A Comparison of Small Cap, Mid Cap and Large Cap Funds

The equity mutual fund investing universe is quite vast. Many types of equity mutual funds exist based on the size or market capitalisation of the companies they invest in. These include large, mid, and small cap mutual fund schemes. In this article, we will understand what are large, mid, and small cap funds, their differences, and what you should consider before investing in them.

What Is Market Capitalisation?

A company's market capitalisation is defined as the number of shares multiplied by the market price per share. For example, Company ABC has one crore shares, and the market price of each share is Rs. 25. The market capitalisation of Company ABC will be Rs. 25 crores (1 crore shares X Rs. 25 price per share).

Types of Capitalisation

Based on their market capitalisation, companies are categorised into various types as follows:

1) Large Cap Companies

In India, the top 100 listed companies, as per their full market capitalisation, are categorised as large cap companies. They are also known as bluechips. These are well-established companies, most of them leaders or among the top 3 companies in their respective sectors/industries.

These companies may have grown fast in the past and reached their current large cap status. Some of them may continue the rapid growth phase, while in the case of some, the growth rate may have moderated. Most of these companies are profitable, have stable cash flows, and pay regular dividends. Their share prices are relatively less volatile than mid and small caps.

2) Mid Cap Companies

The next 150 listed companies (101st to 250th), as per their full market capitalisation, are categorised as mid cap companies. These companies may have grown at a rapid pace in the past and may continue to do so in future. They are yesterday’s small caps and tomorrow’s large caps.

Most of these companies may be in sunrise sectors like renewable energy, electric vehicles, new age technology, e-commerce, waste management, defence manufacturing, travel and tourism, etc. While they have high growth potential, their share prices are relatively more volatile than large caps, but less volatile than small caps.

3) Small Cap Companies

The next 250 listed companies (251st to 500th), as per their full market capitalisation, are categorised as small cap companies. These are niche businesses with the potential for high growth. They are tomorrow’s mid caps and large caps. Their share prices are relatively more volatile than mid and large caps. Also, the liquidity is relatively lower than large and mid caps.

Now that we understand what are large, mid, and small cap companies, let us look at large, mid, and small cap mutual funds.

What Is Large Cap Fund?

A large cap mutual has to invest a minimum of 80% of its total assets in equity and equity-related instruments of large cap companies (top 100 companies). Some indices that give mutual fund investors exposure to large cap companies include the Nifty 50, Nifty Next 50, Nifty 100, etc.

The Nifty 50 Index has performed well in the recent past, with returns of 32.64% in the last one year and 19.39% CAGR in the last five years. The returns are as of 30th August 2024.

Large cap funds are relatively more stable than mid and small cap funds in terms of returns, volatility, etc. These funds give investors exposure to India’s largest listed companies with good growth prospects, profitability at decent margins, stable cash flows and regular dividends.

What Is Mid Cap Fund?

A mid cap fund has to invest a minimum of 65% of its total assets in equity and equity-related instruments of mid cap companies (ranked 101st to 250th). The Nifty Midcap 150 Index gives mutual fund investors exposure to mid cap companies. The index has created wealth for investors by providing returns of 50.08% in the last one year and 31.92% CAGR in the last five years. The returns are as of 30th August 2024. Investors can choose from mid cap ETFs, active or index funds to invest.

The fund manager has to invest a minimum of 65% in mid cap companies and the remaining 35% at their discretion. They can invest some of it in small caps to benefit from their higher growth prospects, in large caps for their stability, or a combination of these with some fixed-income instruments and cash. The mid cap companies that these funds invest in have the potential to grow faster and create wealth for shareholders. The mid caps funds have the potential to give higher returns than large cap funds but with lower volatility than small cap funds.

What Is Small Cap Fund?

A small cap fund has to invest a minimum of 65% of its total assets in equity and equity-related instruments of small cap companies (ranked 251st to 500th). The Nifty Smallcap 250 Index gives mutual fund investors exposure to small cap companies. The index has outperformed the Nifty 50 and Nifty Midcap 150 indices in the recent past. It has given excellent returns of 53.26% in the last one year and 33.50% CAGR in the last five years.

The Nifty Smallcap 250 Index comprises of companies that can grow faster than mid and large cap companies due to their smaller size. However, they can be more volatile compared to mid and large cap companies.

Difference Between Small Cap, Mid Cap and Large Cap Funds

Now that we understand what small, mid, and large cap funds are, let us look at some differences between them.

