Systematic Investment Plans or SIPs – A Tool for Creating Long Term Wealth

Start your SIP today!

Here’s how - an SIP investment puts your savings on autopilot and takes away the need to time the market (an impossible feat). It is a well known fact that predicting short-term market movements is impossible, and trying to do so can make us miss out on market rallies or incur losses, eventually losing faith in equity as an asset class. An example of this could be during the COVID market crash, the ones sitting on the sidelines, thought that they would invest once markets would start to correct, but the rally in the market was so swift that anyone who was waiting for a correction, it did not get the opportunity to invest.

Basically, SIP investments ensure that we do not waste time trying to time the market!

An SIP also helps us inculcate savings discipline and maintain a healthy savings-to-surplus ratio. With an SIP, you can invest a predetermined sum of money every month. In this manner, a SIP investment puts you firmly in the driver’s seat on your journey to wealth creation.

What Are the Benefits of an SIP Investment?

Your decision to make a SIP investment may be one of the smartest investing moves you’ll make! Here are some of the main benefits of starting an SIP.

Goal Achievement

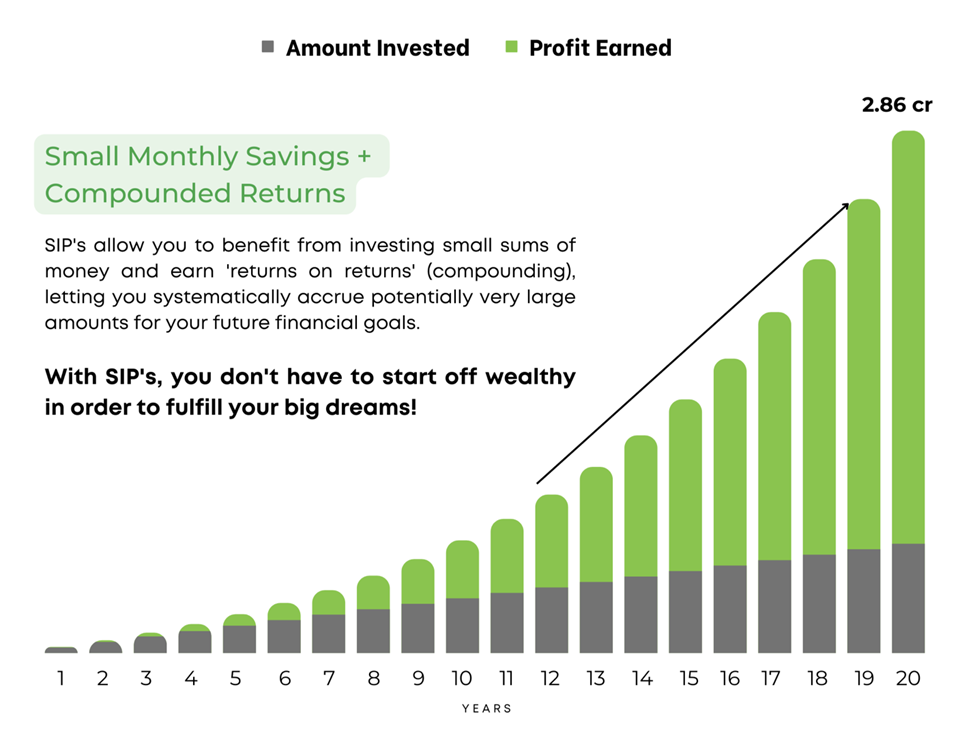

Imagine investing small sums of money on a monthly basis without affecting your household cash flows and being able to create a substantial corpus for your retirement. That is the power of an SIP! An example could be of Rs 25,000 being invested through an SIP for 20 years can yield a corpus of Rs. 2.85 crores*

Investing Discipline

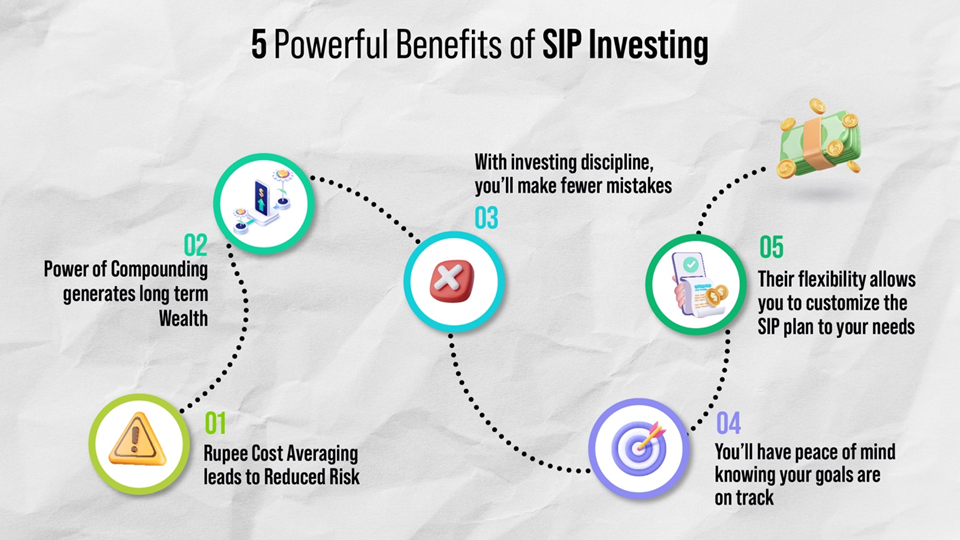

The most important behavioral trait while investing is to stay disciplined and remain consistent while investing through an SIP. An SIP makes sure that your investments are automated making sure that you remain consistent while investing.

