Investing in Udaipur: Achieve Your Financial Goals with a Financial Advisor

Udaipur, often called the "City of Lakes," is a mesmerizing blend of history, culture, and natural beauty. With its serene lakes, majestic palaces, and scenic Aravalli hills, the city is a cherished destination for tourists and residents. The stunning City Palace, a UNESCO World Heritage Site, is a remarkable example of royal grandeur.

While Udaipur is known for its rich heritage and thriving tourism industry, it is also home to growing industries like marble processing, electronic manufacturing, and handicrafts. Just as Udaipur carefully preserves its history while embracing progress, a well-structured investment process helps individuals secure their financial future while adapting to their changing needs.

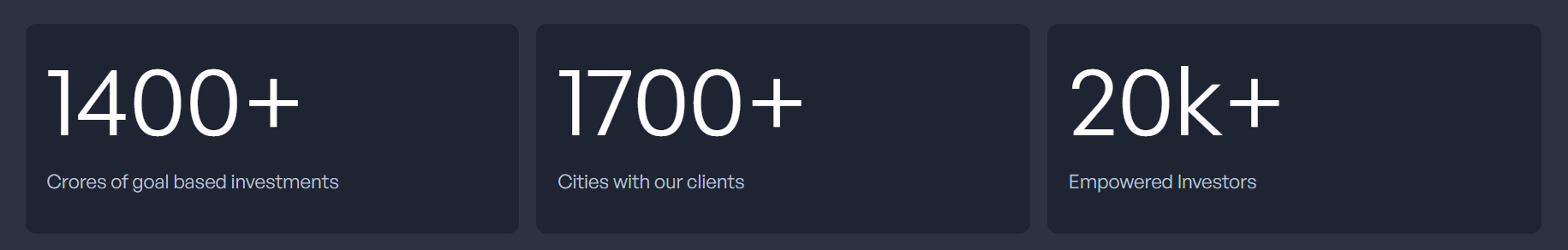

Why FinEdge is the Best Investment Platform for Investors in Udaipur

Why FinEdge | Customized Investment Plan | Best Financial Advisor

How to Invest to Achieve Financial Goals in Udaipur

Investing isn’t just about choosing financial products—it’s about following a structured approach that aligns with your financial goals. Whether it’s your retirement plan, your child's education, or purchasing a home, following a disciplined investment process can make all the difference.

Here’s how you can invest effectively:

1. Define Your Goals: Just as every royal palace in Udaipur was built with a vision, your investments should have a clear purpose. Identify the financial goals you want to achieve, whether it's a regular source of income during your retirement, buying your dream home, or funding your child’s education.

2. Product Alignment: There are tons of financial products available, from mutual funds and stocks to bank accounts like fixed deposits. However, a good investment process doesn’t align products in an ad hoc manner, but rather selects those that fit the investor’s goals, time horizon, and risk appetite.

3. Resilience: Like the forts of Udaipur, which have withstood the test of time, you should be able to endure market volatility. Staying committed to your investment plan maximizes your chances of securing goals like your retirement plan or your child’s education.

4. Timely Reviews: A good investment process doesn’t involve constantly tracking or reviewing your portfolio but rather conducting periodic reviews. If there is a significant life change that may impact your long-term financial goals, it should be incorporated into your investment plan.

5. Expert Guidance: A knowledgeable guide can enhance your experience of Udaipur’s rich heritage. Likewise, a financial advisor in Udaipur can help you navigate the complexities of investing, ensuring you stay on the right track.

Attain Financial Freedom

Benefits of SIP in Mutual Funds for Your Retirement Plan, Child’s Education, and Home Purchase

Mutual fund investments through Systematic Investment Plans (SIPs) are a simple yet powerful tool for achieving long-term financial goals. It enables disciplined and consistent investing while allowing you to benefit from the power of compounding and rupee cost averaging.

Here’s how SIPs can help you plan your financial goals:

• Retirement Planning: SIPs help you build a secure retirement plan through disciplined investing. By investing small amounts regularly and, most importantly, starting early, you can accumulate a substantial corpus over time without feeling a financial burden. Additionally, financial tools like a Systematic Withdrawal Plan (SWP) can help you generate regular income during retirement.

