How to Invest your First Salary

Congratulations! You are ahead of 99.9% of investors already

It's fantastic that you are looking to invest your first paycheck. This puts you ahead of 99.9% of the investing population already! By starting to invest early, you will truly be able to reap the benefits of long term compounding and maximize your wealth. Let's get started on your journey to turning your Dreams into Action.

Your Investing Experts

Mistake #1: Gambling instead of Investing

Mistake #1: Gambling instead of Investing

Many new investors decide to speculate/gamble instead of investing – only trading on stock tips or looking for hot stock tips, for instance. Reckless trading can only have one long term outcome (beginners luck aside); and it’s not usually a positive one. After such a poor initial experience, many young professionals turn away from the stock markets for good, thereby missing out on the long term benefits of stocks.

It’s well know that stocks outperform every other asset class over the long run, real estate included. It’s difficult to quantify in Rupee terms then, just how damaging such an early experience can be in terms of opportunity costs. Young professionals are therefore advised not to do things like speculating in crypto or trading in derivatives, but are encouraged instead to invest selectively in a portfolio of stocks of blue chip companies or mutual funds in a systematic, staggered manner.

Mistake #2: Avoiding Measured Risks

The second mistake is letting your risk profile dictate your investment choices. Many young professionals adopt an overcautious approach early on in life; only committing their monies to PPF accounts or deposits, for instance. Many times, well-meaning parents or grandparents warn us about the dangers of the stock market! In a sense, they are correct because investing with the wrong expectations and with an incorrect understanding of risk/reward is a guaranteed way to lose money. However, there is a big difference between chasing stock tips and investing with purpose.

