The Best Investment Plan in Dehradun: How a Financial Advisor Can Help You Achieve Goals

Dehradun, nestled in the scenic Doon Valley at the foothills of the Himalayas, is a city that perfectly balances nature and modern living. Known for its pleasant weather, lush greenery, and top educational institutions like The Doon School and Welham, it has earned the title of the “School Capital of India.”

The city is also home to major organizations like ONGC, the Survey of India, and the Indian Military Academy, making it a hub for both professionals and retirees. With its strong educational and professional foundation, Dehradun is an ideal place for families looking to build a secure future—just like a good investment plan lays the foundation for long-term stability.

Why FinEdge is the Best Investment Platform for Residents of Dehradun

Why FinEdge | Customized Investment Plan | Best Financial Advisor

Importance of the Best Investment Plan in Dehradun

Having a good investment plan is the foundation of financial security. The best investment plans ensure that your hard-earned money grows over time while keeping you financially prepared for major milestones like retirement, your child’s education, and buying a home. Creating an investment plan is not just about putting money aside, it’s about following a disciplined process. It starts with setting clear financial goals, understanding your risk appetite, and choosing the investment products that are right for you, whether mutual funds, stocks or bank accounts. By sticking to a structured investment planning process and making informed decisions, you can create a secure financial future.

Attain Financial Freedom

Investing in Dehradun: Plan Your Retirement, Child’s Education and Home Purchase

With its peaceful environment and excellent infrastructure, Dehradun has become a preferred destination for those approaching retirement. With a robust investment plan, you can secure a stress-free retirement and enjoy life in a place as serene as this. But a retirement plan isn’t the only important goal; a good plan can enable you to achieve a number of long-term goals.

For instance, Dehradun’s scenic beauty and pleasant weather make it a sought-after location for vacation homes. Many individuals invest in real estate here, either as a second home or as a future retirement retreat. However, such significant purchases require disciplined investment planning to avoid debt burdens.

Additionally, whether you want to plan your child’s education in the city’s top schools or plan for their higher education in other parts of India or abroad, the best investment plans, which have a strong focus on goals ensure that a quality child’s education is also within reach.

Mutual Funds for Investing in Dehradun

Since we’ve talked about long-term financial goals like retirement, your child’s education, and purchasing a home, it’s clear that a well-structured approach is essential to achieve them. Investing in mutual funds can be an effective way to work towards these goals. Specifically, Systematic Investment Plans (SIPs) in mutual funds offer a disciplined way to achieve financial goals over time while benefiting from the power of compounding.

For example, let’s say you’re planning for your child’s higher education, and you estimate that you will need ₹50 lakhs in 18 years. By starting an SIP of ₹8,000 per month in an equity mutual fund with an assumed annual return of 12%, you can comfortably achieve this target.

*12% assumed rate of return not guaranteed

Mutual funds also offer a smart solution for retirement income through a Systematic Withdrawal Plan (SWP). Instead of relying solely on savings, you can invest in a mutual fund and withdraw a fixed amount every month to cover your expenses.

While mutual funds provide a great way to grow wealth, investing in them on an adhoc basis is not favorable. An experienced financial advisor can help you navigate market complexities, select funds that align with your goals, and ensure your investment plan remains on track.

Role of a Financial Advisor in Dehradun

• Customization: The best investment plans are guided by a financial advisor who helps personalize your plan based on your unique goals, whether your retirement plan, funding your child’s education, or purchasing a home. They ensure your mutual fund investments align with your risk appetite and time horizon.

• Aligning the Right Products: With countless investing options available, a financial advisor helps you select mutual funds to invest in that match your financial goals, rather than ones that are popular.

• Behavior Management: Investing requires patience and discipline, especially during market volatility. A financial advisor helps you stay focused on your investment planning journey, preventing impulsive decisions that could harm your financial future.

• Information Clutter: With overwhelming financial advice available online, it’s easy to get lost. A financial advisor helps cut through the noise, offering clear, practical investment strategies that keep you on track towards financial security.

