Accelerated Trends of Women Investing in India

- Women’s workforce participation in India has risen sharply, strengthening financial independence.

- Nearly 1 in 2 new investors in recent studies are women.

- Women set higher retirement and education goals than men.

- Goal-based investing is emerging as a preferred approach among women investors.

Women investing in India is no longer a trend, it is a structural shift in financial participation. Rising workforce inclusion, larger financial goals, and disciplined planning are reshaping the investment ecosystem. As more women take charge of wealth creation, the future of investing is becoming more inclusive and goal-driven.

India is witnessing a meaningful shift in its investment landscape. One of the most encouraging developments is the accelerated rise of women investing in India.

As access to education, employment, and financial awareness improves, more women are participating actively in wealth creation. What was once a largely male-dominated investing environment is steadily evolving into a more inclusive and balanced ecosystem.

This is not just a demographic change, it represents a structural transformation in how households plan, save, and invest.

How Has Women’s Workforce Participation Changed in India?

The foundation of increased women investing in India lies in growing economic participation.

According to recent labour force survey data, women’s workforce participation has increased from 22.9% in 2017–18 to 37% in 2023. This sharp rise reflects:

-

Greater access to employment opportunities

-

Increased financial independence

-

Changing social dynamics

-

Stronger awareness of equal economic participation

With independent income comes greater control over financial decisions. This shift has naturally translated into higher engagement with investments and long-term financial planning.

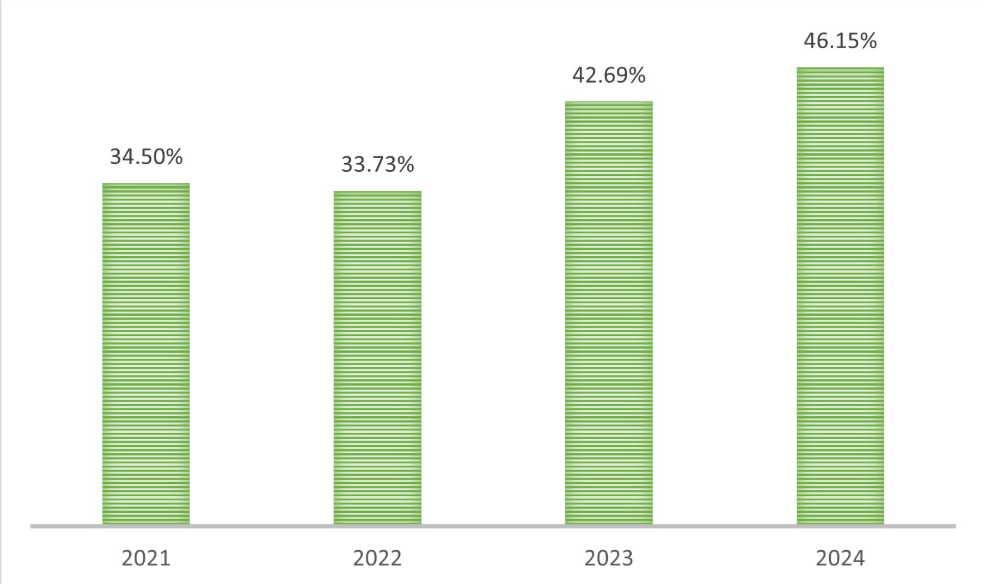

How Has Women’s Investing Evolved in Recent Years?

Over the past few years, women investing in India has evolved from passive participation to active decision-making.

Recent investor studies indicate that nearly 1 in 2 new investors are women. This marks a significant transformation from earlier years, when women’s participation was substantially lower.

This growth has accelerated post-COVID, reflecting:

-

Increased financial awareness

-

A stronger focus on security and long-term planning

-

Greater confidence in managing investments independently

The upward trend in participation between 2021 and 2024 clearly highlights that women are not just entering the investing ecosystem, they are becoming a driving force within it.

Why Are Women Setting Larger Financial Goals?

One of the most striking insights from recent investor data is the scale of financial goals set by women.

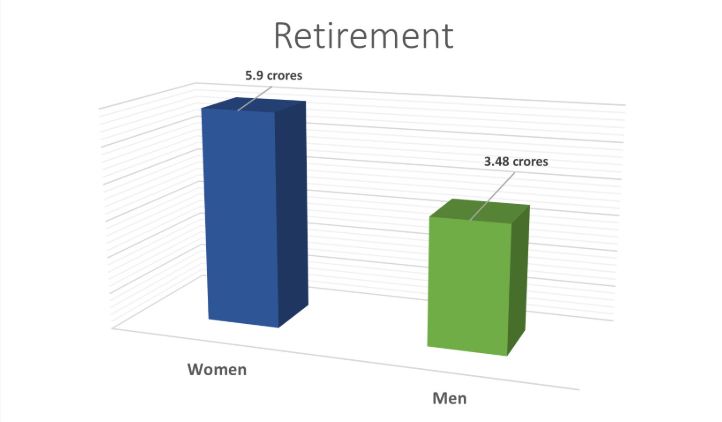

Retirement Planning

Women investors are setting significantly higher retirement targets, with average goals around ₹5.9 crores compared to ₹3.48 crores for men.