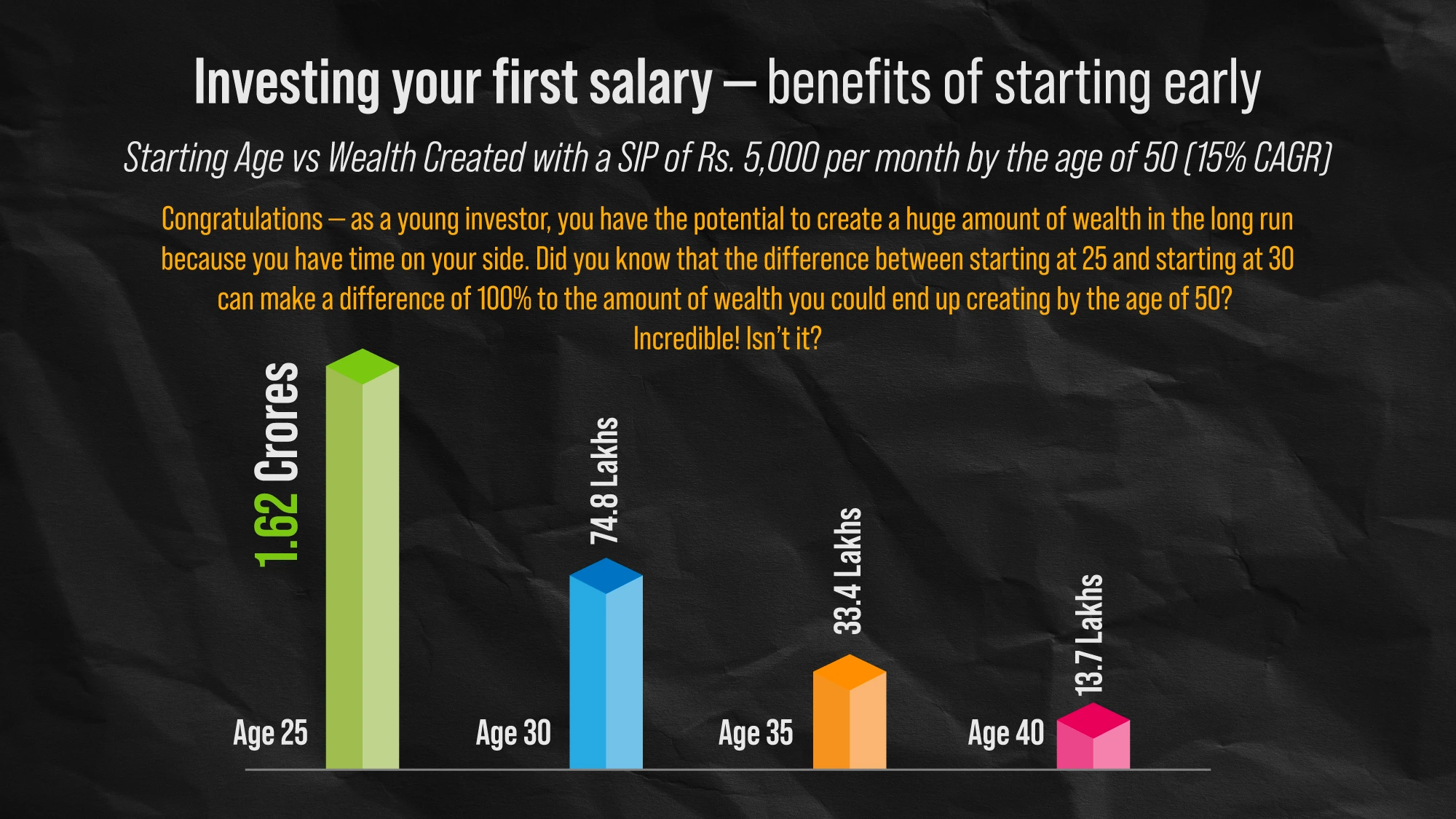

Remember this: the one good thing about money is that over the long run, it can produce more money by way of compounding. By becoming risk avoidant so early in their lives, young professionals rob their future selves of the prospect of creating wealth for their later years. Even Rs. 5,000 invested aggressively through SIP’s can yield 1.5-1.6 Crores – in a PPF account, it’ll never grow beyond Rs. 50 Lakhs. In an LIC policy, even lesser.

Mistake #3: Buying Life Insurance to Save Taxes

Third, young professionals without dependants may end up buying life insurance, just to save taxes in the yearend rush to submit their documents to their HR Managers. Barring a few rare circumstances in which your aging parents are dependent on you from the day you earn your first pay check, this would not be a wise decision. A few low cost ULIP’s (which constitute a more aggressive investment) may make more sense than traditional policies. But why pay for a life cover when you don’t require it in the first place? Just invest the money instead!

Mistake #4: Taking advice from finfluencers, social media or internet searches

Lastly, please be careful about taking advice from finfluencers or social media! Most of them really don’t know much about investing at all, and are giving advice to others nonetheless. When it comes to money, make sure that you work with a professional investing expert towards your financial goals. The earlier you begin, the more wealth you can create in the long term.

In conclusion - here are the thumb rules to follow as a young professional: don’t speculate in stocks, derivatives, commodities and other “weapons of mass destruction”. Invest in long term growth stocks and mutual funds with a time horizon of five to ten years. Start an SIP in an aggressive fund and step it up by 10% annually – one of these SIP’s should be an ELSS (Equity Linked Savings Scheme) which will double up as a tax saving instrument. Avoid low risk, low return investments. And lastly, make sure that you critically evaluate the actual need for a life cover before you buy a policy. Even if you do, make sure it’s a pure term plan. Lastly, be careful about where you are getting advice from.