• Child’s Education Plan: Every parent wishes for a quality education for their child, making it essential to plan early, especially given the high inflation rates in the education sector (typically 11-12%). A mutually fund investment through an SIP can help you achieve this goal by ensuring disciplined investing while also outpacing inflation.

Example: If an undergraduate degree costs ₹10 lakhs today, at an inflation rate of 11%, it could cost around ₹28 lakhs in 10 years. An SIP of ₹12,000 per month in a mutual fund with a 13%* rate of return can help you achieve this amount in time.

*13% assumed rate of return not guaranteed

• Home Purchase: Buying a home in Udaipur, with its scenic beauty and cultural charm, is a dream for many. SIPs can not only help you save for your down payment but also ensure disciplined investing to manage home loan repayments effectively.

Mutual fund investments, especially through SIPs can be a great way to achieve financial goals. However, it is important to make informed decisions that align with your personal objectives. Seeking guidance from a financial advisor in Udaipur can help ensure that your investment process is optimized for success.

Importance of a Financial Advisor in Udaipur

With an abundance of financial products available, choosing the right investment options can be overwhelming. A financial advisor in Udaipur can ensure that your investments align with your unique goals.

Here’s why expert guidance matters:

• Hyper Customization: No two financial journeys are the same, much like no two palaces in Udaipur have identical architecture. A financial advisor customizes investment plans to your specific needs, ensuring a personalized approach to achieving financial goals.

• Commitment to Financial Goals: With mutual fund investments, short-term market volatility is inevitable. A financial advisor can guide you through these times, ensuring you remain committed to your financial goals, rather than make impulsive decisions that may not benefit you.

• Cutting Through Information Clutter: The investment world is full of information online as well as word of mouth. A financial advisor simplifies this information, helping you make informed decisions that are suitable for you.

Dreams into Action (DiA): A Smarter Way to Invest

FinEdge’s proprietary 'Dreams into Action' (DiA) platform empowers investors to build wealth through a structured, disciplined approach. By integrating cutting-edge technology with human expertise, DiA ensures that your investments are hyper-personalized, goal-focused, and behaviorally optimized, whether it is for your retirement plan, your child’s education, or a dream home.

DiA also provides unparalleled convenience, enabling you to invest and communicate with experts no matter where you are located. Your investment manager guides you through every step of the way, from assessing your cash flows to reviewing your portfolio, ensuring your investment decisions remain aligned with your goals.

Your Investing Experts

FAQs

What is the minimum SIP amount for mutual fund investments?

There is no fixed minimum amount for SIPs; it depends entirely on your goals, income, and expenses. SIPs enable you to start with a small amount and gradually step up your investments as your financial capacity increases. For example, you can start with as little as ₹5,000 and increase the amount by 10% annually.

What is the difference between SIP and SWP?

Both SIPs and SWPs are a form of mutual fund investments. An SIP (Systematic Investment Plan) is a way to invest a fixed amount regularly—monthly, quarterly, etc.—so your investment grows over time. In with traditional SIPs you ideally remain invested until you achieve your goal amount.

With an SWP (Systematic Withdrawal Plan), you invest the same way but it lets you withdraw a fixed amount from your investment at regular intervals while the remaining amount continues to grow. SWP is particularly useful for generating a steady income during retirement.

What sets DiA apart from other DIY platforms?

While other DIY platforms allow you to invest, market volatility in equity investments can often lead investors to make impulsive, emotion-driven decisions. FinEdge’s DiA combines the convenience of online investments with human expertise, guiding you through uncertain times and ensuring a customized and disciplined approach to investing.

What Our Clients Say About Us

Related Articles

_(2).jpg)

Systematic Withdrawal Plans (SWPs): A Reliable Way to Generate Income

Learn expert strategies on how SWPs can be a reliable income stream.

The Best Investment Plan for Ahmedabad's Investors

Consult with the best Portfolio Managers in Ahmedabad for investment planning. Invest for your goals through experts.