Understanding Debt and Equity Funds: Key Differences and Benefits

Investors can choose from different types of mutual funds depending on factors like investment time horizon, return expectation, lock-in period, taxation, risk involved, etc. You can look at equity funds for growth and debt funds for stability. In this article, we will understand what are equity funds and debt funds, the difference between equity and debt mutual funds, and things to consider before choosing these funds.

What Are Equity Funds?

A mutual fund that invests a minimum of 65% of its money in equity and equity-related instruments is categorised as an equity fund. These are growth-oriented funds that focus on capital appreciation and creating wealth for investors in the long run. These funds have the potential to give inflation-beating high returns. As these funds invest most of their money in equities, they are suited for investors with an aggressive risk profile.

Why Invest in Equity Funds?

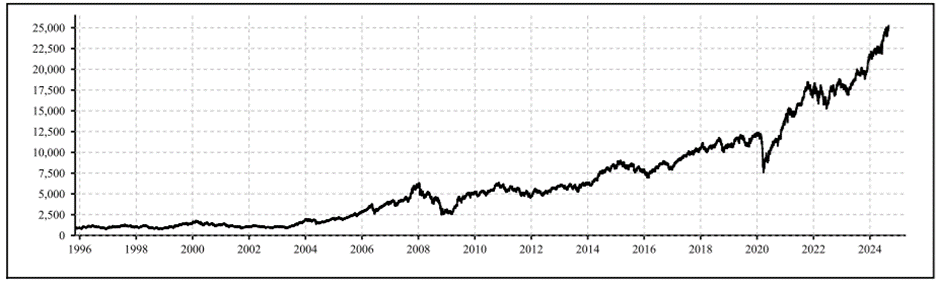

In the past, Indian equities have given good returns to investors. Let us take the example of the Nifty 50 Index and see how it has performed. The Nifty 50 Index has a base date of November 1995 and a base value of 1,000.

Note: The above data is as of 30th August 2024

The above chart shows how the Nifty 50 Index has grown in the last 24 years from a level of 1,000 to above 25,000. It has multiplied investor wealth by a huge 25 times at an impressive 14.35% CAGR over the long 24-year tenure.

While the Nifty 50 Index has grown more than 25 times in the last 24 years, several active large-cap funds have grown investor wealth even better. The mid-cap and small-cap equity funds have given even better returns and created wealth for investors.

In future also, the growth momentum of equities is expected to continue as the overall Indian economy continues to do well. Hence, to benefit from India’s growth prospects in the long term, you should invest in equity funds.

Now that we understand what are equity funds and why one should invest in them, let us look at what are debt funds.

What Are Debt Funds?

A mutual fund that invests a minimum of 65% of its money in debt and money market securities is categorised as a debt fund. These funds can provide low to moderate returns. They can provide stability to the overall portfolio. In most debt funds, the credit risk is low. Hence, they are suited for investors with a moderate to conservative risk profile.

For Whom Does Investing in Debt Funds Make Sense?

Some of the reasons one may invest in debt funds include the following.

1. Capital Protection

Most debt funds invest in high-quality securities where the risk of default is low. The credit rating of the securities is either the best or one of the best. So, if capital protection takes precedence over capital growth, you may consider investing in debt funds.

2. Content With Low to Moderate Returns

As debt funds invest in fixed-income securities, they give low to moderate returns. If you are content with these returns, you may consider investing in debt funds. During times of high inflation, the returns may not be able to beat inflation.

3. Regular Income

Debt funds invest in fixed-income securities that pay interest quarterly, semi-annually, or annually. So, if you are looking for regular income, you may consider investing in debt funds.

4. Short-Term Financial Goals

Do you have any financial goals, where the investment timeline ranges from, say, three months to up to three years? In that case, you may invest in a debt fund to accumulate money for the financial goal. For short-term financial goals, you should avoid investing in equity funds as they are volatile and can experience big sudden falls in the short-term.

Overall, debt funds are suitable for senior citizens, risk-averse investors or first-time investors looking to protect their capital or generate regular returns with low risk.

Equity Vs Debt Funds: What's the Difference?