Why FinEdge’s Dreams into Action is the Perfect Investment Platform for the Residents of Dehradun

FinEdge’s Dreams into Action (DiA) is a bionic investment platform that seamlessly blends human expertise with cutting-edge technology, making goal-based investing smarter and more efficient.

• Client-Centric Approach: Unlike traditional investment firms driven by sales targets, FinEdge prioritizes your financial well-being. Whether you’re planning for retirement, or saving for your child’s education, every recommendation is made with your goals in mind, not product commissions.

• Bridging the Geographical Gap: Dehradun residents no longer need to visit offices to get expert guidance. DiA bridges geographical barriers, allowing you to plan your goals online with ease while still benefiting from the guidance of experienced financial experts.

• Scenario Analysis: Investing isn’t just about returns; it’s about making informed choices. DiA helps you evaluate different financial outcomes so you can take informed risk and invest with confidence.

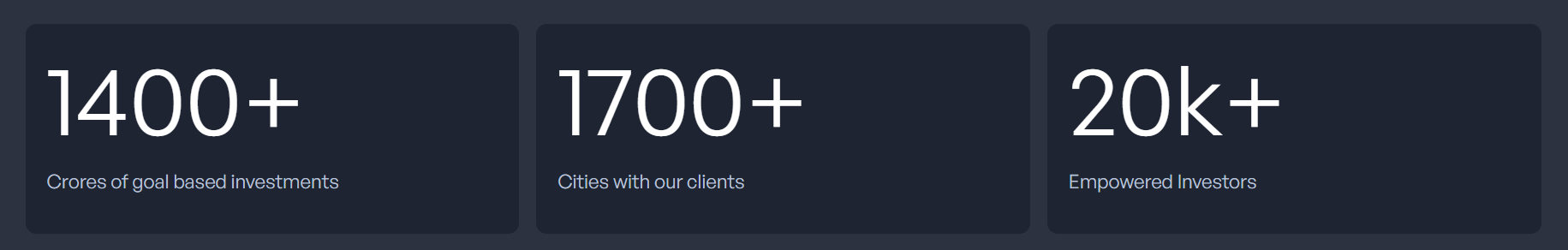

This approach has already transformed thousands of lives. By integrating life goals into every investment decision, DiA ensures that each choice contributes meaningfully to the client’s future. This personalized, goal-centric method sets FinEdge apart, making it an excellent choice for Dehradun's residents.

Your Investing Experts

FAQs

What is an SWP in Mutual Funds?

An SWP (Systematic Withdrawal Plan) is an investment tool that allows you to withdraw a fixed amount from your mutual fund investments at regular intervals, that is, monthly, quarterly or annually. While you withdraw money from your corpus, the remaining funds continue to generate returns.

For example, you can accumulate over 1 crore for your retirement plan in 25 years, with an SIP of Rs 10,000 in a mutual fund with a 12% rate of return. You can start an SWP with that corpus to withdraw Rs.50,000 monthly. Meanwhile, the remaining corpus continues to grow.

Can a Financial Advisor help me plan for a Rs. 30 lakh down payment for a home in 10 years?

Yes. A financial advisor can guide you through a disciplined investing process to help you achieve this goal. By understanding your cash flow—including income, expenses, and liabilities, they will help you define a clear strategy for your ₹30 lakh down payment. Key factors like time horizon and inflation are considered. A financial advisor will also help you choose mutual funds to invest in that align with your risk profile and timeframe, ensuring that you achieve your home down payment over 10 years. Additionally, they can assist you in planning for a home loan prepayment, helping you become debt-free faster and remain disciplined.

What Our Clients Say About Us

Related Articles

Reasons to Get Professional Help for Retirement Planning

Learn how a professional can simplify the retirement planning process, provide a comprehensive plan, and create an income stream.

Why Chandigarh Needs the Best Financial Advisor to Achieve their Financial Goals

Consult with the best Portfolio Managers in Chandigarh for investment planning. Invest for your goals through experts.