FinEdge Achieves 1500 Crores in Assets Under Management

- FinEdge has crossed ₹1,500 crores in AUM, powered by its bionic Dreams into Action (DiA) platform.

- Learn what leaders in the financial industry and clients have to say about FinEdge.

- Trusted by 20,000+ clients across 1,800 cities and 90+ countries, managing goals worth over ₹45,000 crores.

We have crossed ₹1,500 crores in Assets Under Management. This milestone reflects what we set out to achieve, a platform built on strong values, where investors’ interests always come before sales targets. It has been possible only because of the trust our investors have placed in us and their discipline to stay invested. Powered by our Dreams into Action (DiA) platform, we’ve combined technology and human expertise to create investing success for more than 20,000 investors.

“Crossing ₹1,500 crore in AUM is more than just a number; it represents the trust and aspirations of thousands of families who believe in us. With our ‘Dreams into Action (DiA)’ platform at the heart of what we do, we remain committed to making wealth creation a transparent, personalised, and purpose-driven journey. Our mission is to empower every investor to set clear goals, stay disciplined, and achieve lasting financial success with confidence."

- Harsh Gahlaut, Co-Founder and CEO, FinEdge

Breaking the Paradox

FinEdge was born to solve a paradox in the financial industry, where investor interests are too often compromised for profitability and convenience. For years, mis-selling left investors without the guidance and empathy they deserved.

We set out to create something different: a model that uses technology to break geographical barriers and make quality advice accessible, while keeping empathy and personal guidance at the core.

Our aim was to prove that client centricity and scale, technology and empathy, can co-exist. And our journey so far shows that this path is not only possible, it works.