1) Size

The most significant differentiator is the size of companies these funds majorly invest in. A large cap fund invests most of its money in the top 100 listed companies (ranked 1st to 100th), mid cap fund in the next 150 companies (ranked 101st to 250th), and small cap fund in the next 250 companies (ranked 251st to 500th).

2) Risk and Volatility

All equity funds are risky and volatile. However, the degree of risk and volatility varies across categories. Small cap funds are the riskiest and have the highest volatility. Mid cap funds lie between small cap and large cap funds in terms of risk and volatility. Large cap funds have low risk and volatility.

3) Return Potential

In terms of returns, small cap funds have the potential to give the highest returns, followed by mid cap and large cap funds.

Things to Consider Before Investing in Small Cap vs Mid Cap vs Large Cap

Now that we understand the difference between small, mid, and large cap mutual funds, let us look at some things you should consider before investing in them.

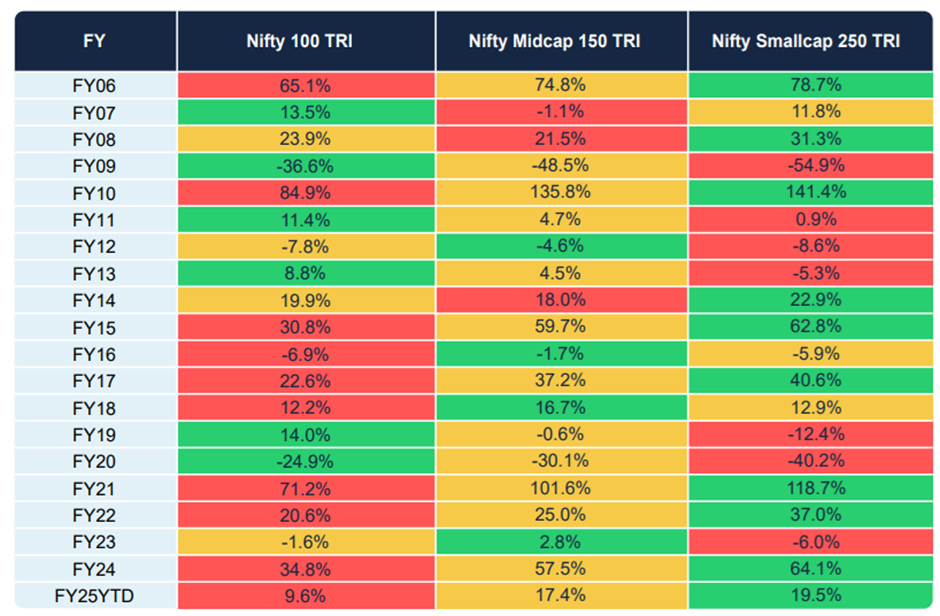

1) Different Category Funds Take Turns to Outperform Each Other

From amongst large, mid, and small cap funds, no single category has outperformed consistently in the past. All three categories take turns to outperform each other year after year.

(Source: HDFC MF - NIFTY500 Multicap 50:25:25 Index Fund presentation)

Note: The above data is as of 25th July 2024

The above table shows, how in the last 19 years,

- Nifty 100 Index (large cap category) has been the best performer in 6 years.

- Nifty Midcap 150 Index (mid cap category) has been the best performer in 4 years.

- Nifty Smallcap 250 Index (small cap category) has been the best performer in 9 years.

So, there is no clear consistent pattern of outperformance by a single category. Hence, you need exposure to all three categories to earn good risk-adjusted returns.

