Step-Up SIP vs. Regular SIP: Which One Builds More Wealth?

- Learn how a Step-Up SIP differs from a regular SIP.

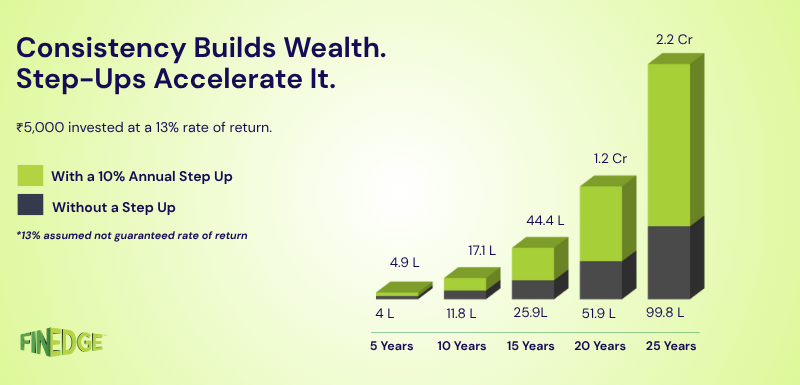

- Discover how increasing your SIP annually can impact wealth creation.

- See a real example comparing both methods for a major life goal.

- Understand when and how much to step up your SIP.

Explore how Step-Up SIPs, small annual increases, can make a big difference when you're saving for major life goals.

What is an SIP?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount regularly into mutual funds. It allows investors to build wealth gradually through consistent contributions, without the need to time the market.

SIPs help create a disciplined investing habit and are especially useful for long-term goals such as retirement, home down payments, or children’s education. Even a small monthly investment can grow meaningfully over time, thanks to the power of compounding.

How SIPs Help with Goal Achievement

SIPs work well because they break down large financial goals into manageable, monthly contributions. For example, if you're saving for a home, you don’t need to wait until you have ₹45 lakhs in hand, you can start with ₹5,000 a month and work toward that goal over time.

They also align well with monthly income cycles and help reduce the pressure of lump-sum investing. With time and consistency, SIPs can form the foundation of any goal-based financial plan.

Want to estimate how SIPs can help you achieve your goals? Try our SIP calculator!

What Does Step-Up SIP Mean?

A Step-Up SIP is a type of SIP where you automatically increase your investment amount every year by a fixed percentage. Typically, investors step up their SIPs by 10% annually.

This means:

-

Year 1: ₹5,000/month

-

Year 2: ₹5,500/month (10% increase)

-

Year 3: ₹6,050/month, and so on

Step-Up SIPs let you start small and gradually increase your investments as your income grows.

Why Should You Step Up Your SIP?

Here are a few reasons why stepping up your SIP can be a smart move:

-

Keeps pace with your income: As your salary increases, so do your investments.

-

Helps close the gap to bigger goals: Regular SIPs may fall short for large goals. Step-ups can bridge that gap.

-

Builds more wealth: A small increase each year can significantly increase your final corpus.

-

Reduces financial stress: You don’t have to start big. Step-ups let you grow into your goals.

If you're serious about long-term wealth creation, it's worth considering a step-up strategy.

Use our Step-Up SIP calculator to see how much more you can build

Example: Regular SIP vs Step-Up SIP

Let’s say you are 25, in the early stages of your career, and planning to make a ₹40 lakh down payment on a home by the age of 40.

You decide to start a SIP with ₹5,000 per month.

-

With a regular SIP, assuming a 13% annual return*, your corpus after 15 years would be around ₹25lakhs.

-

With a Step-Up SIP (10% increase every year), that same SIP could grow to around ₹44 lakhs in 15 years.

-

That’s a significant difference, without any major increase in financial burden early in your career.

The graph above clearly shows the impact of compounding when SIP contributions are increased annually.

Disclaimer: The 13% CAGR used here is based on historical returns and is for illustration only. Actual returns may vary depending on market conditions.

Which One is Better: Regular SIPs or Step Up SIPs

SIPs are a great starting point for any goal. But if your income increases over time, keeping your SIP amount fixed might not be enough, especially for ambitious financial goals.

A Step-Up SIP offers a smart middle ground. You start small, and as your financial capacity improves, your investment grows with it. Over time, this small habit shift can create a significant difference in your wealth outcomes, without feeling like a stretch.

Whether you're saving for a home, a child’s education, or retirement, step-ups allow your investment plan to evolve with you.

FAQs

Your Investing Experts

Continue Reading

How to Build a ₹1 Crore Portfolio: A Practical Guide for Indian Investors

Reaching ₹1 crore isn’t about luck or timing, it’s about discipline, consistency, and the patience to let compounding work in your favor.

Are Mutual Fund SIP Investments Low Risk?

Many first-time investors believe that SIPs are a low-risk way to enter the market. But is that really true? The idea that SIPs offer guaranteed safety can be misleading, especially if the underlying fund is equity-oriented. This blog breaks down the real risk profile of SIPs and helps you understand how they work in volatile markets.

What are the Different Types of SIPs? How to Use Step-Up SIP to Reach Your Financial Goals Faster

SIPs (Systematic Investment Plans) are a cornerstone of goal-based investing in India. But did you know that there’s more than one type of SIP? From the simplicity of Regular SIPs to the adaptability of Flexible SIPs, and the acceleration potential of Step-Up SIPs, there’s a strategy for every kind of investor. In this blog, we’ll explain the different types of SIPs and show you how a Step-Up SIP could help you reach your financial goals faster.

_(28).jpg)

.jpg)