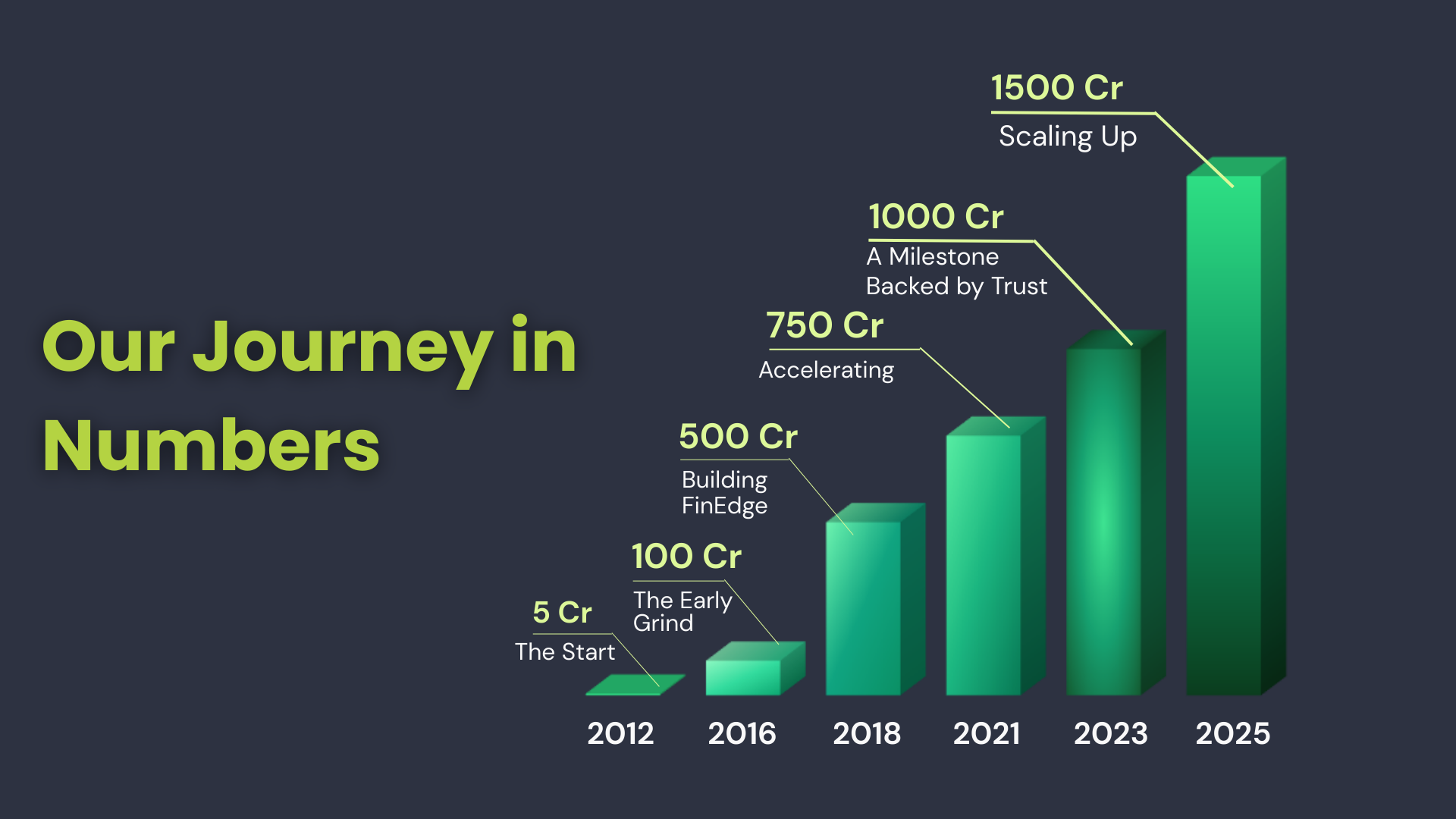

Our Journey in Milestones

2012 – 2016 | The Grind

-

Entered the digital wealth management space as pioneers, when the idea was still unfamiliar in India.

-

Early years were tough, experimenting, rethinking solutions, and fine-tuning our virtual bionic model using every available third-party tool.

-

It took us 60 months to reach our first ₹100 crores in AUM.

-

In 2015, we onboarded our 1,000th client and expanded our reach to over 200 cities.

2016 – 2020 | The Build

-

Added another ₹400 crores in AUM over the next 60 months, taking us to the ₹500 crore milestone.

-

Started creating a digital ecosystem: CRM, reporting systems, online transaction capability, and internal tools to strengthen processes.

-

Our virtual model was recognised in an IIM Calcutta case study, an early validation of our approach.

-

Reached 10,000 clients across 1,000 cities.

2023 – 2025 | The Scale Up

-

We launched Dreams into Action (DiA) after the completion of all five modules.

-

Crossed 20,000 clients, expanding across 1,800 cities and 90 countries.

-

DiA received industry recognition with two awards: Innovation Champion of the Year by Franklin Templeton. Innovative Wealth Planning Tool by ETBFSI FinNext.

-

In just 22 months, we added another ₹500 crores, taking us to our current milestone of ₹1,500 crores in AUM.

DiA – The Bionic Engine Behind Our Growth

Our growth has been powered by Dreams into Action (DiA), launched in 2023. Built from the ground up, DiA democratizes access to high-quality, goal-based investment guidance.

Unlike DIY platforms that act as financial supermarkets, DiA does not push products. It is centred around the 5Ps — People, Personalization, Purpose, Process, and Products, ensuring that every investment journey remains meaningful and goal-driven.

DiA is India’s first truly bionic investing platform, blending human insight with tech-driven intelligence and behavioural understanding. Our investment managers are not salespeople; they take the time to understand each client’s goals and guide them through market ups and downs. Technology makes this possible at scale, enabling clients to track progress, personalise plans, and stay engaged from anywhere in the world.

The Impact of DiA

-

Serving 20,000+ clients across 1,800 cities and 90+ countries

-

Managing future goals worth ₹45,000 crores

-

Supporting 10,200 education goals, 8,200 retirement goals, and 3,500 wealth creation goals

-

Running 40,000+ SIPs, with clients investing ₹18 crores every month

These numbers tell a simple story: disciplined, purpose-led investing works. And this impact has only been possible because of the trust our clients place in us, a trust that shapes every decision we make.

