Review My Investment Portfolio: Align, Simplify, and Achieve Financial Freedom

Your investment portfolio is more than a collection of financial transactions—it’s the foundation for achieving your financial goals. At FinEdge, we help you understand why and when to review your portfolio, ensuring that your investments remain aligned with your life’s aspirations, free from clutter, and primed for long-term success.

Why FinEdge is the Best Choice for Investors

Why FinEdge | Customized Investment Plan | Best Financial Advisor

Your Investing Experts

Why Should You Review Your Investment Portfolio?

Investors often feel the need to review their portfolios, but not all reviews are driven by meaningful reasons. Here are some critical reasons why periodic reviews are essential:

1. Unrealistic Expectations of Returns

Many investors expect irrationally high returns, often influenced by market trends or hearsay. Reviewing your portfolio helps realign expectations with reality, reinforcing a long-term, goal-driven perspective.

2. Chasing Past Performance

Choosing investments based solely on past performance is a common mistake. Markets evolve, and yesterday's winners may not suit today’s goals. Reviews ensure that your portfolio remains aligned with your objectives and risk appetite.

3. Over-diversification from Ad Hoc Investments

Unplanned, sporadic investments often lead to over-diversification, creating a cluttered portfolio that’s hard to manage and less effective. Reviewing helps eliminate redundancies, ensuring every investment has a clear purpose.

4. Balancing Risk vs. Reward

Your financial situation and risk tolerance evolve over time. Periodic reviews ensure your portfolio reflects these changes and continues to deliver the desired balance of growth and stability.

5. Life Events and Income Changes

Major life changes—such as marriage, having children, or a job transition—can significantly alter your financial needs. Portfolio reviews during these moments ensure your investments stay relevant and aligned.Get started

The Risks of DIY Investing

Do-It-Yourself (DIY) investing often leads to common pitfalls that can derail your financial progress:

• Lack of Strategy: Without expert guidance, DIY investors may buy products based on trends, leading to an incoherent portfolio that doesn’t align with long-term goals.

• Overconfidence Bias: Relying on online information can lead to overconfidence, often resulting in risky or redundant investments.

• Missed Opportunities: DIY investors often lack the expertise to optimize asset allocation or capitalize on tax-efficient strategies.

Example: A DIY investor may allocate funds across multiple mutual funds with similar strategies, mistakenly believing this ensures diversification. In reality, this can dilute returns while increasing management complexity.

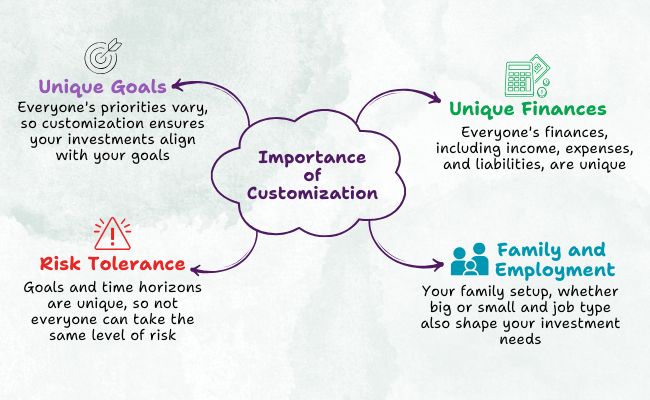

How Non-Customised Portfolios Lead to Mis-Selling

When portfolios are created by salespeople disguised as advisors, they are often built to maximize commissions rather than align with your financial goals. Here’s how it happens:

• Insurance Mis-Selling: Many investors end up buying insurance products like ULIPs or endowment plans as “investments.” These products often provide suboptimal returns and fail to serve as true insurance or investment tools.

• Unnecessary Complexity: A salesperson may recommend a mix of products that appear sophisticated but lack real benefits for the investor.

• No Goal Alignment: These portfolios are often generic, ignoring individual goals like retirement, child education, or homeownership.

Example: An investor looking for wealth creation might be sold a high-cost insurance plan under the guise of “safe investment,” locking up funds for years with poor returns.

The Perils of Over-Tinkering

A hands-off approach can often yield better results than constantly tweaking your portfolio. Over-tinkering, driven by market news or emotional reactions, can:

• Erode Returns: Frequent buying and selling lead to higher transaction costs and tax implications.

• Disrupt Long-Term Goals: Emotional decisions can derail a well-constructed plan.

• Create Complexity: Constant changes can lead to a cluttered and incoherent portfolio.

Real-World Example: The Voya Corporate Leaders Trust Fund—founded in 1935—adopted a passive strategy of selecting 30 stocks and making no active changes for over 80 years. Despite its simplicity, the fund outperformed many actively managed counterparts, proving the power of a disciplined, long-term approach.

For this strategy to work, your portfolio must be:

• Expertly Designed: Created with professional guidance.

• Customised to Goals: Tailored to individual objectives.

• Optimised for Beliefs: Reflective of your personal investment philosophy.

Attain Financial Freedom

Why Goal-Based Investing Matters

Investing without purpose is like navigating without a map. A goal-based portfolio ensures that:

• Every Investment Has a Role: Each product serves a specific purpose, from retirement to education funding.

• Clarity and Simplicity: A focused portfolio is easier to manage and monitor.

