Why Financial Advice Matters for Smart Investing in Kolkata

Kolkata, a city renowned for its cultural heritage and intellectual legacy, was also the financial capital of India up until the 1980s. Mumbai may hold that title now, but Kolkata is a vital business hub for Eastern India. From the timeless beauty of Victoria Memorial to having a 15% year-on-year growth in the number of startups, the city inspires big dreams. For investors in Kolkata, the opportunities for financial growth are immense, making a financial advisor in Kolkata necessary for smart investing.

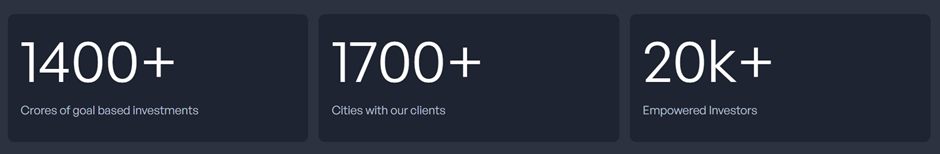

Why FinEdge is the Best Investment Platform for Residents of Kolkata

Why FinEdge | Customized Investment Plan | Best Financial Advisor

Importance of a Financial Planner in Kolkata for Tailored Investment Expertise

In a city buzzing with creativity and opportunity, financial goals deserve more than generic advice. Just like the city’s blend of commerce, arts, and academia, achieving financial success requires a well-rounded investing process. It starts with understanding the investor’s income and expenses, prioritizing their financial goals, and aligning investments to these objectives. This ensures that every decision serves a larger purpose—whether it’s securing retirement, funding your child’s education, or building generational wealth. Wealth creation isn’t about chasing returns. It’s about staying resilient, disciplined, and focused on the long term, much like the steady legacy of Tagore’s poetry. Successful investing isn’t about following trends or quick fixes; it’s about building a plan that aligns with your unique goals and life priorities.

Your Investing Experts

Key Elements of a Great Investing Process

1. Cash Flows: Assessing the inflow and outflow of your income helps you identify and plug any kind of leakages. Also, understanding key ratios like savings to surplus, reserves to surplus, and debt to income can guide you in setting priorities and taking the right steps toward your financial goals.

2. Setting Goals: Investing without clear goals is like navigating Kolkata’s winding lanes without directions. Defining financial goals—be it a vacation or retirement—is essential to building a roadmap that ensures success.

3. Expert Guidance: Investment expertise isn’t about making predictions; it’s about understanding how to take informed risks while staying disciplined through market ups and downs. A trusted expert will not try and position a product that benefits them but rather help investors remain focused on their objectives and avoid impulsive decisions driven by fear or greed.

4. Hyper-Customization: No two investors are alike. Imagine a doctor prescribing you medicine without a health checkup. A good investing process considers individual circumstances, life stages, goals, and risk capacity. Any investment recommendation or approach, whether a Systematic Investment Plan or Systematic Transfer Plan (STP) is aligned with the investor’s goals, ensuring it serves a purpose rather than being made on an ad hoc basis.

5. Resilience: Even with the right plan in place, letting emotions like greed or fear take over—such as trying to time the market or impulsively stopping your SIPs—defeats the purpose of the investing process. Staying invested requires resilience, which is key to experiencing the magic of compounding and achieving your meaningful financial goals.

Importance of Goal-Based Investing

Investing without goals is like sailing without a destination. Goal-based investing ensures that every financial decision is purposeful, aligning investments with specific life objectives rather than chasing market trends. Whether it's securing your dream home, planning your child's higher education, or building a retirement corpus, building an investment process around these goals provides clarity and direction. More importantly, it instills financial discipline, helping you stay committed to your plan despite short-term volatility.

However, just setting goals isn’t enough; customizing an investment plan to match one’s financial situation, risk tolerance, and time horizon is key to goal achievement. This is where expert guidance can make a difference—helping investors stay on track, make informed decisions, and avoid impulsive moves that could derail their progress.

Unlocking Financial Freedom with ‘Dreams into Action’

‘Dreams into Action’ (DiA) is FinEdge’s bionic tech-driven platform is designed to provide a seamless investing experience. It is built upon collaboration between clients and experts, setting realistic expectations to guide your investment journey.

Client Centricity

Unlike many investment platforms, there are no sales or revenue targets. This means that every decision is made collaboratively, with the sole purpose of supporting the client’s financial goals. The client’s interests remain the top priority throughout the investing journey.

Technology Meets Human Touch

DiA seamlessly integrates advanced technology with expert guidance to offer a balanced and effective investment planning experience. In metropolitan cities like Kolkata, Mumbai, and Delhi, where lifestyles are fast-paced, the tech aspect of DiA ensures convenience without sacrificing the quality of meaningful investment planning. It allows clients to access their financial roadmaps and collaborate with experts from anywhere, creating a perfect blend of accessibility and personalized guidance.

Behavioral Coaching

Expert behavioral coaching is necessary to ensure that decisions align with the client’s goals. When reviewing investments, especially during market volatility, the expert offers rational guidance, helping clients avoid impulsive decisions driven by fear or greed. This guidance keeps clients focused on their long-term objectives, ensuring they stay on the path to financial success.

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

The Path Forward

Just as the Maharaja of Cricket, Sourav Ganguly, brought strategy, resilience, and leadership to the game, investors in Kolkata can embrace a similar approach to their financial journey. Success in investing, like in cricket, requires discipline, a well-thought-out plan, and the ability to stay calm under pressure. With the right guidance and a goal-driven strategy, investors too can achieve their own victories—building wealth and achieving financial goals that stand the test of time.

What Our Clients Say About Us

Related Articles

How to Manage Investment Risk Efficiently

Learn expert strategies on how to manage investment risk and achieve better returns. Diversify, allocate assets, and seek expert advice.

Why Goa Needs Access to the Best Investment Advisors

Consult with the best portfolio managers in Goa for investment planning. Invest for your goals through experts.