How to Choose the Best Financial Advisor

Choosing the right financial advisor is a critical decision that can significantly impact your financial well-being. With a multitude of options available, including DIY platforms and traditional brick-and-mortar advisors, it’s essential to identify an approach that is truly client-centric and goal-focused. Popular searches on this topic include "how to choose the best financial advisor for retirement planning," "how to avoid financial misselling," and "goal-based financial planning vs return-based investing." Here’s why FinEdge’s unique bionic model is the ideal choice for your financial journey.

The FinEdge Advantage: A Bionic Model for Modern Investors

"The combination of human insight and cutting-edge technology is the future of financial advising. FinEdge's approach ensures clients get the best of both worlds." — Radhika Gupta, MD & CEO – Edelweiss Asset Management

Learn About FinEdge's Bionic Investing Model

FinEdge combines the power of advanced technology with human expertise to deliver a financial advisory experience like no other. Our bionic model ensures:

• Client-Centricity at Its Core: Unlike traditional advisors, our employees have no sales, product, or revenue targets. This guarantees that our advice is solely focused on your best interests.

• Hyper-Customization: Every investment plan is tailored to your unique goals, risk profile, and circumstances, ensuring your investments are aligned with what truly matters to you.

• Behavioural Guidance: We help you navigate market fluctuations with discipline and resilience, preventing emotional decisions that can derail your financial goals.

Your Investing Experts

Real-Life Examples of How FinEdge Stands Out

Example 1: Avoiding Emotional Decisions During Market Downturns

A DIY investor, Mr. Kapoor, panicked during a market downturn and sold off his equity investments at a loss. In contrast, Mrs. Sharma, a FinEdge client, received timely behavioural guidance from her advisor. She stayed invested and even increased her contributions, leading to significant gains when markets recovered.

Example 2: Tailored Advice for Life Milestones

Traditional advisors often pushed Mr. and Mrs. Mehta towards high-commission insurance products for their child’s education fund. With FinEdge, they received a goal-oriented plan through the DiA platform, which helped them build a diversified portfolio aligned with their timeline and risk appetite. Today, they’re on track to fund their child’s education without compromising their retirement savings.

Example 3: Customizing Risk vs. Reward

A DIY platform recommended a high-risk mutual fund to Mr. Gupta, who was nearing retirement. Lacking context about his risk tolerance, he suffered significant losses. When he switched to FinEdge, our team created a conservative portfolio focusing on income generation and capital preservation, giving him peace of mind as he approached retirement.

Discover More Success Stories from FinEdge Clients

Goal-Focused Investing vs. Return-Focused DIY Platforms

"Investing should aways be about achieving life goals, not chasing returns. FinEdge’s Dreams into Action platform sets the gold standard in goal-based investing." — Nilesh Shah, Group President and Managing Director – Kotak Mutual Fund

Many DIY platforms emphasize returns over goals, leading to impulsive, short-term decisions that can harm long-term outcomes. FinEdge’s proprietary Dreams into Action (DiA) platform prioritizes:

• Your life goals and aspirations over mere returns.

• A disciplined, process-driven approach that keeps you on track.

• Custom strategies considering your unique risk-reward balance, recognizing that every individual’s financial journey is different.

Avoiding Recommendation Traps and Sales Traps

Learn How FinEdge Eliminates Conflicts of Interest

Traditional advisors often fall into two common traps:

• Recommendation Traps: Generic, one-size-fits-all advice that fails to address your personal financial situation.

• Sales Traps: Misselling driven by commission and product-focused incentives, putting your interests at risk.

At FinEdge, our advisors are free from such conflicts of interest. Our process is designed to:

• Provide unbiased, goal-oriented advice.

• Ensure that your financial plan serves your objectives, not a salesperson’s targets.

Bridging the Returns Gap with a Robust Investing Process

Without a structured investing process, many individuals experience a “returns gap” – the difference between market returns and actual investor returns caused by poor decision-making. FinEdge’s process helps you:

• Stay disciplined during volatile markets.

• Avoid costly mistakes like panic selling or chasing market trends.

• Achieve consistent, long-term growth by adhering to a structured plan.

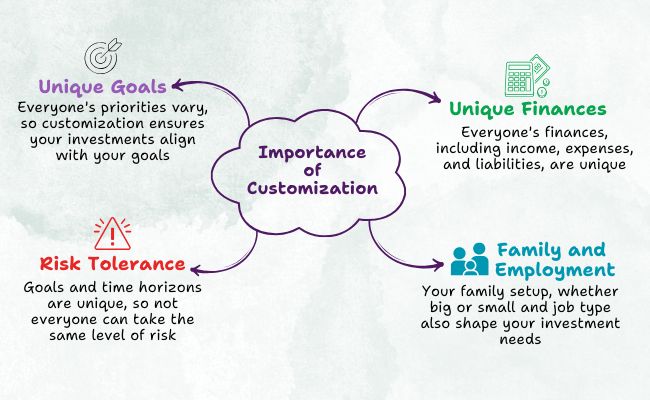

Customisation: The Key to Investing Success

Investing is not a one-size-fits-all endeavor. Your financial success depends on a plan that:

• Aligns with your specific goals, timelines, and aspirations.

• Accurately balances risk and reward based on your unique preferences.

• Adapts to life changes and evolving financial priorities.

Why FinEdge is the Right Choice

Our approach is rooted in providing purpose-driven, personalized, and process-oriented financial advice. By combining the best of technology and human insight, FinEdge ensures:

• A truly client-first experience free from conflicts of interest.

• Highly customized financial strategies tailored to your goals.

• A disciplined approach that bridges the gap between intentions and outcomes.

Take the First Step Towards Financial Freedom

Your future deserves the best financial advisor. Choose FinEdge for a journey that prioritizes your goals, aligns with your values, and delivers results through a proven, client-centric approach.

Attain Financial Freedom

Related Articles

How to Use SIPs to Create Long-Term Wealth

Understand how a consistent and disciplined long-term SIP investment can provide you with the benefits of compounding and creating wealth.

Importance of an Investment Expert in the Financial Planning Process

Understand the importance of an investment expert in the financial planning process.