Investing Insights

Is COVID-19 Triggering These Behavioural Biases in You?

The COVID-19 market crash was more than a financial shock, it was a psychological one. For many investors, it exposed deep-seated behavioural biases that quietly shape our decisions, often at our own cost. Whether it's abandoning your SIPs during a dip or chasing trends at the wrong time, understanding these patterns is the first step toward better investment outcomes. Let’s unpack the most common behavioural traps triggered by market turbulence, and how to avoid them.

5 Behavioural Biases That Influence Our Investment Decisions

Human behaviour takes shape over a period of time based on various factors. Some of these include what we see, read, watch, and learn from people in our lives, television, social media, etc.

Chasing Returns vs. Wealth Creation

Creating Wealth from your investments is all about return maximization, right? Wrong! It may surprise you to know that your pernicious little habit of always trying to maximize portfolio returns may in fact be what is impeding your ability to generate long-term wealth. Here’s are four reasons why.

5 Behavioural Traps That Could Hurt Your Mutual Fund Investments

Learn 5 key biases impacting long-term mutual fund returns to boost your investment success.

Why people lose money in Equity Mutual Funds

Read this blog & know why people lose money in Equity Mutual Funds. Know the top 5 reasons why investors tend to lose money in Equity Mutual Funds. Visit FinEdge now!

Riding the SIP Wave: How to benefit from Volatile Markets

In recent months, equity mutual funds (especially SIP’s) have seen increased inflows and a renewed interest from the retail investor community. Whereas a lot of these SIP’s have been started with the intention of continuing them for 5 to 10 years or more, the truth is that not all of them will actually successfully complete their tenure. In this brief article, we’ll summarize a few key factors to keep in mind while planning for your future goals using SIP’s. Let’s begin with our “three golden rules” of SIP investing!

5 Money Habits of the “Financially Wise”!

Ever wondered how the truly “financially wise” approach their day to day personal finances? This week, FinEdge presents 5 money habits that are nearly universal to all those who are en route to financial Nirvana!

Aligning Investing Styles With Your Life Goals: Growth, Value & Beyond

Your investing style should reflect your goals, not just market trends. Here’s how growth, value, ESG, and risk-based strategies can align with what truly matters to you.

Greed and Fear in Investing: Why Traders Lose Money

Greed tempts investors to chase quick gains, while fear pushes them to sell too soon. Long-term wealth is created by resisting both and staying disciplined through market ups and downs.

FOMO, Panic, Overconfidence: Understanding Your Investing Triggers

Your investment behavior often matters more than the markets. Whether it's fear in a downturn, overconfidence after a win, or FOMO triggered by someone else's success; emotional investing leads to decisions that aren’t aligned with your goals. In this blog, we explore these triggers and how to build a more grounded, goal-oriented approach.

Why Most Investors Underperform Their Investments (Returns Gap Explained)

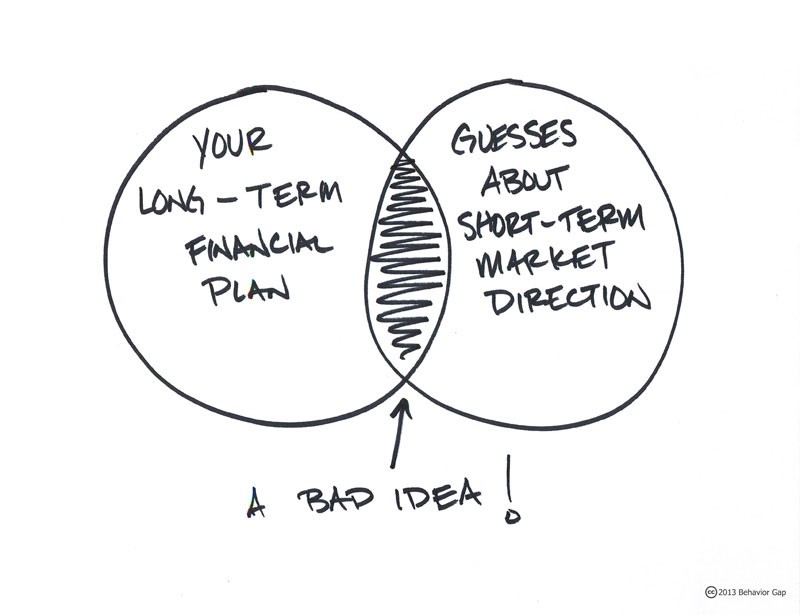

Many investors fail to achieve the full potential of their investments, not because they chose the wrong funds, but because of how they behave during market ups and downs. This difference in expected vs. actual returns is called the returns gap, and understanding it is crucial for long-term success.

Investing in Volatile Markets: How to Build Resilience and Stay on Track

Investing in volatile markets is never easy, especially when headlines scream panic and portfolios turn red. But market cycles are not the problem. The real challenge lies in how investors react. Building investing resilience, the ability to stay aligned with your goals and decisions through ups and downs, is essential for lasting success. In India, as retail participation grows, so does the need for calm, process-led investing.

Latest Posts

Retirement Planning Options in India: Understanding Your Choices

Mar 09, 2026

Why Women Often Make Better Long-Term Investors

Mar 06, 2026

Should You Continue Investing in ELSS and PPF in the New Tax Regime?

Mar 02, 2026

Does High Income Make You Wealthy?

Feb 27, 2026

Retirement Planning in India: A Practical Framework for Long-Term Security

Feb 25, 2026

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

Investing Stories

.jpg)

.png)

_(800_x_575_px)_(1).jpg)

.jpg)

.jpg)

_(1)1.jpg)

.jpg)

.jpg)

.jpg)