Smart Profit Booking Strategy for Long-Term SIP Investors

- Strategic profit booking can help reduce short-term risk without derailing long-term goals.

- Switching load-free SIP units to liquid funds and using STP reduces exposure.

- Continue regular SIPs for rupee cost averaging.

- Avoid emotional exits or timing the market.

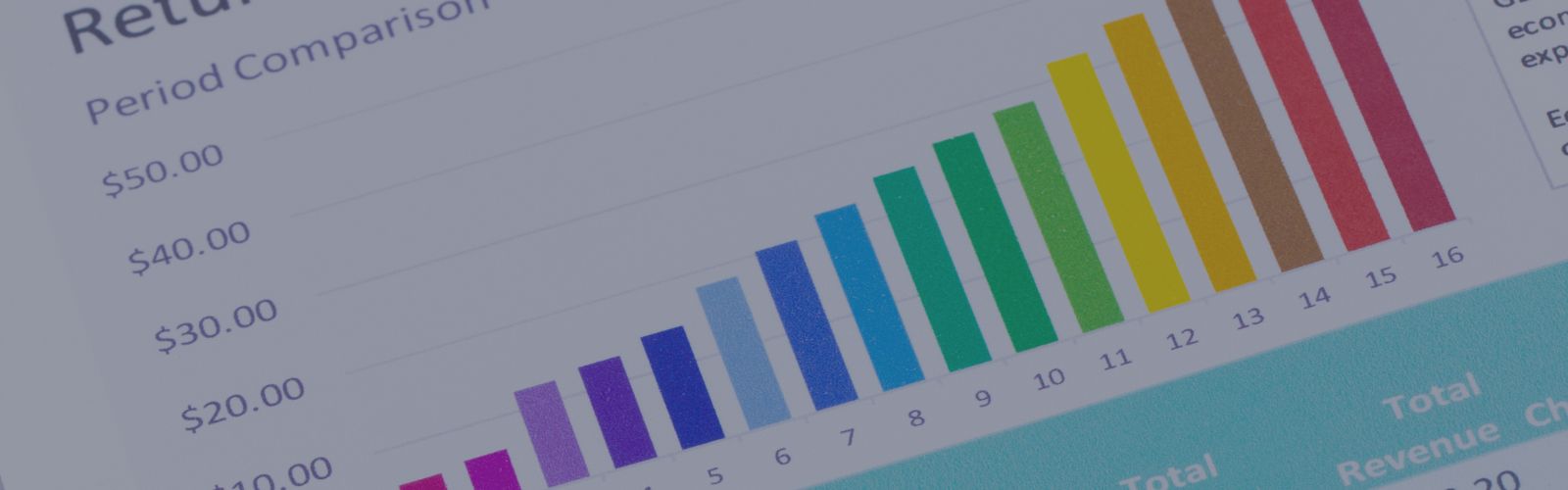

Equity SIPs are great vehicles for long-term wealth creation. But what if markets are overheated and corrections seem likely? In such situations, investors often wonder: should I stay fully invested or take some action? This blog offers a tactical profit-booking strategy using liquid funds and STPs — without halting your SIP or losing sight of your goals.

Why Should Long-Term SIP Investors Consider Booking Partial Profits?

Even long-term investors can benefit from a slight tactical adjustment if valuations appear stretched. Here are a few red flags that justify a measured approach:

-

Valuation Multiples Are Stretched: NIFTY’s P/E ratio above 28x and Market Cap-to-GDP > 85% indicate potential overvaluation.

-

Muted Earnings Growth: Despite rising stock prices, earnings growth is stagnant, often a sign of a bubble.

-

Global Uncertainties: Rising crude oil prices, a falling rupee, and geopolitical tensions like the US-China trade war could trigger volatility.

None of this calls for panic. But it does call for prudence, especially if you’ve been investing via SIPs for several years.

A Smart Strategy: Switch Load-Free Units and Use STP

Let’s break this down simply:

-

Identify Load-Free Units: SIPs are subject to exit loads for up to a year. So, calculate how many units are free of exit load.

-

Switch to Liquid Funds: Move the load-free portion to a liquid fund within the same AMC. This doesn’t amount to an exit, the money stays invested.

-

Start an 18-Month STP: Begin a Systematic Transfer Plan (STP) from the liquid fund back into your equity fund (or a diversified multi-cap fund).

This way, you’re not trying to time the market. You’re simply smoothing your re-entry over the next 18 months.

Why This Approach Helps During Uncertainty

Imagine your equity investment journey as driving a car up a mountain. If you see a storm coming, would you abandon the drive? Of course not. You’d slow down, let the storm pass, and then continue upward. That’s what this strategy does, it helps you coast through a volatile patch while staying aligned with your financial goals.

Also remember:

-

Do Not Stop Your Existing SIPs: Continue them to benefit from rupee cost averaging.

-

Don’t Redeem to Bank Account: Money withdrawn may get spent or parked indefinitely. Keep it within the mutual fund ecosystem.

Final Thoughts: Balance Caution With Commitment

Long-term investing doesn’t mean you never make tactical changes. It means you stay committed to your goals without reacting emotionally to market noise. Booking partial profits via liquid funds and re-entering through STPs allows you to stay invested, reduce downside exposure, and avoid FOMO-driven decisions. It’s not about being fearful — it’s about being prepared.

FAQs

Your Investing Experts

Continue Reading

How to Build a ₹1 Crore Portfolio: A Practical Guide for Indian Investors

Reaching ₹1 crore isn’t about luck or timing, it’s about discipline, consistency, and the patience to let compounding work in your favor.

Are Mutual Fund SIP Investments Low Risk?

Many first-time investors believe that SIPs are a low-risk way to enter the market. But is that really true? The idea that SIPs offer guaranteed safety can be misleading, especially if the underlying fund is equity-oriented. This blog breaks down the real risk profile of SIPs and helps you understand how they work in volatile markets.

What are the Different Types of SIPs? How to Use Step-Up SIP to Reach Your Financial Goals Faster

SIPs (Systematic Investment Plans) are a cornerstone of goal-based investing in India. But did you know that there’s more than one type of SIP? From the simplicity of Regular SIPs to the adaptability of Flexible SIPs, and the acceleration potential of Step-Up SIPs, there’s a strategy for every kind of investor. In this blog, we’ll explain the different types of SIPs and show you how a Step-Up SIP could help you reach your financial goals faster.

.jpg)