Industry Recognition

Over the years, FinEdge has been recognised for its contributions to the investing space:

-

2014 – Jury Award for Financial Advisory (CNBC TV18)

-

2018 – Advisor of the Year (Franklin Templeton India)

-

2024 – Innovation in Investing: Champion of the Year for DiA (Franklin Templeton India)

-

2024 – Certified as a Great Place to Work

-

2025 – Innovative Wealth Planning Tool for DiA (ETBFSI FinNext Awards)

On our recent milestone of crossing ₹1,500 crores in AUM, Radhika Gupta, MD & CEO, Edelweiss Mutual Fund, shared:

"Congrats team FinEdge! As someone who has known and seen your amazing team grow... this makes me very proud. Continue the focus on clients, on simplicity and on people. I am sure the journey is just starting!!”

Other respected leaders have also recognised FinEdge’s work:

“We at Franklin Templeton are proud to be associated with FinEdge and their founders. They have been persistent, meticulous, resilient and have built this business brick by brick since 2011... This unique bionic business model, christened as the ‘Dreams into Action (DiA)’ platform, is a perfect answer for building a scalable, conversational, and personalized goal-based financial planning culture in the country."

- Avinash Satwalekar, President, Franklin Templeton India

“FinEdge, our partner for more than a decade, has built a very strong customer-centric tech platform that enables them to reach lakhs of investors, with no barriers of geography. Being digital is easy, building trust in digital is not. FinEdge has achieved this by bringing human touch into investing — understanding people’s objectives, life purpose, and anxieties, while using technology to make investing simple and accessible.”

- Kalpen Parekh, MD & CEO, DSP Mutual Fund

We’re thankful for many other voices of support. Read more here.

What Our Clients Say

It is our clients who we have always kept at the centre of our business. It fills us with pride when they share their experiences with FinEdge.

Over 1,900 clients have written reviews on Google, giving us an overall 4.7-star rating.

Here are a few of their words:

“For a pensioner, it is so important that our funds are preserved and nurtured so we can continue to live the life we planned and worked so hard for. FinEdge not only wisely advised us how to increase our nest-egg a few years before we retired but has continued to advise us so we have been able to maintain our initial amount. Better, they have given us enough 'profit' to travel extensively. They are daring when they need to be, conservative when they need to be, and the best is, they explain it so lay people can understand the ups and downs of this sensitive and volatile market. It is so comforting to be able to 'learn and earn' when you have stopped earning.”

“I am investing in mutual funds through FinEdge since 2014. I started this following one of my colleagues, without any idea about financial planning and education. Now I see most of my desired goals are on track financially. I feel awakened today about my expenses and investment only because of FinEdge. Thanks for providing such a nice platform for each family who wishes to reach their financial goals. In this tenure of 7 years, I saw a change of three investment managers — and all of them were responsive and knowledgeable.”

“This is one of the best steps I've taken. Having continuous support from FinEdge is outstanding. They are always eager to guide and solve my doubts about my goals. I now know how to make idle money grow and full credit goes to them. And it is not just about wealth creation but also about becoming aware of life milestones well ahead of time and being prepared. Another impressive benchmark is the knowledgeable financial managers I’ve worked with. Their website gives granular details about my portfolio and their mobile app is very advanced. Thank you FinEdge for making life tension free. Looking forward to a lifelong relationship with you.”.

- Nehil Parashar, Principal Memer of Technical Staff, Oracle, Mumbai

The Road Ahead

Like every business, we look forward to growth. But for us, growth will never come at the cost of our clients’ interests.

