How the Top Financial Advisor in Bhopal Can Help Residents Achieve Their Financial Goals

Bhopal, the capital of Madhya Pradesh, located at the heart of India, is a city of lakes, greenery, and a rich cultural heritage. It blends tradition with modern development, making it one of the best places to live in India. The city’s economy is growing steadily, with industries like electrical goods, jewelry, and major enterprises like Bharat Heavy Electricals Limited (BHEL).

Just like Bhopal thrives on steady growth, your financial future needs a well-planned approach. Think of it like the city’s famous Daal Bafla—each ingredient plays a role in creating a dish that is sweet, spicy and sour. In the same way, achieving financial goals requires a balanced investing process.

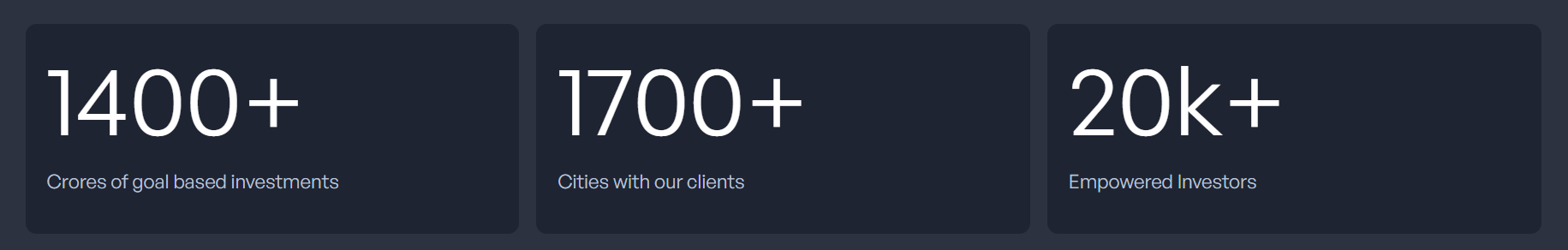

Why FinEdge is the Best Investment Platform for Residents of Bhopal

Why FinEdge | Customized Investment Plan | Best Financial Advisor

Leveraging SIPs to Achieve Financial Goals in Bhopal

Bhopal’s steady growth is a testament to the power of consistency, and the best investment plans work the same way. Achieving your financial goals, whether it's your child’s education, your retirement plan, or building long-term wealth, requires discipline, patience, and informed investing. This is where Systematic Investment Plans (SIPs) come into play.

1. Power of Compounding: Given you remain invested for the long-term, SIP plans allow you to enjoy the benefits of compounding returns. The earlier you start, the more your money grows.

2. Beating Inflation: Inflation in India typically ranges between 4-7%, meaning the cost of living and future financial needs will be much higher than today. Historically, SIPs in mutual funds have outpaced inflation in the long run, ensuring that your financial goals, whether a retirement plan or your child’s education, retain their real value.

3. Discipline: With automated, regular investments, you stay committed to your financial goals without letting market volatility related emotions dominate your decisions.

4. Risk Mitigation: SIP plans help average out market fluctuations through rupee cost averaging, that is, buying more units when prices are low and fewer when prices are high.

5. Affordable and Flexible: You can start small and gradually increase your contributions, making investing accessible for everyone. For instance, let’s say you need ₹50 lakhs for your child’s education abroad in 18 years. By starting a SIP plan with an investment of ₹4,000 per month and increasing it annually by 10%, you could accumulate nearly ₹60 lakhs at a 13% CAGR.

*13% assumed CAGR not guaranteed

Whether you’re a young professional in MP Nagar, a business owner in New Market, or a retiree in Shahpura, a well-planned SIP plan ensures that you build a secure and prosperous financial future. But, these investments are not beneficial if done on an ad hoc basis. The best investment plans include not just choosing the right strategies and products, but also the knowledge and expertise of a financial advisor.

