Key to Investing with Purpose - Resilience

THE PROBLEM!

Today, top performing funds and their past performance can be easily accessed by almost everyone through a simple google search. Why is it then that very few people can remain invested long enough to create wealth?

Information clutter has massively amplified fear and greed, the two most destructive forces in the investing world. Information is no longer a premium, in fact it’s turned destructive!

THE SOLUTION...

DiA – Dreams into Action : An investing platform built & designed by FinEdge from the ground up, bringing out the best in people and technology

Your Investing Experts

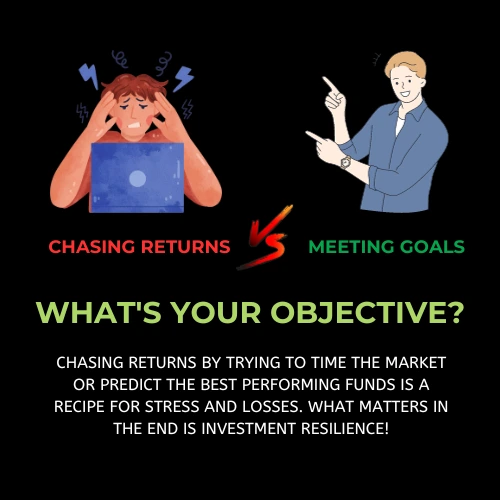

The Problem with “Returns – Centric Investing”

Most investing platforms these are return centric. This leads to an investment push using greed as a hook thereby setting up an incorrect foundation of expectations.

Unfortunately, in investing, technology is being used to commoditize the investment process and enabling sales but not to make investing journeys and outcomes better.