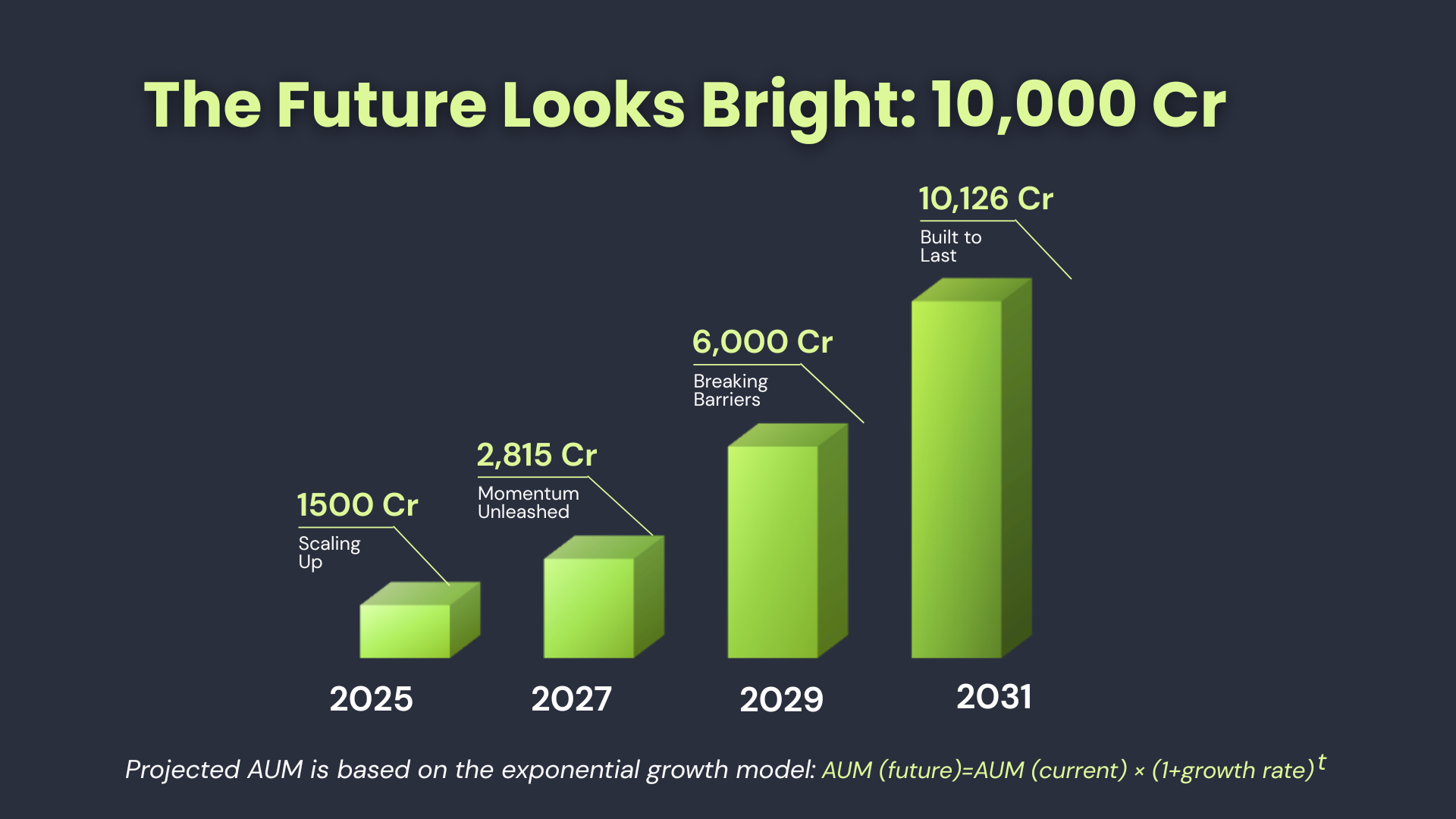

Looking ahead, reaching ₹10,000 crores by 2031 is not just a goal, it is the natural outcome of staying disciplined and values-driven.

We will continue to do what we have always done: put clients first, protect their goals, and guide them with the same consistency and care that has brought us this far.

FAQs

Your Investing Experts

Continue Reading

FinEdge Achieves 1500 Crores in Assets Under Management

We have crossed ₹1,500 crores in Assets Under Management. This milestone reflects what we set out to achieve, a platform built on strong values, where investors’ interests always come before sales targets. It has been possible only because of the trust our investors have placed in us and their discipline to stay invested. Powered by our Dreams into Action (DiA) platform, we’ve combined technology and human expertise to create investing success for more than 20,000 investors.

Why Do Most Investors Struggle with Wealth Creation?

Investing takes just a click today, but building wealth is a different game. Most investors stumble not on “what to buy,” but on how they behave when markets test their patience.

Tactical vs Strategic Asset Allocation: Which Approach Fits Your Investment Journey?

Choosing between tactical and strategic asset allocation can shape your wealth journey. The right approach depends on whether you value flexibility or long-term discipline.

.png)