NRI Investing Trends 2025 – Insights from 90+ Countries

- USA leads with 21% of NRI clients, followed by strong representation from the UAE, UK, and Canada.

- Retirement and children’s education make up 57% of all NRI financial goals.

- Over 75% of NRI clients remain invested for 5+ years, reflecting strong long-term discipline.

- Average NRI SIP at FinEdge is ₹6,486 — more than double the industry average.

This study reveals how NRIs think, plan, and act differently when investing in India – and the critical roadblocks they face. Based on 898 long-term NRI investors.

From ₹4,200 Cr+ in managed goals to investment patterns across 90+ countries, our latest NRI Investors Study reveals how global Indians plan, invest, and overcome unique challenges when building wealth in India.

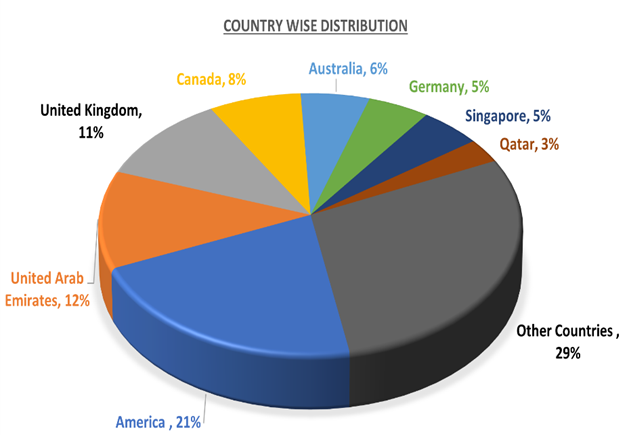

Which Countries Have the Highest Number of NRI Investors?

1. USA contributes the highest number of NRI clients at 21%.

2. This aligns with the large Indian diaspora and high disposable income levels in the US.

3. Strong Presence in the Middle East: The UAE (12%) and Qatar (3%) together account for 15% of the

NRI client base.

4. Going by the trend, the United Kingdom, Canada, Germany, Singapore, and Australia are key contributors:

The UK at 11% and Canada at 8% are countries with a high concentration of NRI clients, whereas Germany, Singapore, and Australia collectively form another 16% and are meaningful contributors. The Indian community in these countries is financially aware and understands the long-term wealth-creating potential of investing in the Indian market.

5. 29% of clients fall under the categories of ‘Other Countries’, suggesting a long tail of smaller but meaningful pockets across the globe.

FinEdge has NRI clients spread across 90+ countries around the world.

What Are the Top Financial Goals for NRIs in 2025?

|

|

|

|

|

Average Goal Size (In ₹ Crores) |

|

|

Goal Type |

Number of Goals |

Target Amount (in Crores) |

NRI % by Nos |

NRIs |

RIs |

|

Children’s Education |

565 |

461 |

30% |

0.82 |

0.52 |

|

Retirement |

517 |

3228 |

27% |

6.24 |

3.64 |

|

Wealth Creation |

206 |

302 |

11% |

1.47 |

0.72 |

|

Home Purchase |

178 |

136 |

9% |

0.76 |

0.51 |

|

Children's Marriage |

161 |

101 |

8% |

0.63 |

0.58 |

|

Emergency Fund |

129 |

18 |

7% |

0.14 |

0.10 |

|

Loan Prepayment |

92 |

18 |

5% |

0.19 |

0.13 |

|

Holiday Planning |

58 |

3 |

3% |

0.05 |

0.06 |

|

Car Purchase |

26 |

2 |

1% |

0.07 |

0.08 |

|

Total |

1941 |

4269 |

|

|

|

Total Goals: 1941

Goals under Management (GuM): Rs. 4,200 crores.

