How a Financial Advisor in Meerut Can Help You Invest Smartly

Meerut is among the fastest-growing urban areas, ranking 14th in India and 63rd globally. A Morgan Stanley report placed it 5th on the "vibrancy" index, ahead of Delhi and Mumbai. The city is undergoing rapid infrastructural expansion, including expressways, the Eastern Dedicated Freight Corridor, and the Delhi-Meerut RRTS. It is a major industrial hub, excelling in sports goods, gold trading, sugar production, and manufacturing of metals and musical instruments. The city hosts over 23,000 industrial units, with prospective growth in IT and logistics. Meerut is well-connected via road and rail, with the Delhi-Meerut Expressway and three national highways. The upcoming metro and RRTS projects aim to enhance urban mobility. With its industrial strength and ongoing infrastructure developments, Meerut is set to become a major logistics and business hub in Western Uttar Pradesh, bolstered by the state's industrial initiatives and expanding transport network.

Meerut is on the cusp of a major transformation, fuelled by rapid infrastructure development and growing economic opportunities. With its strategic location near Delhi, the city is witnessing enhanced connectivity, making it a prime hub for industries, education, and healthcare. Additionally, another Morgan Stanley study in 2023 predicts that Meerut’s economy could grow four times in just four years. With such growth ahead, it is only fitting for the residents of Meerut to plan their investments wisely to grow their wealth and secure their financial future.

Why FinEdge is the Top Choice for Meerut's Investors

Why FinEdge | Customised Investment Plan | Best Financial Advisor

Your Investing Experts

A Strong Investment Plan for Meerut’s Residents

The RRTS may get you from Delhi to Meerut in just 40 minutes, but investing doesn’t work at high speed. Unlike a rapid train, a successful investment journey is not about getting somewhere fast—it is about careful planning, patience, and discipline.

Here’s how residents of Meerut can invest wisely and build lasting financial security:

Define Your Goals

Every great journey begins with a destination in mind. Whether it’s buying a home, securing retirement, funding your child’s education, or building wealth. You wouldn’t board a train without knowing where it’s headed. Similarly, investing without clear financial goals can lead to undesirable financial outcomes.

Time in the Market, Not Timing the Market

Many investors get caught up in trying to time the market, waiting for the perfect moment to invest. However, history shows that staying invested for the long term is far more effective than constantly jumping in and out based on short-term trends. If you keep switching tracks or delaying the journey, you’ll never reach your destination on time. Similarly, staying invested and being consistent is the key to effectively achieving financial goals.

Aligning the Right Products

A one-size-fits-all approach doesn’t work in investing. Your investment products, whether it is stocks, mutual funds, or bank accounts, should be selected based on your financial goals and not what is trending.

Stay Disciplined

Investing success is often derailed by distractions—market trends, FOMO, and panic-driven decisions. When traveling, you don’t jump off the train at every station—you stay on board until you reach your destination. Similarly, to be able to achieve your goals and enjoy the power of compounding, a disciplined approach is essential.

Collaborate with an investment Expert

A professional investment expert customizes your plan according to your goals, cash flow, and risk capacity and ensures you don’t make panic-driven decisions during market volatility. A financial advisor in Meerut can ensure you stay on track through all market conditions.

Choosing the Right Financial Advisor in Meerut

The right advisor will prioritize your financial well-being over ad hoc recommendations. Here’s what to look for when selecting the best financial advisor in Meerut:

• Hyper-customization: A great advisor should follow an investment process that includes understanding your unique financial situation, goals, and risk tolerance. Choose an expert who provides tailor-made investment solutions that align with your long-term objectives

• Check on Investing Behaviour: A good advisor helps you stay disciplined, manage emotions, and avoid panic-driven decisions during market ups and downs. Being able to achieve financial goals isn’t just about returns, it’s about sticking to your plan and making informed choices

• Client Centricity: A good financial advisor in Meerut should focus on your goals, not sales targets. They create a plan that aligns with your objectives and provide guidance to keep you on track toward achieving them.

Dreams Into Action: Personalized Investing

FinEdge’s tech-enabled platform Dreams into Action (DiA) platform is more than just a financial tool - it is a personalized investment journey. A tech platform backed by expertise, DiA helps clients articulate their life goals and creates a personalized investment plan to turn those dreams into reality. By focusing on systematic, long-term investment planning, DiA helps navigate the complexities of financial markets and build long-term wealth.

