5 Behavioural Traps That Could Hurt Your Mutual Fund Investments

Learn 5 key biases impacting long-term mutual fund returns to boost your investment success.

It’s no secret that behavioural patterns go a long way in influencing the investment decision process for asset classes that deliver non-linear returns. And with AMFI’s Mutual Funds Sahi Hai campaign drawing new investors into the fold in droves, it’s critically important to self-educate oneself on cognitive and behavioural biases that could drag long term Mutual Fund investment returns down over time.

Here Are the 5 Factors Influencing Investment Decision

Sunk Cost

The sunk cost keeps us hanging on to losing investments for extended periods of time, simply because we’ve already held on to them for long! For instance, you may have invested into a fund that fell by 30% immediately after you invested, and consistently featured in the bottom quartile performers since. The sunk cost bias will prevent you from taking the hit and moving on to a fund with better prospects.

Loss Aversion

Do you see red every time your Mutual Fund investments slip into the red? Fear not, you suffer from the all too common affliction known as the ‘loss aversion’ bias. With cognitive studies suggesting that the pain of losing 1 rupee may outweigh the pleasure of gaining 1 rupee by a factor of 2X, it’s no wonder that most people are extremely averse to seeing even notional losses on their investments! However, Mutual Funds can sometimes slip into the red – only to recover strongly in the long term. Make sure you keep your wits about you.

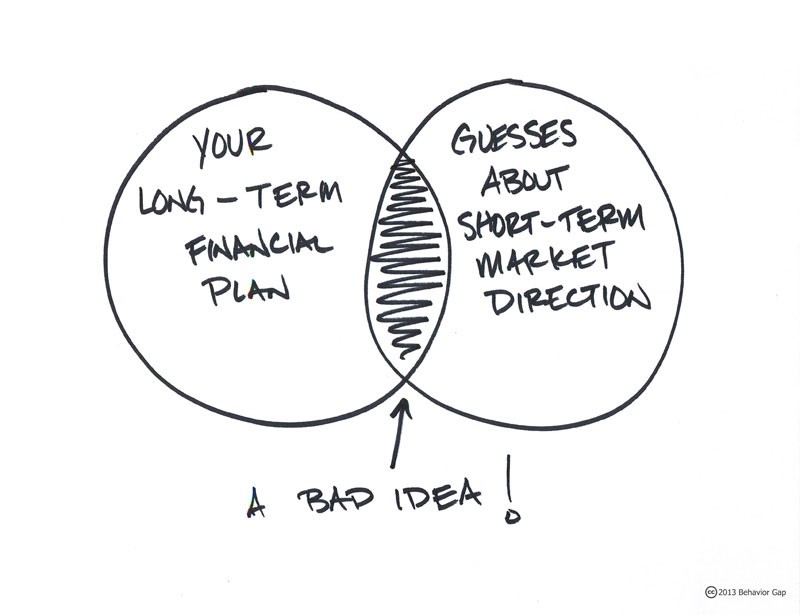

Bubble-Vision

Those endless hours of tuning into business news channels, where so called ‘experts’ air their views 24/7, can cost you dearly. Remember, news channels need to sensationalise market movements to improve their TRP’s – which the exact opposite of what you, as a Mutual Fund investor, need. So turn off that panic & euphoria inducing “bubble-vision”, strap on your seatbelt, and stay put for the long haul in a good quality Mutual Fund to reap maximum rewards.

Conformation

The abnormal tendency to cling steadfastly to your prior point of view – even when your opinion is flying in the face of all reasonable evidence – is known as the conformation bias. As a Mutual Fund investor, you cannot afford to be opinionated. You must have the ability to coolly evaluate facts and decide your asset allocation between various asset classes such as equity, debt, hybrids and the like.

Recency

The recency bias is precisely what leads to the selection of Mutual Fund investments based on recent past performance parameters such as 1-year returns. We tend to assume that what has happened recently ill continue to extrapolate itself into the future as well. However, as a Mutual Fund investor, the exact opposite often tends to be true – a fund that has delivered low returns over a 1-year timeframe sometime rebounds when market cycles reverse, and vice versa. Beware of the pernicious trap of the recency bias!

Your Investing Experts

Relevant Articles

Aligning Investing Styles With Your Life Goals: Growth, Value & Beyond

Your investing style should reflect your goals, not just market trends. Here’s how growth, value, ESG, and risk-based strategies can align with what truly matters to you.

Is COVID-19 Triggering These Behavioural Biases in You?

The COVID-19 market crash was more than a financial shock, it was a psychological one. For many investors, it exposed deep-seated behavioural biases that quietly shape our decisions, often at our own cost. Whether it's abandoning your SIPs during a dip or chasing trends at the wrong time, understanding these patterns is the first step toward better investment outcomes. Let’s unpack the most common behavioural traps triggered by market turbulence, and how to avoid them.

5 Behavioural Biases That Influence Our Investment Decisions

Human behaviour takes shape over a period of time based on various factors. Some of these include what we see, read, watch, and learn from people in our lives, television, social media, etc.

.png)

.png)

.jpg)