often approach long-term goals with excessive caution, preferring fixed-income instruments like PPF or endowment plans. While these offer stability, they limit compounding potential. Equity mutual funds, on the other hand, reward investors who remain patient and disciplined over long durations.

For Short-Term Goals

For goals due within three years, such as a car purchase, home down payment, or vacation, capital preservation should take priority. Opt for liquid, arbitrage, or short-term debt funds. These categories minimize volatility and safeguard your capital when liquidity is required.

How to Select the Top Mutual Funds to Invest in India

Selecting the best mutual fund to invest in requires structured evaluation, not reactive decision-making. Here’s a framework for selection:

-

Define Your Investment Goals – Clarify what you’re investing for and over what time horizon.

-

Research Fund Categories – Understand whether equity, debt, or hybrid funds suit your goals.

-

Evaluate Long-Term Performance – Look for consistency across 5–10 years, not 6–12 months.

-

Check the Fund Manager’s Track Record – Experience and tenure matter, particularly across market cycles.

-

Ensure Trueness to Label – A “mid-cap fund” should remain true to its category; avoid style drift.

-

Review Fund House Reputation – Strong governance and process orientation often correlate with stability.

-

Consult a Financial Advisor – Professional guidance ensures alignment between your financial goals, time horizon, and risk capacity.

SIPs are the Best Way to Invest in Mutual Funds in 2025

SIP investing is one of the most effective ways to build wealth systematically — but only when executed correctly.

Before starting a SIP, evaluate:

-

Your understanding of risk: SIPs are market-linked and differ from traditional instruments like recurring deposits.

-

Fund quality: Choose funds with a long-term track record of consistent management. Avoid ranking-based SIP decisions.

-

Goal mapping: Every SIP should be linked to a financial goal, not short-term returns. This connection fosters discipline and minimises impulsive emotional decisions.

Remember, your behaviour matters more than your fund selection. A well-chosen SIP held through market ups and downs often outperforms an “ideal” SIP that’s frequently interrupted.

Conclusion

The idea of finding the “best mutual fund” changes every year, but the foundation of successful investing never does, discipline, clarity, and process. Rather than chasing fleeting returns, align your investments with your long-term goals, review periodically, and stay resilient through volatility. That’s how wealth is truly created, not by predicting winners, but by staying invested in a winning process.

FAQs

Your Investing Experts

Continue Reading

What Is NAV in Mutual Fund? A Simple Guide to Understanding Net Asset Value

If you are trying to understand what NAV in mutual fund investing means, the answer is simple: NAV, or net asset value, represents the per-unit value of a mutual fund’s portfolio after deducting its liabilities. It tells you how much each unit you hold is worth at the end of a trading day. It does not indicate whether a fund is cheap, expensive, or better than another, it is simply a daily valuation measure.

ELSS Mutual Funds: A Simple Way to Save Tax and Build Long-Term Wealth

ELSS mutual funds help you save tax under Section 80C while participating in equity markets for long-term growth. With the shortest lock-in among 80C options and the flexibility of SIP investing, they can align tax efficiency with disciplined wealth creation. Used correctly, ELSS is not just a tax-saving tool, but a long-term investment strategy.

GIFT Nifty vs Nifty 50: Understanding the Key Differences

Many investors often hear terms like GIFT Nifty and Nifty 50 used interchangeably. However, they are not the same. While Nifty 50 represents India’s top 50 companies and reflects the health of the stock market, GIFT Nifty is a futures contract based on that index, designed to provide extended trading access especially for global participants. Understanding this distinction is essential before interpreting market signals.

.png)

.png)