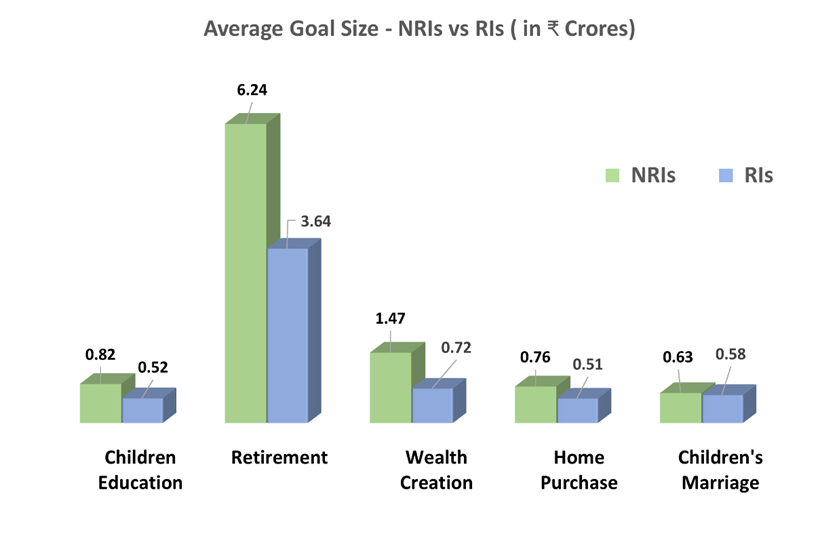

A Comparison of Average Goal Size between NRIs and Resident Indians

These higher goal sizes reflect a combination of stronger savings capacity and a higher cost of expectation for future lifestyle or education.

Key Findings:

1. Children’s Education is a top priority, with 30% of all Goals for NRIs.

NRIs are focused on securing quality education for their children. Rs. 461 crores have been targeted towards this goal. The average size of this goal is Rs. 82 Lakhs in comparison to Rs. 52 Lakhs for Resident Indians.

A similar study of RIs also shows that 29% Resident Indians have planned for their children’s education.

2. Retirement Planning Comes Close at 27%.

A total of Rs. 3,228 crore is planned for retirement within this sample size of NRIs. Also, the average goal amount at Rs. 6.24 crores is about 75% higher than Resident Indians at Rs. 3.64 crores. This signals high awareness among NRIs about future lifestyle protection, healthcare costs and inflation. Many may retire in India and would like to build a retirement corpus here.

24% of goals planned by RIs are for Retirement Planning.

For NRIs, the top two goals of retirement & child’s education account for 57% of all goals.

3. Wealth Creation, Home Purchase & Children’s marriage are strong objectives too.

- Wealth Creation at 11% isn’t about speculation—it is about building wealth with a view to the long term. Average Goal Size for Wealth Creation for NRIs is Rs. 1.47 crores versus Rs. 72 lakhs targeted by Resident Indians.

- Home Purchase at 9% suggests many NRIs would like to own real estate in their home country.

- Children’s Marriage is another significant goal, forming 8% of total goals for NRIs. The average goal size for this goal is Rs. 63 lakhs.

The top two priorities – retirement and children’s education – account for 57% of all goals among NRIs, compared to 53% for Resident Indians.

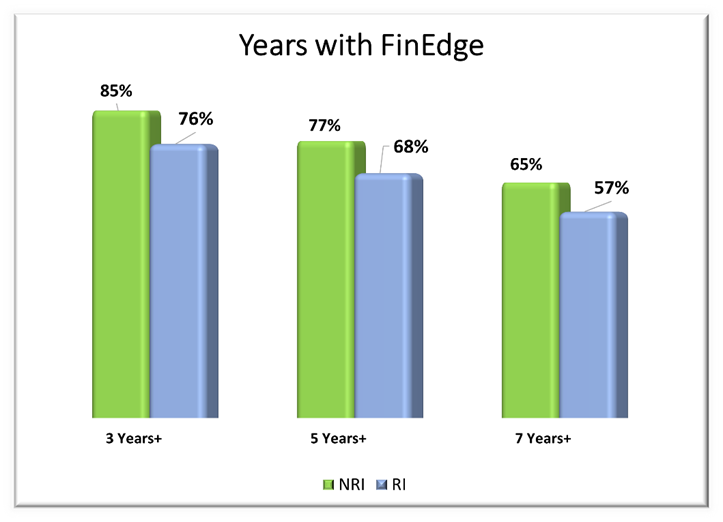

How Does NRI Investing Tenure Compare with Resident Indians?