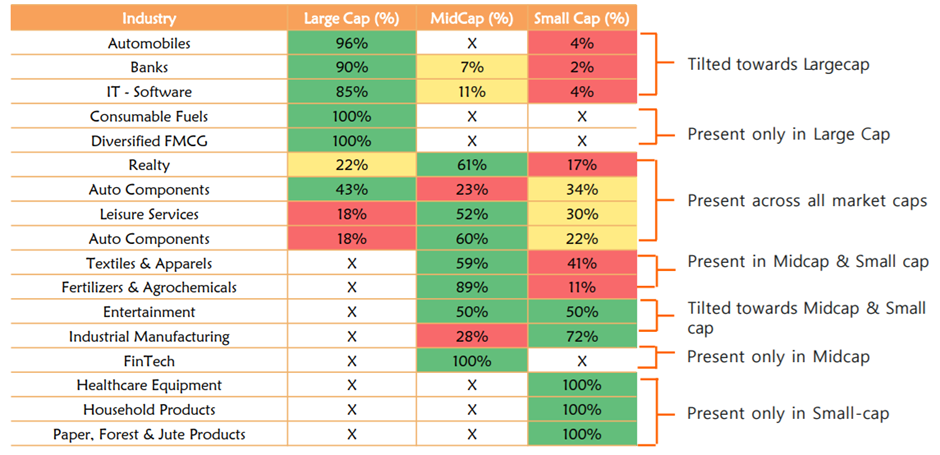

2) Different Category Funds Give You Exposure to Different Sectors

To build a diversified portfolio, you should have exposure to all sectors of the economy. However, if you choose one from large, mid, and small cap funds, you may get exposure to limited sectors.

(Source: Mirae Asset MF - NIFTY500 Multicap 50:25:25 ETF presentation)

Note: The above data is as of 31st July 2024.

The above table shows:

- While the large cap indices can give you exposure to companies in the consumable fuels and diversified FMCG sectors, the mid and small cap indices don’t.

- Similarly, the mid cap index can provide you exposure to fintech, fertilisers and agrochemicals companies. However, large and small cap indices don’t provide exposure to these sectors.

- Similarly, the small cap index can provide you exposure to healthcare equipment, household products, paper companies, etc. However, the mid and large cap indices don’t provide exposure to these sectors.

Hence, to have a diversified portfolio with exposure to all sectors of the economy, you should invest in a combination of large, mid, and small cap funds.

Build a Diversified Portfolio to Achieve Your Financial Goals

We have discussed the meaning of large, mid, and small cap funds, their differences, and why you should have all three in your investment portfolio. But which large, mid, and small cap funds should you select and what should be the proportion of each category in your portfolio?

To understand this, you should work with an investment expert. They can help you list your financial goals, prepare a goal plan, and recommend the appropriate large, mid, and small cap funds to achieve the financial goals. Along with the mutual funds’ recommendation, they can do the regular review to track the progress, and handhold you throughout the financial planning journey till the financial goals are achieved.

FAQs

What Are the Options for an Investor to Invest in Large, Mid, and Small Cap Mutual Funds?

An investor can invest in large, mid, and small cap mutual funds in the following three ways: active funds, index funds, and exchange-traded funds (ETFs). Active funds and index funds offer the systematic investment plan (SIP) route. In an active fund, the fund manager decides which stocks to buy and sell, the quantity, and the price. The fund manager aims to outperform the benchmark with active management.

In an index fund, the fund manager invests in all the benchmark index constituents as per their weightage in the index. Index funds have the benefits of low cost, simplicity, and benchmark returns (after accounting for expense ratio and tracking error).

Which Indices Can Provide an Investor Exposure to Large, Mid, and Small Cap Stocks?

An investor can get exposure to different categories of stocks through the following indices:

- Large cap stocks: Nifty 50, Nifty Next 50, and Nifty 100 indices

- Mid cap stocks: Nifty Midcap 150 Index

- Small cap stocks: Nifty Smallcap 250 Index

The Nifty LargeMidcap250 Index can provide exposure to large and mid cap stocks through a single index. The Nifty MidSmallCap 400 Index can provide exposure to mid and small cap stocks through a single index. The Nifty 500 Index can provide exposure to large, mid, and small cap stocks through a single index.

Your Investing Experts

Relevant Articles

Why Mid-Cap Allocation Needs More Discipline Than Large Cap

Mid-cap allocation demands more discipline than large cap because it comes with sharper market swings. While mid caps offer higher long-term growth potential, they also test investor patience during downturns. The key is not choosing one over the other, but understanding how each behaves across market cycles.

Why Return-Focused Investing Fails in Volatile Markets

Return-focused investing fails in volatile markets because it relies on recent performance as the primary decision-making anchor. When markets fluctuate sharply, investors who chase returns tend to react emotionally switching funds, exiting prematurely, or increasing risk at the wrong time. Over time, these reactions interrupt compounding and damage long-term wealth creation.

What Is NAV in Mutual Fund? A Simple Guide to Understanding Net Asset Value

If you are trying to understand what NAV in mutual fund investing means, the answer is simple: NAV, or net asset value, represents the per-unit value of a mutual fund’s portfolio after deducting its liabilities. It tells you how much each unit you hold is worth at the end of a trading day. It does not indicate whether a fund is cheap, expensive, or better than another, it is simply a daily valuation measure.

.png)