Investing Insights

Mayank is a co-founder at FinEdge and his experience of more than 20 years in the banking and financial services industry has been instrumental towards building the FinEdge platform.

He has held key positions across the Retail and Wholesale Banking verticals at Standard Chartered Bank, driving growth in segments managed by him.

Mayank is a post graduate in Marketing and Finance and has completed his Bachelor’s degree from Delhi University.

He has a keen interest in technology and likes to keep himself updated with the latest in the tech world.

Successful Investing – 5 Incredible Learnings From the Past 20 Years

The year was 2001 and Atul, an avid investor, was all geared up to secure his retirement. He was 40 years old then and his retirement was 22 years away. He started investing Rs. 25,000/- every month systematically in an equity mutual fund… Before I reveal the outcome of Atul’s investing journey, let us dive into some valuable investing lessons of the past 20 years.

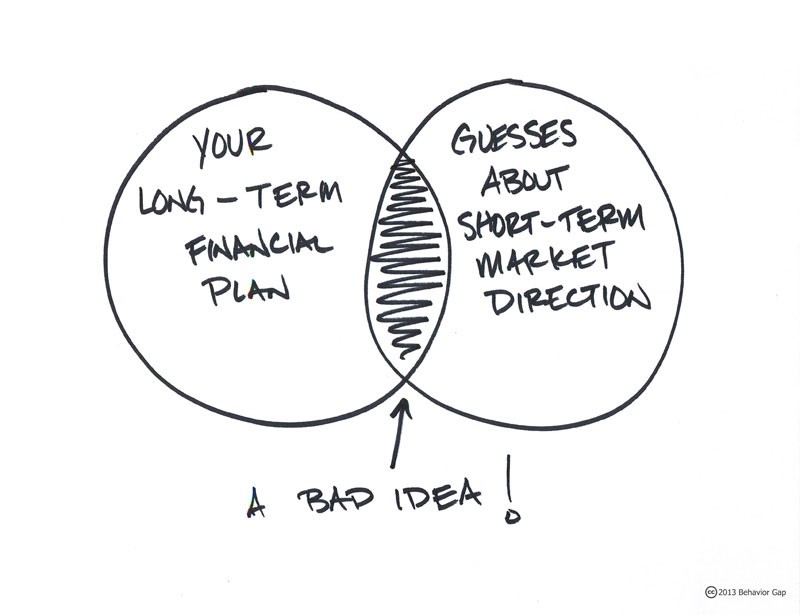

5 Behavioural Traps That Could Hurt Your Mutual Fund Investments

Learn 5 key biases impacting long-term mutual fund returns to boost your investment success.

CAGR vs XIRR vs Absolute Return: Understanding Which Return Really Matters

When reviewing investment performance, investors often come across multiple return figures absolute return, CAGR, and XIRR. While these numbers may appear similar, they measure performance very differently. Understanding what each metric represents, and when to use it, is essential for making informed investment decisions and setting realistic expectations.

Financial Planning Before and After Retirement India: A Complete Guide to Building & Managing Your Retirement Life

Planning for retirement is not just about saving, it’s about understanding how your needs evolve. Financial planning before and after retirement India requires two different skill sets: building your corpus before retirement and managing it wisely afterward so it lasts 25–30 years.

Should NRIs Invest in Mutual Funds in India?

India’s economy is entering a powerful growth phase, and NRIs have a unique chance to be part of it. Mutual funds make it simple, transparent, and goal-driven to participate in this long-term opportunity.

How Many Mutual Funds Should You Hold? Avoid Duplication & Over-Diversification

Owning more mutual funds doesn’t mean more safety. The key to smart investing is holding just enough funds — each with a purpose tied to your financial goals.

Why Mutual Funds Are the Smartest Way to Build Your Child’s Marriage Fund

Indian weddings are beautiful but expensive affairs, and their costs are rising every year. Mutual fund SIPs can help you plan ahead, ensuring your child’s big day is celebrated without financial stress.

Understanding Foreign Institutional Investors (FIIs) and Their Role in the Indian Stock Market

Foreign Institutional Investors (FIIs) are among the biggest movers of the Indian stock market. Their buying or selling patterns often set the tone for market sentiment, liquidity, and long-term growth, making them vital to understanding how global money shapes India’s financial ecosystem.

Why Investment Planning is Crucial for Indian Seafarers in the Merchant Navy

Life at sea brings adventure, discipline, and global exposure, but it also demands a clear financial anchor. For Indian seafarers, smart investment planning is essential to turn offshore earnings into lasting security. With expert guidance and goal-based investing, financial peace can sail alongside every voyage.

What is a Flexi Cap Fund? Meaning, Returns, Benefits & Taxation

Flexi cap funds offer investors the freedom of dynamic allocation across large, mid, and small caps. Learn their meaning, performance, taxation, and suitability before investing.

What Are Large-Cap Funds? Risks, Returns, and Should You Invest?

Large-cap funds are the foundation of most equity portfolios. They may not deliver overnight riches, but they provide stability, consistency, and peace of mind for long-term wealth building.

Should Young People Invest in Equity? Lessons from India’s New Investing Wave

More young Indians are stepping into equity markets than ever before, with over half of new investors now under 30. Starting early is a powerful advantage, but without discipline and purpose, convenience-led investing can quickly turn into costly mistakes.

Latest Posts

Should You Continue Investing in ELSS and PPF in the New Tax Regime?

Mar 02, 2026

Does High Income Make You Wealthy?

Feb 27, 2026

Retirement Planning in India: A Practical Framework for Long-Term Security

Feb 25, 2026

When Is the Right Time to Start Investing for Your Goals?

Feb 23, 2026

How to Adjust Your Investments After a Salary Raise

Feb 20, 2026

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)