This reflects:

-

A strong focus on long-term independence

-

Recognition of longer life expectancy

-

A desire to remain financially secure without dependency

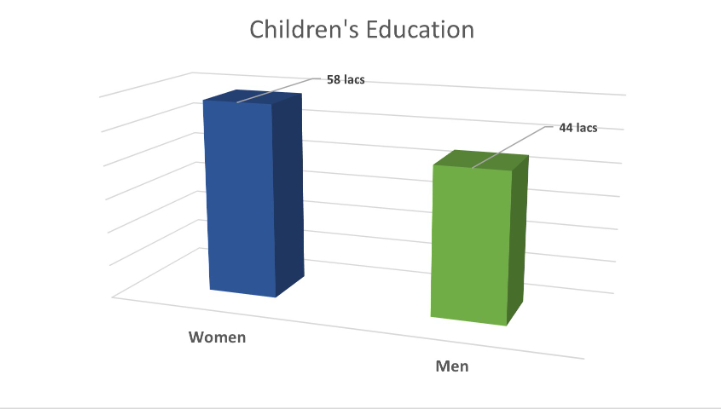

Children’s Education Planning

Similarly, women are setting larger goals for children’s education, averaging ₹58 lakhs compared to ₹44 lakhs among men.

This indicates:

-

Greater prioritisation of future planning

-

Structured thinking around inflation and rising education costs

-

A disciplined, long-term outlook

These patterns show that women investing in India is not reactive, it is increasingly goal-driven and structured.

Why Is Goal-Based Investing Gaining Popularity Among Women?

Goal-based investing aligns naturally with how many women approach financial decisions.

Instead of focusing solely on returns, this approach connects investments directly to life objectives such as:

-

Retirement

-

Children’s education

-

Home ownership

-

Financial security for dependents

By linking investments to clearly defined goals, investors can:

-

Maintain discipline during market volatility

-

Avoid emotional reactions

-

Measure progress objectively

-

Stay focused on long-term outcomes

As financial literacy improves, more women are adopting this structured method of investing rather than chasing short-term performance.

What Challenges Do Women Investors Still Face?

Despite rapid progress, certain challenges remain.

Financial Literacy Gaps

Access to information has improved, but continuous education is necessary for informed decision-making.

Confidence Barriers

Even highly accomplished professionals may hesitate when making independent investment decisions.

Time Constraints

Balancing professional and personal responsibilities can delay financial planning.

Lack of Customisation

Generic investment advice often fails to consider individual life stages, responsibilities, and goals.

Addressing these challenges requires not just access to products, but access to structured financial processes.

Why Does Process Matter in Women Investing in India?

Sustainable wealth creation depends less on short-term performance and more on:

-

Clarity of goals

-

Alignment with risk tolerance

-

Regular review and course correction

-

Emotional discipline during market cycles

As more women participate in investing, process-driven frameworks are becoming increasingly important. A collaborative, personalised approach helps investors build confidence and stay consistent across different market environments.

The Broader Impact of Rising Women Investors

The rise of women investing in India has implications beyond individual portfolios.

-

It strengthens household financial planning.

-

It improves long-term capital formation.

-

It creates a more diverse and resilient investment ecosystem.

-

It contributes to broader economic equality.

As participation increases, the investment landscape becomes more inclusive, balanced, and future-ready.

Final Thoughts

The accelerated rise of women investing in India is one of the most encouraging financial trends in recent years.

Greater workforce participation, larger financial goals, and a growing preference for goal-based investing indicate a shift toward long-term financial empowerment.

As more women take control of their financial futures, India’s investment ecosystem is not only expanding, it is evolving.

FAQs

Your Investing Experts

Continue Reading

Does High Income Make You Wealthy?

A high income can create the possibility of wealth. But wealth itself is built through structure, patience, and intentional decisions. It is less about how much you earn, and more about how deliberately you direct it

Accelerated Trends of Women Investing in India

Women investing in India is no longer a trend, it is a structural shift in financial participation. Rising workforce inclusion, larger financial goals, and disciplined planning are reshaping the investment ecosystem. As more women take charge of wealth creation, the future of investing is becoming more inclusive and goal-driven.

Army Day Special: Why Investment Planning Matters More Than Ever for Armed Forces Personnel

They serve the nation with discipline and sacrifice, often across unpredictable locations and life stages. On Army Day, we reflect on why thoughtful, long-term investing is just as critical to securing their future beyond service.