With DiA, Investment Managers and investors work together and co-own goals and investment managers follow investing best practices and continuously guide investors, resulting in tangible value creation beyond thrill-seeking. DiA is built for investors who want to ‘invest with purpose’ for their important life goals and are willing to be disciplined and committed.

This approach has already transformed the lives of thousands of people. By incorporating life goals into the investment process, DiA ensures that every investment decision is meaningful and aligned with the client’s future aspirations. It is this personalized touch that sets FinEdge apart and makes it an ideal choice for the residents of cities like Pune.

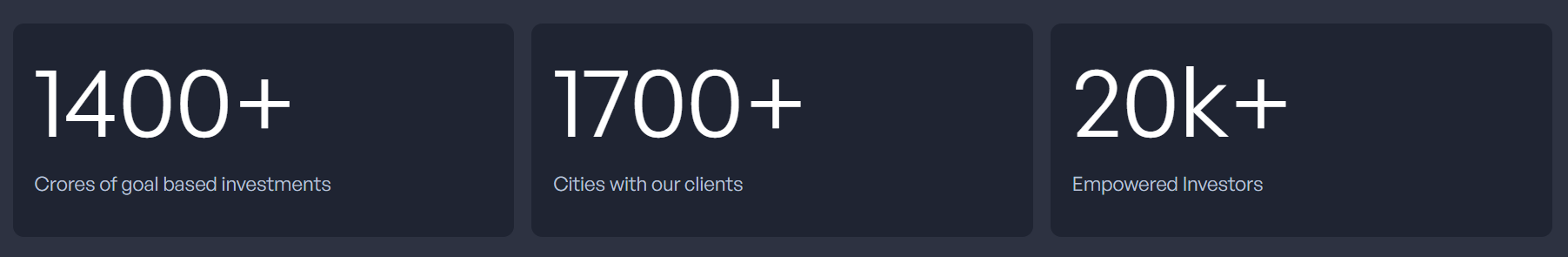

With clients in more than 1700 locations in India and 90 countries in the world, DiA does not have geographical limitations in reaching out to its clients.

Invest with Purpose, Stay on Track

Meerut is on the fast track to growth, and residents have a fantastic opportunity to build wealth by investing smartly and patiently. Just as the city is evolving with thoughtful infrastructure, your investments need a structured plan, expert support, and long-term commitment.

Start your investment journey with a goal-based strategy and expert guidance!

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

FAQs

Why is an Investment expert necessary?

In today’s age of technology, geographies do not matter, so an advisor does not have to be physically present in Meerut any other city. Residents of Meerut can benefit from investment experts who are available online and follow a high-tech, human interface bionic model. A financial advisor adds immense value by helping investors stay focused and disciplined, ensuring they follow a structured approach rather than making emotional or impulsive investment decisions. During market fluctuations, expert guidance can provide clarity and prevent panic-driven investment decisions that may derail financial goals.

What are the features of the ‘Dreams into Action’ (DiA) Investing platform?

DiA offers goal-based investment planning, expert investing guidance, personalized portfolios and paperless transactions. It provides paperless transaction capabilities and user-friendly tools to help investors make informed decisions and achieve their financial goals with confidence.

Are mutual funds a good investment option?

Mutual funds can be a great option for long-term investing as you can opt for approaches like SIPs to benefit from the principle of accumulation and the power of compounding. SIPs in Mutual Funds help accumulate a corpus for your goals over a long investing journey. Mutual Funds rely on the expertise of a fund management team and follow principles of diversification to mitigate risk. However, to invest in a Mutual Fund, you must take help from an Investment expert who has the ability to create a customised investment plan and is by your side to see through your long term investment journey. Make sure that the expert is credible, reputable and has good reviews from clients. A great way to check on this would be to go through Google reviews of any entity you are aligned with.

What Our Clients Say About Us

Related Articles

The Impact of Inflation on Your Financial Goals

Learn about the true impact of inflation on your long-term financial goals and strategies to stay ahead of it.

Why Kolkata Professionals Need Investment Experts to Manage Their Portfolio

Consult with the best Portfolio Managers in Kolkata for investment planning. Invest for your goals through experts.