Key Findings:

1. NRIs have shown a higher orientation towards long-term investing in comparison to Resident Indians

2. Over 75% NRIs have remained invested for 5 years+ and 65% of investors have remained invested for 7 years +. This period has witnessed significant volatility in the markets, including the market meltdown during the COVID pandemic.

3. Over 68% RIs have remained invested for 5 years+ & 57% of investors have remained invested for 7 years +

This investing behaviour spanned major volatility events, including COVID, the Russia-Ukraine war, the 2024 elections, the Israel-Middle East war, the India-Pak conflict, Trade wars, and global interest rate spikes.

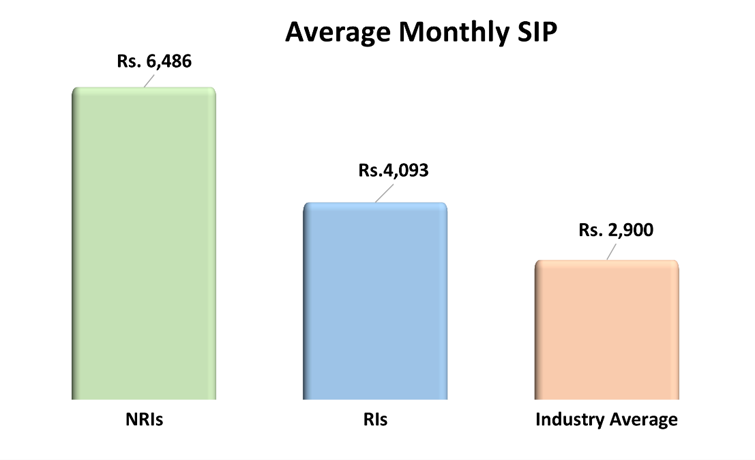

What Do Monthly SIP Trends Reveal About NRI Investing Habits?

Average SIP for an NRI client at FinEdge: Rs. 6,486

Average SIP for Resident Indians at FinEdge: Rs. 4,093

Average Industry monthly SIP: Rs. 2,900 (approx)

Key Findings:

1. NRI Clients Invest significantly more: The average SIP amount for NRI clients at FinEdge is Rs. 6,486, which is 58% higher than that of resident Indian clients at an average monthly SIP of Rs. 4,093.

2. The Average monthly NRI investments are more than double the monthly industry average of Rs. 2,900. This shows a strong commitment among NRIs when it comes to long-term investing.

3. Resident Indian Clients also outperform Industry Average: The average SIP for resident Indian clients at FinEdge is Rs. 4,093, which is about 41% higher than the industry average of Rs. 2,900.

This difference reflects both the larger surplus capacity among NRIs and their stronger orientation towards long-term investing via SIPs.

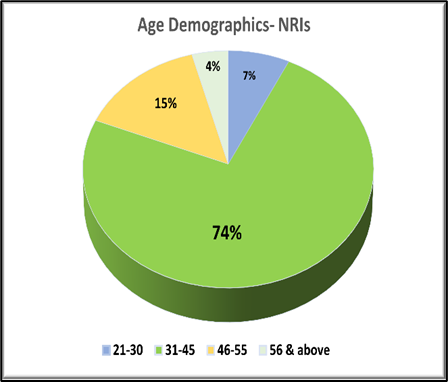

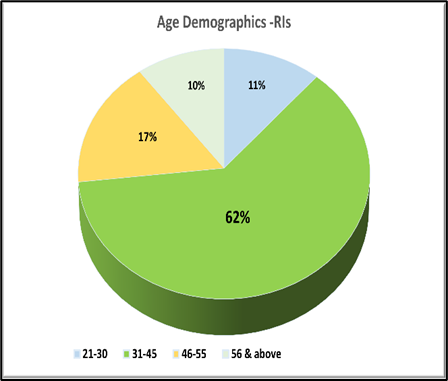

How Do NRI Investor Age Demographics Differ from Resident Indians?

