Best Investment Plan for Residents of Thiruvananthapuram

Thiruvananthapuram, the capital of Kerala, is a city where rich cultural heritage meets modern progress. Unlike other cities in Kerala, Trivandrum has established itself as a major information technology hub, contributing over 55% of the state’s software exports. The city’s economic landscape is shaped by its growing tech sector, alongside traditional industries like mineral processing, textiles and handicrafts.

With a rising number of professionals working in the IT sector and related industries, many individuals here enjoy increasing incomes but often have limited time to focus on managing their finances effectively. This makes having a well-thought-out investment plan crucial—one that aligns with their personal financial goals and evolving lifestyles.

Whether it’s planning for a comfortable retirement, investing for children’s education, or building wealth to own a home, a disciplined investment approach helps Trivandrum’s residents navigate financial complexities. In a city where tradition and opportunity go hand in hand, making informed investment decisions ensures that long-term financial goals are achieved with purpose and clarity.

Why is FinEdge the Top Investment platform for Trivandumites

Why FinEdge | Customised Investment Plan | Best Financial Advisor

Your Investing Experts

The Drawbacks of Traditional Investment Approaches

Despite numerous opportunities, many investors get caught in traditional investment methods that don’t support long-term wealth creation. Mis-sold products driven by commissions and DIY platforms that prompt impulsive decisions based on short-term gains often hold investors back. Unlike generic, "one-size-fits-all" solutions, successful investing demands a customized strategy centered on long-term objectives, avoiding distractions from market ups and downs.

Selecting the Best Financial Advisor in Trivandrum

A trusted advisor will prioritize your financial health over short-term gains or one-off recommendations. Consider the following key aspects when making your choice:

Personalized Strategies

-

Understanding Your Unique Situation: Look for an expert who thoroughly understands your financial landscape, including your goals and risk tolerance.

-

Tailored Investment Solutions: The ideal advisor crafts bespoke strategies that align with your long-term objectives.

Steady Guidance

-

Market Discipline: A dependable advisor helps you stay disciplined, especially during market fluctuations, ensuring that your decisions remain well-informed rather than reactionary.

-

Emotion Management: They provide the support needed to navigate the ups and downs of the market, keeping you on track with your financial plan.

Client-First Focus

-

Prioritizing Your Goals: The best advisors prioritize your financial aspirations over meeting sales targets.

-

Long-Term Partnership: Their approach is centered on developing and maintaining a plan that aligns with your long-term financial journey. As your life changes—like starting a family—your advisor will adjust your financial plan to keep it aligned with your evolving needs.

The NRI Edge: Kerala's Global Integration

According to the Kerala Migration Survey of 2023, about 2.2 million people have emigrated from Kerala, with the UAE emerging as the most preferred destination. These emigrants contributed an impressive ₹2,16,893 crores in remittances. NRIs from Thiruvananthapuram often look for opportunities to invest back home, but investing from abroad comes with its own set of challenges—navigating complex documentation, understanding tax regulations, avoiding mis-sold products and finding reliable financial experts can make the process seem overwhelming.

This is where Dreams into Action (DiA) platform can help —it’s a personalized investment experience, combining advanced technology with expert guidance from financial experts, DiA helps investors define their life goals and creates tailored investment plans to turn those dreams into reality. By emphasizing systematic, long-term investment strategies, DiA simplifies the complexities of financial markets and supports sustainable wealth creation.

With DiA, investors and Investment Managers collaborate, co-owning financial goals. Investment Managers apply best practices and provide continuous guidance, ensuring value creation that goes beyond short-term gains. DiA is designed for those who wish to invest with purpose—focusing on meaningful life goals through disciplined and committed investing.