Attain Financial Freedom

How the Top Financial Advisor in Bhopal Can Benefit You

With so much financial information available online, making investment decisions can be overwhelming, from where to invest to how to start a SIP plan. Just like the bustling streets of Chowk Bazaar, where an array of options can confuse even the best shoppers, the investment world is full of choices—some suitable for you and some not-so-suitable. This is where a trusted financial advisor in Bhopal can make all the difference.

A top financial advisor in Bhopal ensures that your financial plan is personalized to your unique needs. The best investment plans ensure that the products you invest in, align with your personal financial goals, be it your retirement plan, child's education or purchasing a car rather than blindly following trends. A financial advisor simplifies complex information, helping you make clear and informed decisions.

Life is unpredictable, and financial plans need to adapt to changing circumstances. Market fluctuations, career shifts, or unexpected expenses can easily derail investments. A financial advisor ensures that you stay committed to your financial goals, making necessary adjustments along the way while keeping your long-term objectives at the forefront.

How to Choose the Top Financial Advisor in Bhopal

Choosing the right financial advisor is just as important as choosing the right investment plan. The best financial advisors don’t focus on selling products—they focus on your goals. A top financial advisor in Bhopal will always prioritize a client-centric approach, ensuring your investments align with your long-term goals. Clear communication is essential; a good advisor sets realistic expectations, guiding you through SIPs, step-up SIPs, and goal-based planning to build sustainable wealth. Most importantly, investing is a long-term journey that requires discipline. A reliable financial advisor ensures your investments follow a structured process helping you achieve your meaningful financial goals.

Why FinEdge’s Dreams into Action is an Ideal Investment Platform

Dreams into Action (DiA) is FinEdge’s tech-enabled investment platform designed to create a customized investment roadmap catered to your financial goals, whether it's your retirement plan or securing your child’s education.

• Personalization: DiA’s ability to hyper-customize investments ensures a highly personalized experience, increasing the likelihood of long-term success.

• People: The platform fosters collaboration between investors and financial experts, enabling meaningful conversations and joint decision-making.

• Purpose: Investing with a clear purpose helps cut through information overload, making it easier to stay committed and navigate market volatility with confidence.

• Process: A structured investment process, including regular discussions, scenario analysis, and behavioral management, builds discipline and resilience in your financial journey.

• Product: DiA ensures that investments align with your goals rather than what is popular.

DiA encourages best investment practices and ensures that every financial decision is well thought out, making it an ideal choice for investors in Bhopal who seek long-term financial success.

Also Read: Financial Advisor in Indore

Your Investing Experts

FAQs

Should I invest with a SIP plan or lumpsum for my child’s study abroad in 15 years?

Lumpsum investments may lead to timing the market, whereas SIP plans offer a disciplined, automated approach to saving for long-term goals. Since your child’s education abroad will need a large sum in 15 years, SIPs can be a great option. They help you stay committed while benefiting from compounding, ensuring that your funds grow steadily over time. But, it’s important to remember that the best approach to investing depends on your financial situation, cash flow, and risk capacity. With the guidance of an expert, you can determine what suits you best.

Are mutual funds a good option to invest in for my retirement plan?

Mutual funds—especially through SIPs, are an excellent option for long-term goals like retirement. They allow you to invest consistently and build wealth over time. Since inflation can significantly impact retirement savings, mutual funds help in outpacing inflation in the long term. However, since markets can be volatile in the short run, having an expert’s guidance ensures that your investments are aligned with your retirement plan and adjusted as needed.

Can a financial advisor help me purchase a house in India?

Yes. A financial advisor can analyze your cash flow, financial ratios, and risk capacity to help you plan for buying a home. They work with you to create a structured plan for accumulating a down payment and repaying a home loan in a disciplined manner. More importantly, they help set realistic expectations and align your investment strategy with financial products that suit your goal.

What Our Clients Say About Us

Related Articles

Why a Home Purchase Plan is Important: A Home Loan Checklist

Learn expert strategies on how to efficiently accumulate funds, reduce interest burden and achieve debt free home ownership faster.

Why Financial Advice Matters for Smart Investing in Kolkata

Consult with the best Portfolio Managers in Kolkata for investment planning. Invest for your goals through experts.