NRI

|

Age Group |

% of Total |

|

21-30 |

7% |

|

31-45 |

74% |

|

46-55 |

15% |

|

56 & above |

4% |

Resident Indians

|

Age Group |

% of Total |

|

21-30 |

11% |

|

31-45 |

62% |

|

46-55 |

17% |

|

56 & above |

10% |

Key Findings:

1. The majority of Investors are between 31–45 Years:

74% NRIs are in the 31–45 age group, which reflects a high concentration of mid-career professionals actively investing for long-term goals. In comparison, 62% RIs fall in this age bracket.

2. NRIs Start Investing later than RIs:

7% of NRIs are aged 21–30, compared to 11% of RIs. This suggests that NRIs begin their investment journey a bit later, possibly once their careers stabilise overseas.

3. Senior participation is higher among RIs:

10% of RIs are aged 56 and above, compared to just 4% of NRIs. This implies more retirees or pre-retirees among resident investors, while NRIs are more active during their earning years.

4. Investors aged 46–55 at 15% NRIs and 17% RIs make for a modest share:

This group could be in the consolidation stage of their investing lifecycle.

74% of NRI investors are aged 31–45, indicating this group is planning mid-career and aligning wealth creation with long-term life goals.

NRIs start later but go deeper – only 7% of NRI investors are in the 21–30 group vs 11% of RIs.

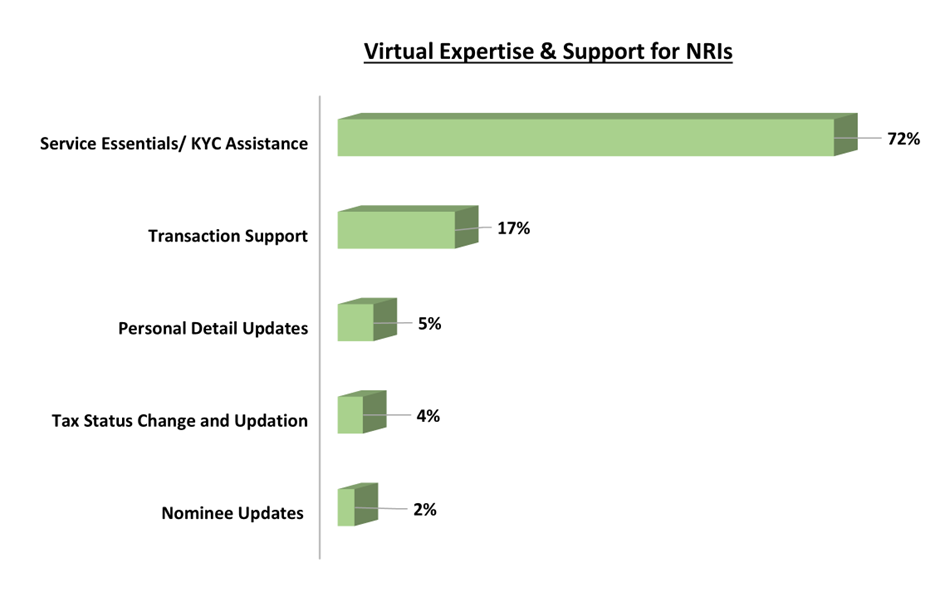

How Does FinEdge Provide Virtual Support for NRI Investors?

NRIs have unique requirements based on the cross-border complexities of investing in India. Due to the distance, clients cannot meet their investment experts face-to-face; they need a credible touchpoint in India. Complying with changes in regulations, reviewing investments or planning for goals all need expert assistance.

Examples of some changes in guidelines over the past few years that needed intervention, as they directly affected the continuity of investments or access to funds that are invested.

• PAN & Aadhaar Linking

• Mandatory KYC Validation

• Mandatory Nominee updation

• FATCA Compliance

• Two Factor Authentication for all Redemption/ Switches.