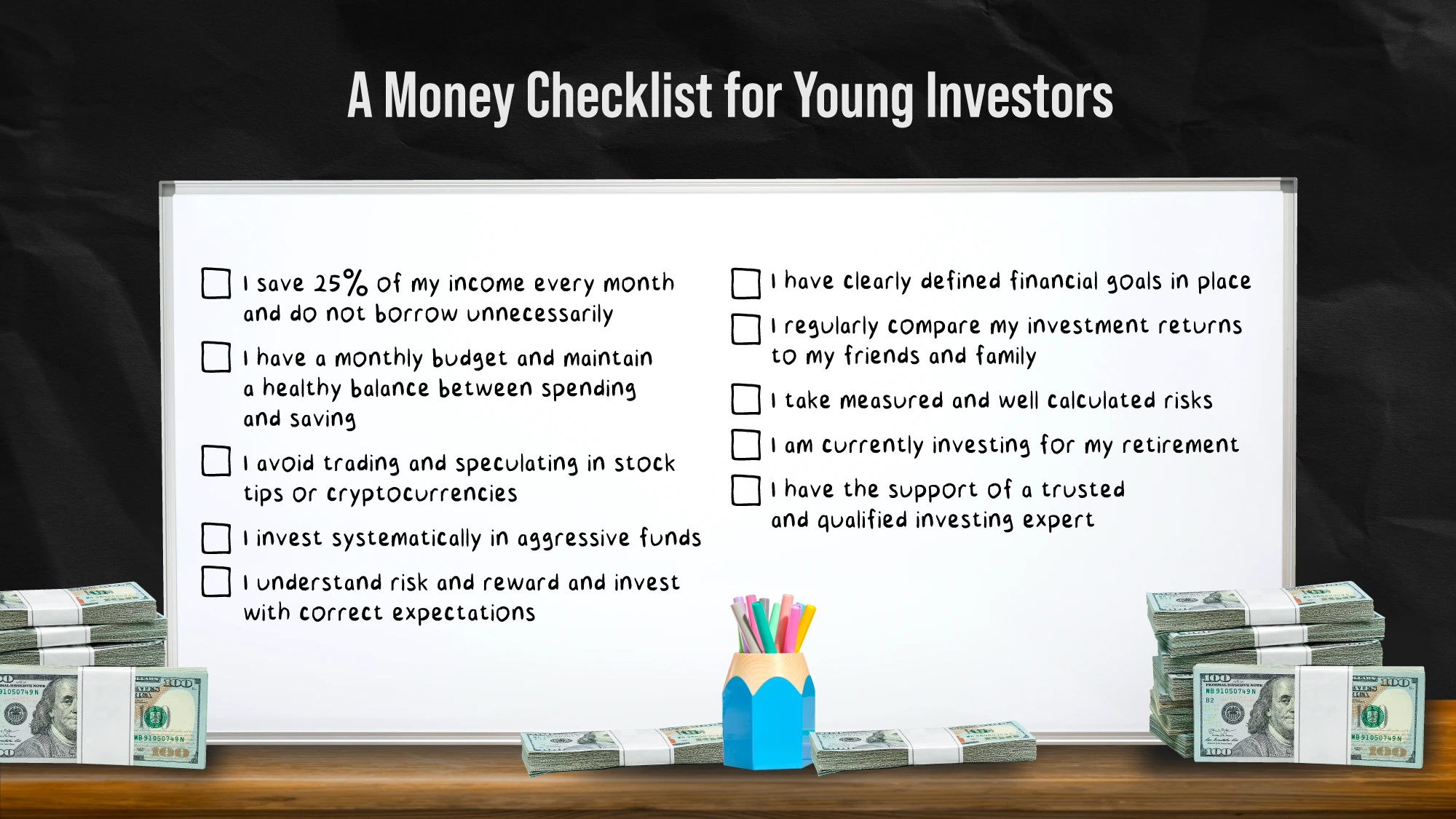

If you answered “No” to 3 or more of the above, you need the support of an investing expert!

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

FAQ’s – Young Professionals & Investing

Where is the best place to invest my first salary?

The best way to invest your first salary is to start an SIP in a mutual fund. However, doing this in an ad hoc manner without proper understanding of how they work, and without the support of an expert, can work against you. It is best to start a SIP as part of a well thought out financial planning exercise.

How can I earn high returns without risk?

A zero risk investment, in theory, can only give you as much returns as a government bond. Any return above that will require taking some degree of risk. Beware of so-called research analysts who actually just give stock tips and promise high returns with low risk. These are usually scamsters in disguise. Remember, long term wealth creation requires you to take a certain degree of risk. Consult with an expert and figure out how to do so effectively.

Should I invest into the trending crypto today?

Like any speculative investment, its impossible to predict the Best Crypto to buy Right Now. In fact, cryptocurrencies themselves have not been able to deliver long term value to most investors till now, Most investors have burned their fingers in speculative crypto trading after their prices have gone up. Just because some new coin is the trending crypto today, doesn’t mean it’s the right investment. Its best to stop checking crypto prices and work with an expert on a clear, goal based financial plan instead.

What percentage of my first salary should I be investing every month?

There’s no one size, fits all answer to this question. Ideally, it’s healthy to save at least 20% of your post tax income in a systematic and disciplined way. However, your magic number may be higher or lower depending upon your unique life situation. You should not start an SIP for an amount that is uncomfortable for you to continue for the long term, as your success would depend completely upon your ability to continue investing through the ups and downs of market cycles.

Should I buy Life Insurance with my first salary?

First, you must remember to never combine investing with insurance. Doing so would be a big mistake. You should only buy a pure term plan if you have financial dependents. If not, you do not need to. Make sure that you don’t fall into the trap if investing into an endowment plan or a ULIP just to save taxes at the end of the financial year.