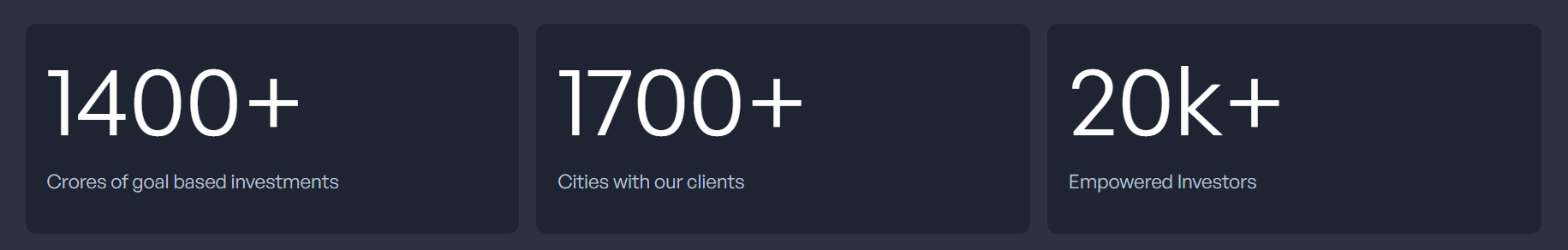

This unique approach has transformed the financial journeys of thousands. By aligning every investment decision with individual aspirations, DiA delivers a truly personalized experience. With clients across 1,700+ locations in India and 90 countries worldwide, DiA breaks geographical barriers, making expert investment guidance accessible everywhere—especially in growing cities like Trivandrum.

Thiruvananthapuram: Why Now is the Time to Invest

As Thiruvananthapuram rises as a center for economic growth, IT development and tourism, the opportunities for wealth creation are greater than ever. With expert-driven decisions and a tech-enabled roadmap, investors in Trivandrum can secure their financial future and turn their financial dreams into reality.

Also Read: Investment Planning in Kochi

Attain Financial Freedom

FAQs

My child's education is going to graduate in 15 years; when do I start mutual fund investing?

The ideal time to start is as early as possible, especially for education-related goals. Education inflation in India averages around 11%, meaning the cost of higher education rises significantly over time. For example, if a university fee is ₹5,00,000 today, it could rise to approximately ₹24,00,000 in 15 years—almost five times the current amount.

Starting early and working with a financial expert ensures you have a tailored investment plan that accounts for inflation and aligns with your specific needs, helping you achieve this important goal without financial stress.

As an NRI from the Middle East, how do you plan investing for your retirement and home purchase in India?

Investing in long-term goals like retirement and buying your home involves making an investment plan with a systematic investment process. Having an investment expert is a good choice, combined with a personalized roadmap for achieving these financial goals through a platform like Dreams Into Action (DiA), makes all the difference. The expert understands your goal requirements and time horizon, manages your investing behavior, and ensures that everything—from onboarding and transactions to compliance—is handled effortlessly. With DiA’s advanced tech features, you can even complete documentation tasks like KYC registration virtually and seamlessly.

I want to plan a vacation; is investing for it a good idea?

Absolutely. Investing systematically for your vacation helps you save without dipping into emergency funds or taking loans. By choosing the right short-term investments, you can enjoy your trip stress-free while staying aligned with your long-term financial goals.

How can a financial advisor help me invest better?

A financial advisor is like a fitness trainer. While you can work out on your own, a trainer designs a plan tailored to your goals, keeps you disciplined and helps you avoid mistakes that could set you back. Similarly, a financial advisor creates a personalized investment plan, keeps you focused and guides you toward your financial goals efficiently.

What Our Clients Say About Us

Related Articles

Income Tax Changes in Budget 2025 & RBI's Rate Cut: A Boost for Growth & Investments

Lower taxes, cheaper loans, and a push for private sector growth— learn how the latest Union Budget and RBI’s rate cut are shaping India’s economic future.

Why Bangalore Professionals Need Investment Experts to Manage Their Portfolio

Consult with the best Portfolio Managers in Bangalore for investment planning. Invest for your goals through experts.