• KYC Updation and Tax Status change

• NRE/NRO Account Updates

• Fund Restrictions – Fresh Inflows, Segregation of Portfolios or Redemption Restriction

• Declaration for similar contact Information Updation

Resolution to Service-related concerns faced by the sample set of NRI clients at FinEdge :

|

|

|

|

|

|

Service Essentials/ KYC Assistance |

KYC Updates, Change of Bank in folios, Account Statements, ARN Transfers |

2072 |

72% |

|

Transaction Support |

ECS bounce, Goal Mapping, Transaction rejections, Issues related to redemptions etc |

491 |

17% |

|

Personal Detail Updates |

Mobile, Email, Address or any personal information updation |

143 |

5% |

|

Tax Status Change and Updation |

FATCA, RI to NRI, AMC Update for Tax Status changes |

116 |

4% |

|

Nominee Updates |

|

57 |

2% |

72% of all requests from NRIs are related to hygiene tasks, not investment advice. This underscores the critical need for seamless support and regulatory handholding.

Key Findings:

1. Service Essentials and KYC Assistance form the majority of support requests at 72%

72% of all service-related requests for NRIs form part of investment hygiene: bank detail changes, KYC updates, account statements, and ARN transfers.

2. Transaction Support – 17%

Close to 17% of issues are related to actual investment execution: ECS bounces, failed redemptions, rejected transactions, and goal mapping errors. These can disrupt investment journeys or derail goal timelines if left unresolved.

3. Personal Detail Changes – 5%

Simple updation of personal information like mobile numbers, emails or addresses needs assistance. For NRIs, dealing with OTPs or document proof from abroad becomes a matter of inconvenience.

4. Tax Status and Compliance – 4%

Whether it is FATCA declarations or changing from RI to NRI, compliance requirements can be complex. It is essential to stay compliant with these regulatory guidelines as non-adherence can affect the continuity of investments.

5. Nominee Updates – 2%

This is often neglected but deeply important. This is essential as this ensures that in the untimely demise of the investor, transmission formalities can be undertaken smoothly.

Engagement Metrics at FinEdge

The data above suggests that new or revised guidelines are issued from time to time. Hence, engagement, especially with NRI clients, needs to be regular and consistent to comply with rules and regulations. We at FinEdge believe that NRIs have unique requirements that require expertise and speed. Our tech platform helps engage with our NRI clients across the world with ease and convenience. Active engagement with clients helps to reinforce goals and ensures the right decision-making is incorporated within the investing process.

Average Virtual Meetings per year with NRI Clients: 5.4

Average duration of Virtual Meetings: 32 minutes

Average Reviews of Portfolio per year per NRI Client: 1.9

Virtual trust is everything – our average NRI client does 5.4 virtual meetings and two portfolio reviews annually with FinEdge.

Tech alone isn’t enough – consistent engagement is key to building NRI investing resilience.