Convenience

Did you know that an SIP investment can be started with as little as Rs. 500 per month? It’s extremely convenient to start an SIP, as the entire process is paperless and can be completed in under 10 minutes with FinEdge’s world-class onboarding platform.

Risk Reduction

By allowing your SIP investment to continue irrespective of market cycles, you’ll benefit from the “rupee cost averaging effect,” which will ensure that you buy more units when markets fall and fewer units when they go up – leading to better risk-adjusted returns from your SIP Mutual Fund in the long run.

Power of Compounding

It is popularly said that ‘Compounding is the 8th wonder of the world’, and truly so.

By spending more time in the market and to let compounding take effect on your investments, you are creating a massive opportunity for wealth creation. Let me demonstrate this with the diagram below. This is how your investments would look when you invest through an SIP of 25,000 for 20 years. The first 11 years could look like a very slow and laggard period of investing with moderate returns. The 12th year onwards, we start seeing the ‘Compounding effect.’ This is also known as the inflection point, where the compounding curve of your investment starts taking shape of a ‘hockey stick’ – denoting exponential growth of your investments.

Step-up SIPs – Do They Make Sense

Think of a step-up SIP investment as a turbocharged SIP! In a step-up SIP, you issue a standing instruction to top up your SIP every year by a fixed percentage. For example, you may be comfortable investing Rs. 10,000 per month today but are quite confident that you’ll be able to increase this SIP investment by 10% on an annual basis. Instead of increasing this SIP investment manually, you can issue an upfront instruction to adjust the SIP mutual fund by increasing the amount by 10% annually.

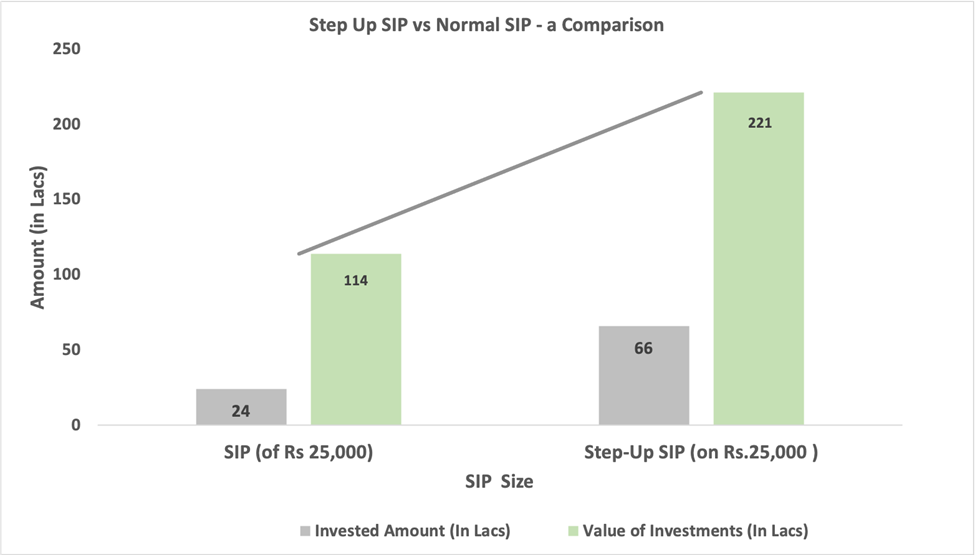

By investing Rs. 10,000 per month through an SIP in an Equity Mutual Fund for 20 years you can create a corpus of Rs. 1.14 crores*. The total invested amount during this period would be Rs. 24 lacs in this period.

Now let’s apply a 10% step up annually, on the monthly SIP value of Rs. 10,000 and see the impact on the final corpus. The total corpus that would be created by the end of 20 years is an astounding Rs. 2.21 crores* with an invested amount of Rs. 66 lakhs.

This makes Step Up SIPs a fantastic choice for long-term financial goals, and it is therefore recommended that a step up in your SIP can be transformational for your financial goals.

How to Invest in SIP Mutual Funds?

In today’s era of digital investing, starting a SIP investment is truly as easy as 1-2-3!

‘Dreams into Action’ – FinEdge’s transformational investing platform not only makes transactions easy but also ensures that all investments are started after undergoing a detailed investing process. The above examples of Wealth creation through long term investing is an outcome of a great investing process that is client centric, customized and highly collaborative. DiA has ensured that investing success is not the outcome of predicting the course of the market but to have greater clarity on goals, risk tolerance and investing beliefs. The natural outcome of this process would be an investing behaviour that is conducive for investing success.

Financial Plan & Goal Setting

Starting a SIP investment without setting proper goals is one of the main reasons why investors fail! The first question to ask isn’t which SIP mutual fund to invest in, but “why” you are investing. A professional Financial Advisor can help you define your goals through a detailed and eye-opening financial planning process.

KYC & Online Account Opening

Having set your goals, you are now ready to move to the next step in your SIP investment journey by opening an SIP investment account! FinEdge offers a seamless, fully digital KYC (Know Your Customer) and account opening experience. All you need are soft copies of basic documents such as your PAN Card, Aadhar Card and a copy of your cheque with your name on it.

Fund Selection

Fantastic! Now, with your financial goals clearly defined with the help of an investment manager, your KYC formalities are done, and your account opened, you can select the best Mutual Fund for your goals. For long-term goals like your retirement, you can go for an aggressive fund category like a mid cap or a small cap fund. These funds could be volatile but also have the potential to deliver high returns in the long run. For shorter-term goals, you can go for investments into debt funds, liquid funds or arbitrage funds.

*Assumption of 13% Annualized Return

Achieve your goals with SIP's