How a Financial Advisor in Varanasi Can Help You Create Wealth

Varanasi—“older than history, older than tradition, older even than legend,” as Mark Twain observed—is more than a spiritual destination. From the sacred steps of Manikarnika Ghat to the majestic Kashi Vishwanatha Temple, the city pulses with opportunity, where culture and commerce come together seamlessly.

Famed for its exquisite Banarasi saris, woven with luxurious silks and brocades laced with gold and silver, Varanasi’s heritage of craftsmanship continues to drive trade and business. With religious tourism booming and initiatives like the Golden Triangle of Religious Tourism—linking Ayodhya, Prayagraj and Varanasi—fueling rapid economic growth, the city is poised for an exciting future.

As Varanasi embraces new possibilities, making smart financial decisions today is key to building sustainable wealth for tomorrow.

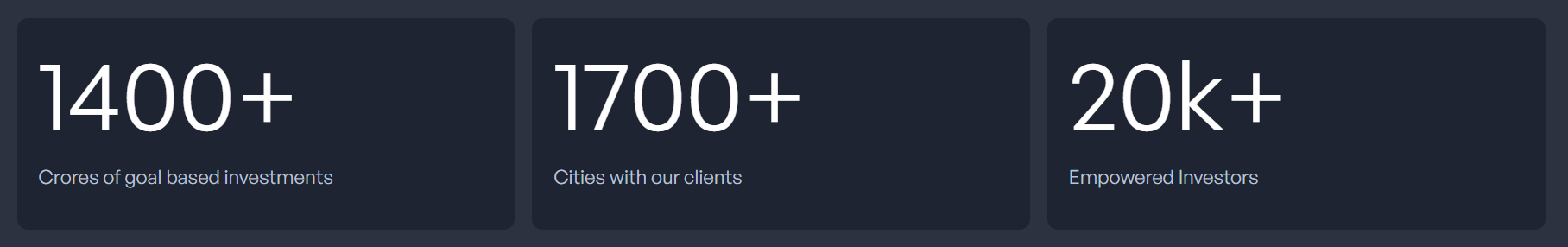

Why FinEdge is the Preferred Platform for Investors

Why FinEdge | Customised Investment Plan | Best Financial Advisor

Your Investing Experts

How do Varanasi’s Residents Start Their Investment Journey

Start with Defining Your Goals

Every great journey starts with a clear destination in mind. Whether it’s owning your dream home, ensuring a comfortable retirement, funding your child’s education or building wealth. After all, you wouldn’t board a flight without knowing its destination. In the same way, investing without well-defined financial goals can result in unforeseen financial outcomes.

Focus on Time in the Market, Not Timing the Market

Think about booking a flight. You check prices, hoping they’ll drop. You wait, refresh and hesitate—only to see prices rise or flights sell out. In the end, you either pay more or miss out. Investing is similar. Waiting for the “perfect time” often means missing opportunities. Markets will always fluctuate, but staying invested consistently is what ensures you reach your financial destination on time.

Aligning the Right Products

Investing isn’t one-size-fits-all. Your choices—whether stocks, mutual funds, or savings accounts—should match your financial goals, risk tolerance and timeline. It’s like planning a trip. A friend’s last-minute flight might work for them, but a bus or train could be a smarter, more affordable option for you. Choose investments that fit your journey, not what’s trending.

A Disciplined Approach works better

Investment success often gets sidetracked by distractions like market noise, FOMO and impulsive decisions. Think of it like a bus trip—you don’t hop off at every stop; you stay seated until you reach your destination. Similarly, achieving your financial goals and benefiting from the power of compounding requires discipline and staying the course.

Collaborate with an Investment Expert

A professional investment expert tailors your plan based on your goals, cash flow and risk capacity, while helping you avoid panic-driven decisions during market volatility. Think of a financial advisor in Varanasi as a local tour guide—someone who understands your background, speaks your language and provides personalized guidance to navigate your financial journey with confidence.

