Planning for your Childs Education Why it Matters

Planning for your child's higher education is a process that involves both financial and non-financial considerations. Like all parents, you most likely aspire to provide your child with a top-quality education. However, being able to successfully fund a great education for your kid requires advance planning, and the determination to stick to a long-term plan resolutely. Here are 6 important things for you to keep in mind to help you plan for your child's higher education:

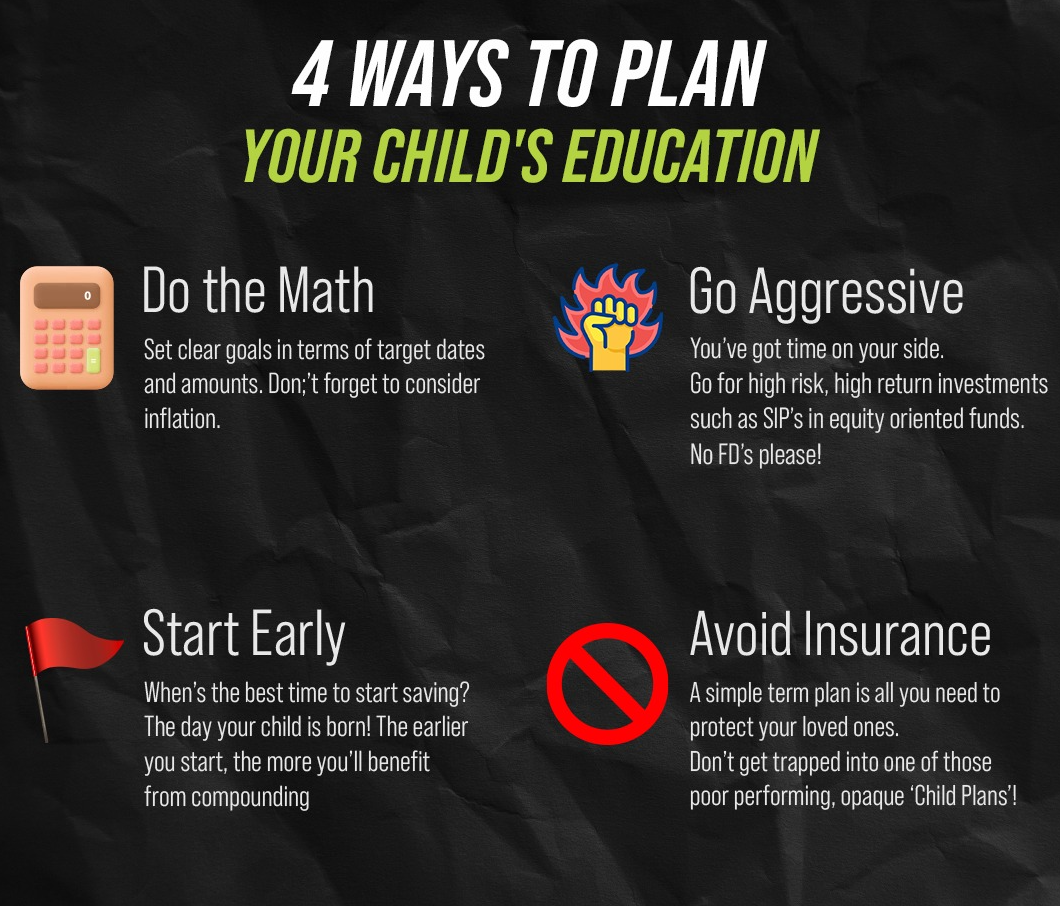

Start Early

Begin saving for your child's education as early as possible. Consider setting up a dedicated education fund by carefully calculating the amount that would be needed in future when your child is ready to pursue his higher education.

The earlier you start saving, the more time your money has to grow through compounding. interest.

Education = Earning Potential

Studies have shown that the quality of education received by your child will impact her lifetime earnings by 25-50%. Over the course of one’s career, that’s a very large amount. As time goes on, it’s quite likely that the job environment will continue to become more hypercompetitive, with only the best educated students securing high quality placements. This makes it all the more important for you, as a responsible parent, to plan for your child’s education well in advance.

Student Loans = Bad Idea

While sometimes it’s the only option, it’s not necessarily the best one. A thumb rule is that you or your child will need to repay one and a half times the loan amount over time. A debt-ridden career start could drive your child to take unwise and short term financial decisions. Although student loans do allow a full deduction of interest expenses incurred under Section 80E, they should still be looked at as a last resort.

Explore Financial Aid and Scholarships:

Government Aid: Research government-sponsored scholarships, grants, and loans. Institutional Aid: Check if the chosen institutions offer scholarships or financial aid.

Private Scholarships: Explore private scholarships offered by corporations, foundations, or community organizations.

Don’t fall into the Life Insurance Trap!

Mutual Funds offer a variety of products and solutions that could enable you to build a large enough corpus for your child’s education. You can run a long-term SIP Investment in an aggressive mutual fund as the goal tenor usually would be more than 10 years for your childs education. In comparison, traditional savings plans such as fixed deposits and life insurance are inflexible do not have the potential to deliver high returns in the longer term.

An Investment expert can help you with the best solutions and funds to help build a corpus for your child’s education, in light of your unique circumstances. Keep this in mind - because child education planning has an emotional angle to it, sales people play to this and often end up trapping unsuspecting investors in low return instruments like Endowment plans etc.