Smart Investment Planning with a Financial Advisor in Kanpur

Kanpur is the largest city in the state of Uttar Pradesh and is referred to as an economic powerhouse for the most populous state of the country. Once the financial and commercial center of Northern India, it continues to thrive as Uttar Pradesh’s commercial capital. Uttar Pradesh has witnessed a resurgence in the past few years and it as popularly stated by Prime Minister, Shri Narendra Modi that if India needs to grow, then UP would need to grow exponentially. The focus of the government in the past few years has been to upgrade and create new infrastructure, maintaining law and order and creating manufacturing corridors to boost the states economic activity. Infact, Uttar Pradesh is already one of the fastest growing states in the country with 12% growth in the last 7 years and Kanpur has contributed vastly to this growth. While there are other centers of development emerging in the state like Varanasi, Agra, Meerut and Ayodhya, Kanpur still remains critical do drive growth in the state.

Kanpur also boasts of one of the most prestigious educational institutions in the country – The IIT or the Indian Institute of Technology, Kanpur. IIT Kanpur was the first institute to offer a computer science education in India. The institution has given us the finest engineers and has the distinction of 17 Padma Shri, 4 Padma Bhushan, 1 Padma Vibhushan, and 33 Shanti Swarup Bhatnagar Prize recipients affiliated with it.

With growth and prosperity comes the responsibility of making smart financial choices. Just as businesses invest strategically to thrive, the residents of Kanpur will also be bearing the fruits of economic prosperity and that is why your hard-earned money should be working just as efficiently to secure your financial future.

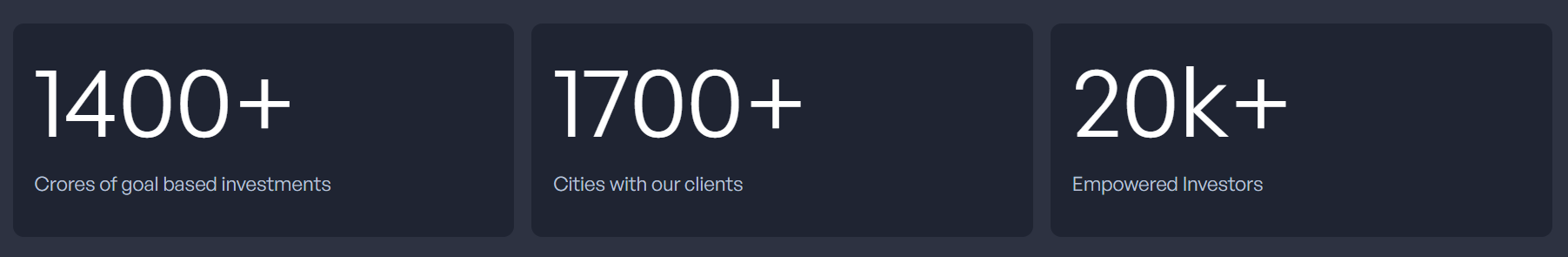

Why FinEdge is the Preferred Investing Platform for Investors in Kanpur

Why FinEdge | Customised Investment Plan | Best Financial Advisor

Your Investing Experts

Smart Investment Planning for People in Kanpur

A good investing process is the difference between short-term gains and long-term wealth creation. Just as Kanpur’s industries thrive towards their goals and objectives, the residents of the city would also need to follow a disciplined approach focusing on their personal financial goals, risk tolerance, and a purpose-driven investment plan.

Let’s understand the key elements of a good investment plan:

• Customization: A personalized approach, aligned with your income, goals, and risk appetite—ensures that your money is working towards achieving what matters most to you, whether it’s purchasing a home, your child’s education, or a comfortable retirement. Investing is not a one size fits all approach and hence a high degree of customization would be important. Additionally, any approach taken, whether a lumpsum investment or Systematic Investment Plan (SIP) should be aligned to your unique investing purpose.

Let me give you an example, Ramesh at 35 years of age might have a goal of homeownership and would need to have a long-term plan to save money for the purchase of his property whereas Sumit also the same age would like to prioritize his retirement. Both would need a very different investment approach as both Ramesh and Sumit have unique goals, financial situations, and risk-bearing capacities. Hence, a customized approach remains key to successful investing.