How can a Financial Advisor in Varanasi aid your Investment Journey?

Like a local guide navigating Varanasi’s winding lanes, a financial advisor helps you cut through market noise, avoid pitfalls and make informed, goal-focused decisions—ensuring a smooth and rewarding investment journey. Here's how:

• Sorting the Information Clutter: In today's fast-paced world, investors are overwhelmed with advice, market trends and a variety of investment options—from equities and debt to SIPs and lump sum investments—all available at the touch of a button. Insurance-linked products like ULIPs are also widely promoted. However, impulsive investments driven by FOMO can derail progress toward financial goals. A financial advisor in Varanasi ensures that every decision aligns with your objectives, creating a structured and purpose-driven investment plan for long-term success.

• Managing your Investing Behavior: Market volatility can easily spark panic, prompting impulsive decisions that hinder long-term wealth creation. However, a dip in the market today has little bearing on a retirement goal that’s 20 years down the line. Staying focused on the bigger picture is key to building lasting wealth.

• Informed Risk: Sometimes, playing it too safe can be the biggest risk. While savings accounts and fixed deposits provide stability, they often fail to outpace inflation over time.

• Personalization: Every investor’s journey is unique—just like custom-tailored clothing, the right fit makes all the difference. A one-size-fits-all approach doesn’t work in investing. A financial advisor in Varanasi crafts investment plans tailored to your goals, risk tolerance and financial situation, providing a personalized strategy and a clear roadmap for long-term growth.

Smart Investment Planning Made Simple with Dreams into Action (DiA)

Investing online has never been easier, but quick decisions and chasing market trends can often hurt your long-term financial growth. That’s where DiA, FinEdge’s tech-enabled platform, comes in. It combines the power of smart technology with expert guidance, giving you a clear, goal-focused path for your investments.

With DiA, you’re not navigating the world of investing alone. It helps you make confident decisions, stay on track and build lasting financial security.

Best of all, it fits right into your lifestyle. Whether you’re at home, at work, or traveling, you can access your investment plan anytime, anywhere—making smart investing simple and stress-free.

Growing with Varanasi : Build Your Wealth for Tomorrow

As Varanasi thrives with rising tourism, trade and rich craftsmanship, it’s the right time to grow your wealth. Invest with purpose, stay patient and stay committed.

Start your financial journey today—because smart investing is all about the right plan at the right time.

Attain Financial Freedom

FAQs

Why is discipline important in investing?

Discipline ensures you stay invested despite market ups and downs, allowing the power of compounding to work in your favor. For investors, maintaining a long-term view and sticking to a well-structured plan is essential for building sustainable wealth.

Are Fixed Deposits a Good Investment?

Fixed deposits (FDs) offer stable returns and are considered a low-risk option. With inflation in India averaging 4-7% and FDs typically offering returns of 6-7%, your money may only just keep pace—or may not keep pace at all. For long-term goals, especially those 20 years away, such as funding your child's education, inflation becomes even more critical, averaging 11-12%. Similarly, for goals like enjoying a comfortable retirement while maintaining your current lifestyle, inflation averages 6-7%.

To achieve these long-term financial goals, it’s essential to invest in options that allow your money to grow faster than inflation, ensuring it retains its value when you need it most.

How does a financial expert help you invest better?

A financial expert is like a tour guide on a trip. While you could explore on your own, a guide knows the best routes, hidden gems and how to avoid delays. Similarly, a financial expert helps you choose the right investments, avoid common mistakes and stay on track, ensuring you reach your financial goals smoothly and efficiently.

What Our Clients Say About Us

Related Articles

Understanding the Difference Between Multicap and Flexicap Funds

Learn how both differ significantly in their investment approach and mandates and understand these differences are crucial for making informed investment decisions.

What Should the People of Uttar Pradesh Do to Grow Their Accumulated Wealth

Consult with the best Portfolio Managers in Uttar Pradesh for investment planning. Invest for your goals through experts.