Some of the differences between an equity and debt fund include the following.

|

Equity Funds |

Debt Funds |

|

They invest most of their money in equity and equity-related instruments. |

They invest most of their money in fixed-income instruments like debt securities, money market securities, etc. |

|

The objective is to grow the capital. It has the potential to deliver inflation-beating high returns and create wealth in the long run. |

The objective is to protect the capital. It can deliver low to moderate returns. |

|

Suited for investors with an aggressive risk profile. |

Suited for investors with moderate to conservative risk profile. |

|

It is suitable for long-term financial goals like building a fund for a child’s higher education, marriage, own and spouse’s retirement, etc. |

It is suitable for short-term financial goals like building an emergency fund, buying a two-wheeler, vacation fund, etc. |

Things to Consider Before Investing in Equity Funds

Before investing in equity funds, you must consider the following.

1. Financial Goals

Financial goals are the most important thing to consider before investing in equity funds. You should work with an investment expert who can list your financial goals and make a goal plan to achieve them. You should map your equity funds to your long-term financial goals so that you continue your investments till the goals are achieved.

2. High-Risk, High-Return Potential Investment

In the short-term, equities are volatile and are vulnerable to big falls. However, the volatility reduces over time, and in the long run, it evens out. In the long run, equities have the potential to give good returns and help you achieve your financial goals. Thus, equity funds are a high-risk, high-return potential financial product.

3. Taxation

Before investing in equity funds, you should understand how they are taxed at the time of redemption. When you redeem equity mutual fund units within 12 months of purchase, the short-term capital gain (STCG) tax is levied at 20%. When you redeem equity mutual fund units after 12 months of purchase, the first Rs. 1,25,000 long-term capital gain (LTCG) in a financial year is exempt. The incremental LTCG is taxed at 12.5% without indexation.

Debt Funds Vs Equity Funds: What to Choose?

Most investors will need to have a mix of equity and debt mutual funds in their portfolio. While equity can provide growth, debt can provide stability. If your investment time horizon is more than five years, the proportion of equity funds can be higher than debt funds. Thus, your portfolio can have a mix of equity and debt funds. However, the proportion will vary on factors like financial goals, investment time horizon, return expectation, risk appetite, etc.

FAQ's

What Is the Long-Term Outlook for Indian Equity Mutual Funds?

Amongst major economies, India is one of the world's fastest-growing economies. The growth momentum is expected to continue in future as well. The Finance Ministry expects the Indian economy to hit $7 trillion by 2030. The Government aims for India to become a developed economy by 2047 with $30-35 trillion in size. While we progress from the current $4 trillion to $30 trillion by 2047, there will be a lot of wealth-creation opportunities for Indian equity investors. Hence, it makes sense for long-term investors to invest in equity mutual funds and benefit from the India growth story.

How Can You Make the Best of Debt and Equity Funds Together?

You can make the best of debt and equity funds together in a Systematic Transfer Plan (STP). Have you received a lumpsum amount and want to invest it in equities in a staggered manner? In that case, you can start a systematic transfer plan (STP). You can park the lump sum in a debt fund (source fund) and, through an STP, transfer a specified amount every month to an equity fund (target fund).

Your Investing Experts

Relevant Articles

Should You Continue Investing in ELSS and PPF in the New Tax Regime?

With Section 80C deductions removed under the new tax regime, ELSS and PPF must now stand on their investment merit. The decision is no longer about tax savings alone, it is about suitability, liquidity, and long-term goals.

When Is the Right Time to Start Investing for Your Goals?

When is the right time to start investing for your goals? Many believe the answer depends on market stability, income comfort, or economic certainty. In reality, the right time is when your goals are clear and you are prepared to act with discipline. Wealth is rarely created by waiting. It is built through consistent participation guided by a defined investment process.

How to Adjust Your Investments After a Salary Raise

A salary hike is more than a pay revision, it is an opportunity to realign your financial direction. The smartest response to higher income is not immediate lifestyle expansion, but a structured review of your goals, debt position, and investment contributions. When handled thoughtfully, each raise can accelerate wealth creation rather than simply increase monthly expenses.

.png)

.png)