• Aligned Risk: Your investments reflect your goals and risk tolerance.

At FinEdge, we specialize in creating customized, goal-based portfolios designed to align with your life aspirations.

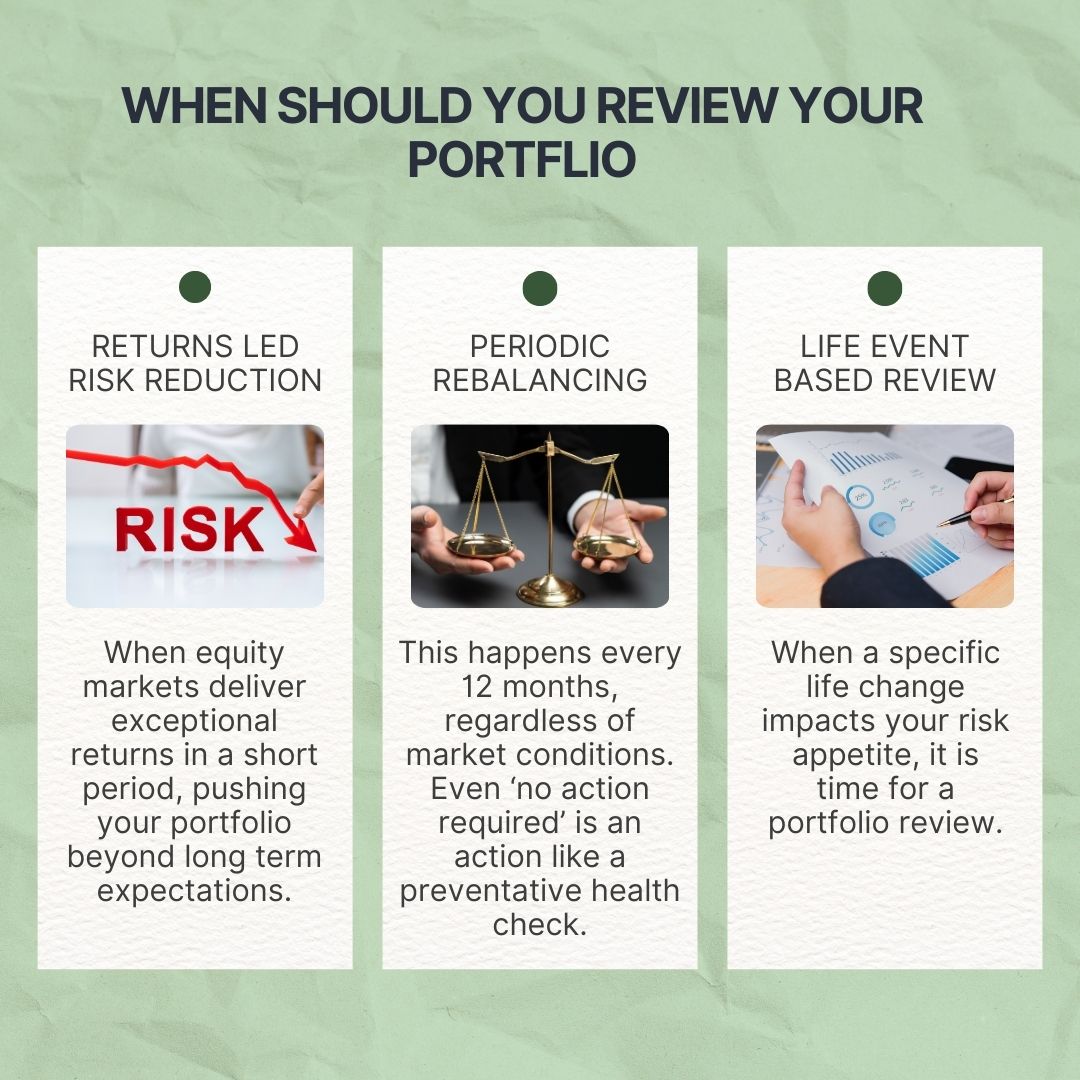

When Should You Review Your Portfolio?

Frequent reviews can harm performance. However, a well-constructed portfolio requires attention during:

• Life Changes: Marriage, children, career transitions, or retirement.

• Income Shifts: Significant changes in earnings.

• Periodic Check-Ins: Scheduled reviews to ensure continued alignment with goals.

Simplify Your Portfolio with FinEdge

At FinEdge, we offer expertise in designing purpose-driven investment portfolios. Our experts help you:

• Declutter Your Investments: Eliminate redundancy and focus on what matters.

• Optimize for Goals: Align your portfolio with life objectives, risk tolerance, and financial aspirations.

• Build Discipline: Avoid emotional decision-making with our guidance and support.

Take the First Step Today

Ready to simplify your investments and align them with your goals?

Contact FinEdge for expert portfolio review and advice. Let’s create a financial strategy that works for you—now and in the future.

Invest with Purpose | Review with Confidence | Achieve Your Goals

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

Related Articles

Top Tips for Successful Investment Portfolio Management

Understand what investment portfolio management is, how to build and manage an investment portfolio.

Why Goa Needs Access to the Best Investment Advisors

Consult with the best Portfolio Managers in Goa for investment planning. Invest for your goals through experts.

\