• Setting Goals: A well-defined investment strategy starts with clear financial goals. Investing in an ad-hoc manner can lead to impulsive decisions that may hinder your long-term financial security. Defining your goals ensures that every investment decision aligns with your broader financial aspirations.

• Aligning the Right Products: As we have discussed above, what works for one investor may not necessarily work for another. With a wide range of investment options available—stocks, mutual funds, fixed deposits, and more—it is essential to choose products that align with your individual risk tolerance and financial goals.

• Resilience: Disciplined investing isn’t about avoiding market volatility but managing it wisely. A robust investment process ensures you stay committed to your financial goals, rather than reacting impulsively to short-term market movements. True wealth is created by staying invested, maintaining discipline, and letting compounding work in your favor over time.

Importance of an Investment Manager

Most people believe that investing success is about choosing the right funds or instruments to invest in. However, the reality is that investor behavior plays a far greater role than market movements in determining long-term financial outcomes.

Many investors unknowingly make decisions that work against their financial goals:

• Stopping their investments due to fear, missing out on the power of compounding.

• Chasing past returns, assuming that what worked before will work again.

• Jumping from one trend to another, driven by FOMO (Fear Of Missing Out) rather than goals.

A trusted investing platform for the residents of Kanpur helps you manage these impulsive behaviors—keeping you focused on your goals rather than reacting to short-term market fluctuations. While the platform should be aided by cutting-edge technology, the face of the platform should be an investment expert who has the ability to customize and handhold an investor’s long investment journey. Just like a coach guides a team through challenges, the right investment expert in Kanpur can help you navigate uncertainty and stay on track to achieve your financial goals.

Why "Dreams into Action" Investment Platform is the Perfect Fit for Investors in Kanpur

Through our tech-enabled platform "Dreams into Action" (DiA), we provide personalized investment solutions tailored to individual financial goals. Whether you're planning to buy a home, fund your child's education, or build a secure retirement corpus, the platform ensures that every investment is aligned with your long-term objectives.

In Kanpur’s growing financial and industrial landscape, long-term wealth creation is essential for its residents. With DiA, we emphasize the importance of staying invested and maintaining a strong goal-focused approach to achieve financial success. The platform leverages expert-driven investment strategies to help investors track progress, make informed decisions, and stay on course to achieve their financial milestones.

Kanpur is a city brimming with potential, attracting new investments and expanding its industrial reach. With the right investment approach and a trusted expert, individuals can secure their financial future while navigating the fast-paced changes in the economy. DiA has empowered many residents of the city of Kanpur by creating investment plans that are aligned to their goals, making them better investors on their way to a successful investing journey.

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

FAQs

Why is an Investment expert necessary?

In today’s age of technology, geographies do not matter, so an advisor does not have to be physically present in Kanpur or any other city. Residents of Kanpur can benefit from investment experts who are available online and follow a high-tech, human interface bionic model. A financial advisor adds immense value by helping investors stay focused and disciplined, ensuring they follow a structured approach rather than making emotional or impulsive investment decisions. During market fluctuations, expert guidance can provide clarity and prevent panic-driven investment decisions that may derail financial goals.

Are SIPs the best choice for investing?

SIPs in mutual funds are a good approach to investing because they allow you to invest at regular intervals, ensuring discipline. Additionally, they offer the benefits of compounding and rupee cost averaging. You can start with a small amount and step up your investment as your income grows. However, the right investment choice depends on various factors such as your financial goals, risk capacity, and time horizon for achieving those goals.

Are fixed deposits a good investment?

Fixed deposits provide stable returns, making them a low-risk investment option. However, investment decisions should not be based solely on returns but should be part of a personalized financial plan that considers informed risk. It’s important to note that the average inflation rate in India ranges between 4-7%, while fixed deposits typically offer returns of around 6-7%. To achieve long-term financial goals, it is crucial to invest in a way that allows your money to outpace inflation, so the value of your money is not lost when you approach your long-term goals.

What Our Clients Say About Us

Related Articles

How to Manage Investment Risk Efficiently

Learn expert strategies on how to manage investment risk and achieve better returns. Diversify, allocate assets, and seek expert advice.

Why Bangalore Professionals Need Investment Experts to Manage Their Portfolio

Consult with the best Portfolio Managers in Bangalore for investment planning. Invest for your goals through experts.