The Best Investment Plan for Ahmedabad's Investors

Ahmedabad, the largest and most populous city in Gujarat, is also the financial capital and the biggest contributor to the state's GDP. A vibrant hub of business, education, and industry, Ahmedabad blends tradition with progress—from the bustling C.G. Road to the peaceful Sabarmati Ashram. Its strong industrial base, driven by pharmaceuticals and textiles, fuels economic growth. With top institutions like IIM Ahmedabad, the city fosters innovation, making it a great place for professionals and businesses to grow.

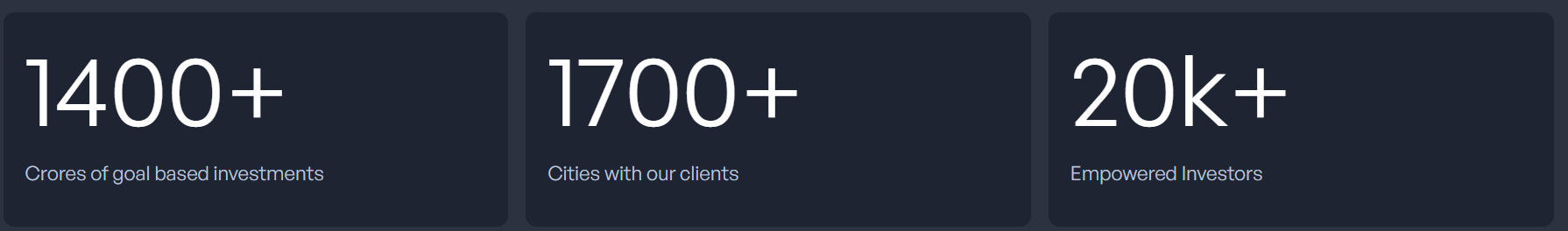

With a fast-growing economy and expanding opportunities, Ahmedabad is an ideal place to build long-term wealth. Our bionic investment model combines technology with expert guidance, providing goal-based investment solutions. At the heart of this approach is Dreams into Action (DiA)—a platform designed to help investors turn financial goals into reality.

Why FinEdge is the Preferred Investing Platform for Agra's Investors

Why FinEdge | Customised Investment Plan | Best Financial Advisor

Why Choose Our Bionic Model?

In a world filled with information clutter, trends, and mis-sold products, our approach stands out. While most investment platforms focus on pushing products to meet sales targets or gain commissions, we prioritize you and your unique goals. Here's how:

• Client Centricity: Every investor is guided by a dedicated investment manager who collaborates with you to craft a hyper-customized financial roadmap.

• Tech-Enabled Expertise: Our DiA platform provides seamless digital convenience, allowing for hyper-customization, scenario analysis, and informed decision-making.

• Goal-Focused Approach: Investing is easy, but wealth creation requires discipline. By aligning your investments with your financial goals like retirement, your child’s education or even purchasing a car, we help you stay on track for financial success.

Your Investing Experts

The Problem with Traditional Investment Approaches

The financial industry is filled with challenges—mis-sold insurance products, misleading past performance data, and DIY platforms that leave investors vulnerable. Unlike generic solutions, our approach ensures:

• No "one-size-fits-all" investments.

• Products pushed with commission-driven agendas.

• No distractions from short-term returns.

How Our Investment Planning Helps Ahmedabad Investors Succeed

Our bionic platform, Dreams into Action (DiA), is designed to make investing collaborative, adaptable, and transparent. It encourages joint decision-making, ensuring your investment plan evolves with your needs.

Invest with Purpose

Ahmedabad is a city of visionaries, from entrepreneurs to salaried professionals. Staying committed to long-term goals is essential, and our platform ensures your investments align with major milestones like:

• Securing your child’s education whether in India or abroad.

• Building your dream home in Ahmedabad’s expanding real estate market.

• A retirement plan, ensuring financial security during the golden years of your life

Achieve your Financial Goals Goals – Retirement, Child’s Education, Buying a home

Markets fluctuate, but financial discipline ensures long-term success. Your retirement or child's higher education goals need a customized roadmap that is unique to your requirements. Many investors struggle with panic-driven decisions when they are not focused on their goals. Our platform integrates behavioral insights to help you overcome fear and greed—two of the biggest obstacles to long-term wealth creation and goal achievement.

Hyper-Customized Investment Plans

No two investors are alike. Your meaningful financial goals like retirement, purchasing a home or your child's higher education require a customized roadmap. We take a personalized approach by understanding your financial habits, cash flows and aspirations to create a plan catering to your needs.

Informed Risk Management

Sometimes, avoiding risk can be the biggest risk. While fixed deposits and savings accounts provide stability, they may not beat inflation in the long run. Our experts help balance risk and returns, ensuring your investments grow while protecting your wealth from inflation. One of the most effective ways to achieve long-term financial goals is through SIPs in Mutual Funds. By following the accumulation and averaging principle, SIPs help mitigate risk and build wealth over time. For instance, investing just ₹10,000 per month for 20 years could grow into a corpus of ₹1.15 crores—with only ₹24 lakhs invested. This disciplined approach helps you stay on track for a secure future.

*Assumed return of 13% which is not guaranteed

Ahmedabad: The Time to Invest is Now

As a city brimming with business opportunities and economic growth, Ahmedabad presents immense potential for long-term wealth creation. Whether you’re an entrepreneur, a corporate professional, or an investor looking to secure your financial future, our data-driven strategies and deep financial expertise help you capitalize on this growth while taking informed risk.

Take the First Step Towards a Wealthier Future

The road to financial freedom starts with the right investment approach. Partner with us and experience the difference of goal-based investing. Whether you’re just starting or planning multi-generational wealth, our expertise and technology will guide you every step of the way.

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

FAQs

Are SIPs better than Fixed Deposits (FDs) for investment?

Fixed Deposits offer stability with 6-7% returns, but since inflation in India ranges from 4-7%, your money may not grow significantly in real terms. For long-term goals like retirement or your child’s education, beating inflation is key. SIPs in mutual funds, based on historical market performance, have delivered 12-13% returns, though not guaranteed. Taking informed risks, that is, being adequately protected but also considering the impact of factors like inflation over time is important when making any investment choice.

Which are the best Mutual Funds to invest in?

Mutual funds are a great way to achieve long-term financial goals, but there’s no one-size-fits-all fund. The right choice depends on your specific goals, whether it’s buying a car, planning for retirement, or funding your child's higher education. Additionally, factors like your income and expenses as well as your risk capacity play a role in deciding the best choice of investment for you.

What are the benefits of using a bionic investment platform like Dreams into Action (DiA)?

Many DIY investment platforms make it easy to fall into the trap of timing the market, which can lead to impulsive decisions and hurt long-term goal achievement. DiA, a bionic investment platform, combines technology with expert guidance to help you make informed choices. Instead of waiting for the perfect time to invest, you collaborate with an expert who customizes a strategy to your financial goals. From setting goals to portfolio reviews, you receive ongoing support to stay on track. Plus, DiA’s combines cutting-edge technology with human expertise which allows you to connect with your investment manager anytime, anywhere, making the investment process seamless and convenient.

What Our Clients Say About Us

Related Articles

How Falling Markets Can Benefit Your SIP Plan

Falling markets often trigger anxiety and fear. Read this article to learn how disciplined investing through SIPs can work in your favour.

Why Kanpur Professionals Need Investment Experts to Manage Their Portfolio

Consult with the best Portfolio Managers in Kanpur for investment planning. Invest for your goals through experts.