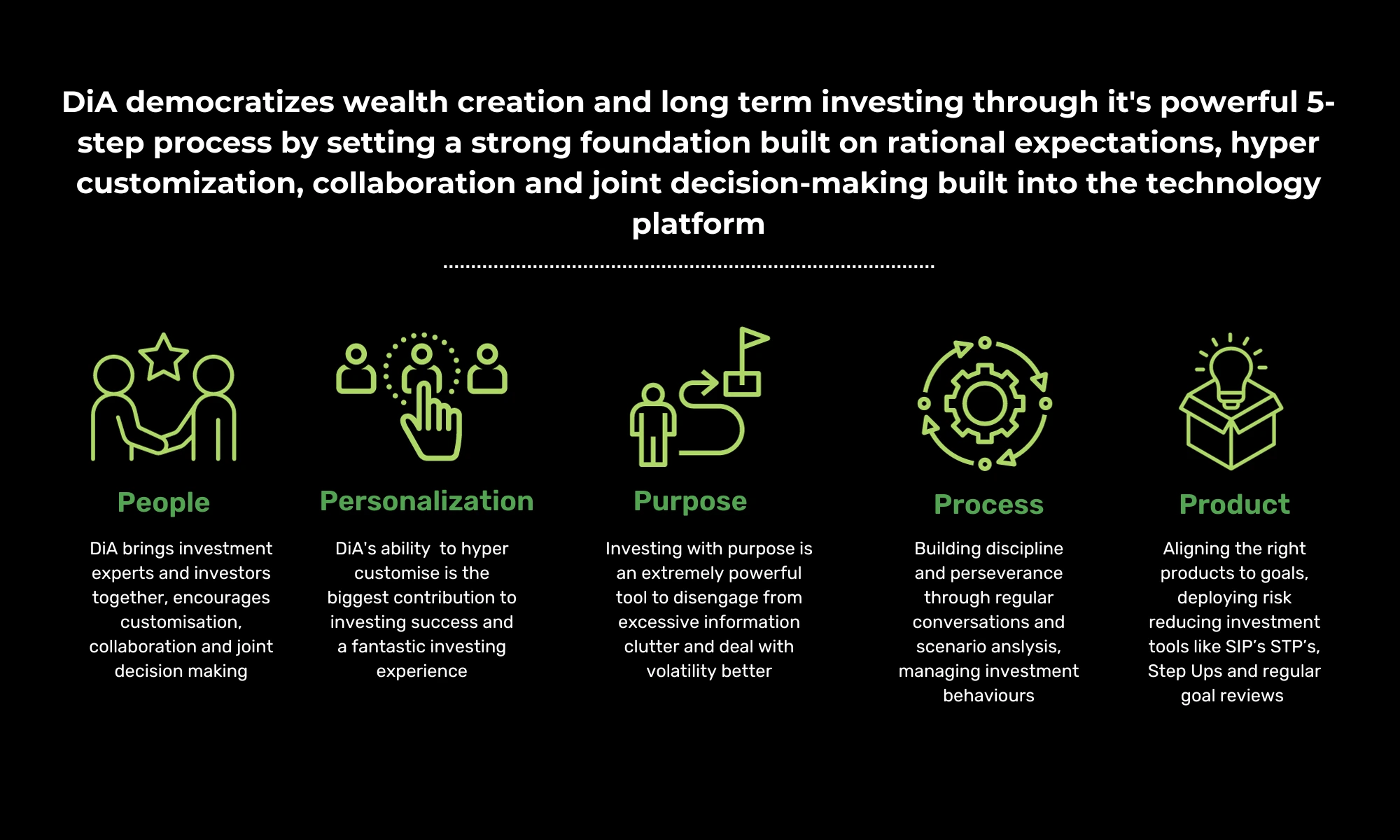

A great investing platform democratizes wealth creation and long term investing by setting a strong foundation built on rational expectations, personalized investing, collaboration and joint decision-making built into technology platform.

Technology needs to play a pivotal role in enabling people, investors as well as investing experts, to come enhance their abilities with an end objective to achieve investing perseverance. This ability to be resilient, despite market volatility, and remain invested for the long term can happen only if technology can empower a 5-step process to deliver value comprehensively to the investor as well as the investing experts.

What are the 5 P’s of investing that lead to investing with purpose?

People: Investment and technology platforms should bring experts and investors together, encourage personalized investing, collaboration, co-ownership of goals, joint decision making while following a strong conversation led investment process. The platform is an enabler for the investment manager to customise and have meaningful conversations. Technology is a driver to add value and to follow critical investment processes to ensure that client interest is protected at all times. Technology should make experts better at managing investments and relationships, thus bringing out the best in people through technology! Managing investing behaviour is critical to staying invested. We can be our own enemy when it comes to investing.

Personalization: From client discovery session, understanding cash flows, financial ratios, investing behaviour and attitude towards risk & reward. Technology should be an enabler of personalized investing. An investment that might be a boon for one individual can be a bane for the next. This ability of technology to assist hyper personalized investing is the biggest contribution to investing with purpose and a fantastic experience.

Purpose: The tech platform should help in setting financial goals, prioritizing them, aligning investment solutions, collaborative engagement to build understanding around inflation, time value, compounding, diversification.Investing with purpose.Investing with purpose is an extremely powerful tool to disengage from excessive information clutter which can make managing market volatility tough.

Process: Building perseverance through regular conversation, understanding the relationship between volatility and risk / reward, focusing on goals rather than returns, setting unique individual performance benchmarks, enabling scenario analysis to understand ‘what ifs’, building intelligence around investing discipline. A great wealthtech platform would ensure that there is an iron cast process around investing best practices. Technology can enable and enforce this investment process so that there is uniformity in the investing journey, irrespective of the amounts of the investor.

Products: Aligning the right products to goals and risk profile, deploying risk reducing investment tools like SIP’s STP’s tools, Step up investing, time-led realignment to goals, reviewing life and financial events at recurring intervals. Technology plays a major part not only in transactional convenience and reporting but also as a solution provider to the right investing practices.

A tech Platform that brings the ‘5 P’s’ together to make better investors through investing perseverance. The ability to stay invested despite testing market volatility to create long term wealth!

People + Personalization + Process + Purpose + Products = Perseverance

Almost all the wealth tech around today focuses on the last part ‘product recommendation’. There aren’t any investing platforms outside of the ‘Dreams into Action’ investing platform from FinEdge that encompasses all 5 P’s that lead to investing perseverance.

Investing resilience comes from understanding risk, managing behaviour and investing with purpose, followed by the right products. All this combined gives the investor the ability to stay invested. Wealth Creation can only happen if investment resilience is achieved!

Attain Financial Freedom