5 Reasons Why Hyderabad Needs the Best Financial Advisor

Hyderabad has emerged as a major international IT centre, with more than 1500 IT firms setting up their base in the city. Hyderabad’s IT hub, known as ‘Cyberabad’, attracts many global companies. It is home to the largest Amazon corporate office and one of the world’s largest development centres for Microsoft. The city is the gateway of business for the state of Telangana and is fast emerging as a centre for entrepreneurship in the country. Interestingly, Hyderabad is also home to the maximum number of billionaires after Mumbai and Delhi.

Hyderabad is also home to Ramoji Film City—the world’s largest film studio complex and is the heart of the Telugu film industry. Some of the biggest Indian movies have been produced here ‘Baahubali’ & ‘Pushpa’ are notable names. Hyderabad offers it all: proximity to IT hubs, quality education, and a vibrant quality of life. The city has proved to be a centre for innovation and ambition.

Why is FinEdge the best investment platform for the residents of Hyderabad

Why FinEdge | Customised Investment Plan | Best Financial Advisor in Hyderabad

Your Investing Experts

Why Hyderabad's Residents Need an Investment Expert to Achieve Their Financial Goals

Drawing parallels with Hyderabad’s famous ‘Paradise biryani,’ cooked with a blend of spices and culinary expertise, investing is also a process that combines expertise, personalization and realistic expectations. Just like the result of great culinary skills is a flavorful Biryani dish, the end result of a great investing process is an investment portfolio best suited for your goals and personal financial situation. An understanding of personal cash flows and financial ratios, with suitable investment products, can help professionals prepare for a secure financial future. By aligning investments with goals, people can achieve financial well-being and make the most of the opportunities that a growing city has to offer.

Let’s explore why the residents of a city like Hyderabad would need the best Investment Expert:

Customization- An expert ensures that your investment decisions are not made on an ad hoc basis but are personalized to your unique financial situation and goals, whether planning for retirement, purchasing a car, or creating a fund for your child’s higher education. The foundation of a great investment process begins with a clear investing roadmap. This must include household budgeting of income/expense, identifying gaps or leakages, and calculating key personal finance ratios like debt-to-income ratio, surplus ratio and investing ratios. This roadmap should identify and establish where you are today and what needs to be done to have a great household balance sheet in the future.

Risk Management and Investing in the Right Product- A common mistake investors make is either taking excessive risk into (investing based on short-term past returns in Equity funds) or being too risk averse (locking long-term investments in life insurance policies, FDs, PPF etc.). The difference between a 7% return and a 14% return over 20 years can be exponential. Investing in the right products will allow you to achieve financial freedom in your life and making informed decisions based on risk Vs return will enable you to reap the benefits of compounding.

By understanding your risk tolerance and investment horizon, an expert can recommend the best investment options. Risk Mitigation through goal orientation, long-term horizon and staggered investing through SIPs in Mutual Funds (Systematic Investment Plans) or STPs (Systematic Transfer Plans) is an essential part of an investment roadmap created by an expert.

Goal Orientation –While market fluctuations are inevitable, an expert ensures that you stay focused on achieving your goals like Retirement or your child’s education through a disciplined investment approach. If you do not invest with a clear purpose, it drastically diminishes your ability to remain invested. These goals help in establishing a scientific approach towards meeting them in the future. This will also enable you not to be tempted to dip into investments for ad hoc requirements. Remember, a dream without a plan is just a wish.

Focus on Actionable Intelligence - Today, one of the biggest challenges to long-term investing is information overload. Paying heed to too much information on social media platforms, news and ‘finfluencers’ leads to panic and decision paralysis. Most of this information is based on short-term trends and is directly in conflict with your long-term investing plan. Paying too much attention to all this information can lead to knee-jerk / panic-driven investing decisions like trying to time the market etc.

Information overload has made investing easier but wealth creation almost impossible. This information clutter has massively amplified fear and greed, the two most destructive forces in the investing world. Information is no longer a premium, in fact, it’s turned destructive!

Goal Reviews – having periodic reviews and making changes to your goals is important to ensure that the road map is updated. These reviews should be based on life events (change in income/ expenses), additions to the family or any other material event in your life. One should refrain from making changes in the portfolio purely based on performance (market sectors are cyclical and investments will never have linear returns)

Importance of Choosing the Right Financial Expert

In cities like Hyderabad, Bangalore and Chennai, known for their thriving tech industry and growing startup ecosystem, choosing the right financial expert is important for achieving financial goals. These cities have a busy and ambitious population that seeks to build wealth. The right expert will focus on helping you stay aligned with your financial goals, offering personalized advice that goes beyond chasing returns. Instead of acting as a salesperson, an expert will recommend investment products that best fit your goals and risk tolerance, making sure that your best interest is always the priority.

Attain Financial Freedom

'Dreams into Action': Your Personalized Investment Platform

Most ‘Do it Yourself’ or Robo Advisory apps are ‘recommendation’ focused, whereas DiA is ‘journey’ focused. Worse, most DIY or automated platforms use algorithms that recommend investments based on past returns, leading to misplaced investor expectations. Due to this, DIY apps help you get started - but do not help you remain invested and create wealth over the long term. Since most of these apps are like financial supermarkets, they do not create the right behaviour that help investors create long-term wealth. On the contrary, they encourage a shopper’s mindset in which investors end up seeking the next thrill or money-doubling investment, without understanding that speculative investing or investing led by greed or fear can prove detrimental in the long run.

With FinEdge's tech-enabled platform, ‘Dreams into Action’ (DiA), clients can seamlessly communicate and collaborate with a Investment Manager, no matter where they live. DiA is not a financial supermarket but a collaborative investment platform that is process-led and focuses on the behaviour or psychology of investing. With DiA, Investment Managers and investors work together and co-own goals and investment managers follow investing best practices and continuously guide investors, resulting in tangible value creation beyond thrill-seeking. DiA is built for investors who want to ‘invest with purpose’ for their important life goals and are willing to be disciplined and committed.

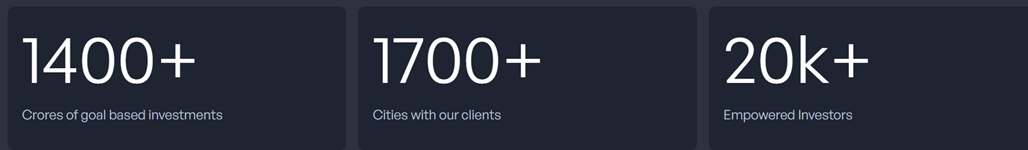

This approach has already transformed the lives of thousands of people. By incorporating life goals into the investment process, DiA ensures that every investment decision is meaningful and aligned with the client’s future aspirations. It is this personalized touch that sets FinEdge apart and makes it an ideal choice for the residents of city like Hyderabad. With clients in more than 1700 locations in India and 90 countries in the world, DiA does not have geographical limitation in reaching out to its clients.

Also Read: Financial Planning in Vishakhapatnam

What Our Clients Say About Us

Related Articles

.jpg)

Top Wealth Management Strategies for Long-Term Success

Understand wealth management, how it differs from wealth creation, and the best wealth management strategies.

Unlocking Wealth in Chennai: The Need for the Best Financial Advisors

Consult with the best Portfolio Managers in Chennai for investment planning. Invest for your goals through experts.