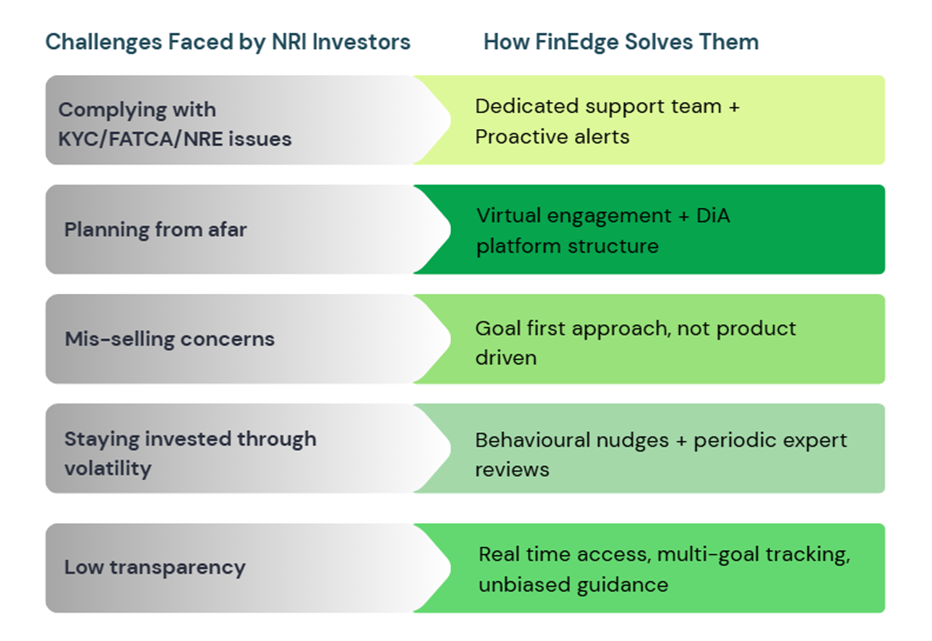

Why NRI Investing in India is Complex – and What Makes it Work

Challenges faced by NRIs can be the reason of not investing in the Indian markets. Often, navigating through them would require being updated with the latest regulations and processes. Given below are some common challenges that our global Indians face when investing in India:

• Regulatory changes: KYC freezes, FATCA, Tax confusion

• No face-to-face access to credible experts

• Higher ticket sizes = higher risk of mis-selling

• Need for long-term visibility, honest reviews, and local oversight

The FinEdge Solution

Navigating Distance, Complexity and Goals — Why NRIs Trust FinEdge with ₹4,200 Cr+ in Goals.

The core FinEdge values of ‘no sales/product/revenue targets’ help NRI investors escape the mis-selling trap.

Refer: Economic Times article on some challenges faced by NRIs

Refer: Khaleej Times article on NRI Investing

Why Global Indians Trust Us - In Their Own Words

“While for the first 6 yrs I had been in India and experienced prompt responses all the time but last one year that I have been working from Bangkok has been even better. Long distance never seemed any barrier at all. Infact I was more than happy with speed of the responses and quality of the conversations. My special word for my Financial Advisor Ms Deepika. She has been extremely professional and has fine sense of financial acumen to make all my investments choices very good. Way to go for both Deepika and FinEdge.”

Vaibhav Pandey

Sales Director at Reckitt Benckiser

Bangkok, Thailand

“The company FinEdge is a very-very reliable and trustworthy company, its platform and services are well explained by its team, I joined them totally new, and after 7 to 8 years with them, no regrets. I am very happy also the fund managers are well equipped and very polite, patient and intellectual and take care of your investments like their own business. I thank them for their hardwork and dedication and wish them and the company all the best. A big thanks once again.”

Danny Raymond Bonwaity

Merchandiser at Costco

Paris, France

“Great experience so far. FinEdge created a good portfolio for me and it has given very good returns. Off course I had to stay invested. They also keep reviewing the portfolio on a regular basis and advise. Overall very good experience!"

Hemant Shrivastav

Senior Consultant at TCS

Zurich, Switzerland

Copyright Disclaimer:

This study is the intellectual property of FinEdge. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form, without the prior written permission of FinEdge, except in the case of brief used for non-commercial purposes or media coverage, provided that full and clear credit is given to FinEdge and the source is cited as the FinEdge NRI Investors Study.

FAQs

Your Investing Experts

Continue Reading

Accelerated Trends of Women Investing in India

Women investing in India is no longer a trend, it is a structural shift in financial participation. Rising workforce inclusion, larger financial goals, and disciplined planning are reshaping the investment ecosystem. As more women take charge of wealth creation, the future of investing is becoming more inclusive and goal-driven.

Army Day Special: Why Investment Planning Matters More Than Ever for Armed Forces Personnel

They serve the nation with discipline and sacrifice, often across unpredictable locations and life stages. On Army Day, we reflect on why thoughtful, long-term investing is just as critical to securing their future beyond service.

How to Categorise Financial Goals: Short, Medium, and Long-Term Goals Explained

Before we get into strategies and structures, it’s important to understand the value of categorising financial goals. Every individual has a unique set of aspirations, but not all goals carry the same urgency or impact. By breaking them down clearly, you can build a systematic, purpose-driven investment plan tailored to your life.

.png)

.jpg)