NASDAQ Mutual Funds Was One of the Best-Performing Indices in 2023 With 55% Returns. Should You Invest?

In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. Looking at the 55% eye-popping returns in 2023, many Indian investors are looking at ways of investing in the NASDAQ out of sheer FOMO (Fear of Missing Out). They expect the outperformance to continue in 2024 and beyond.

While most media headlines screamed about the 2023 returns, they did not highlight that in the previous year (2022), the NASDAQ 100 Index crashed 32%. So, should you invest in the NASDAQ 100 Index? Let us discuss.

US Economy Versus Indian Economy

The NASDAQ mutual funds gives exposure to the top US companies that are heavily dependent on the performance of the US economy. However, many of these companies are MNCs and derive revenue from other countries also. The US is a mature economy with low economic growth. The 2024 economic outlook for the US is not very rosy. The current high interest rates are expected to slow down the economy. Many experts predict either a soft landing or a recession for the US economy in 2024. It will have an impact on the earnings of the NASDAQ companies.

On the other hand, the Nifty 50 gives exposure to the top Indian companies that are heavily dependent on the performance of the Indian economy. India is a developing economy with high economic growth potential. The Reserve Bank of India (RBI) expects the Indian economy to grow at 7% in FY 2024-25, making it one of the fastest-growing economies in the world. India’s economic growth momentum is expected to continue beyond FY 2024-25 also. When the Indian economy grows, the earnings of the Nifty 50 companies will also grow, thus benefitting their share price performance.

For an Indian investor, from an overall growth point of view, having exposure to Nifty 50 and other Indian companies will make more sense than NASDAQ 100 and other US companies.

Currency Risk

As a resident Indian, when you invest in NASDAQ 100 or any other US index, you invest in US Dollars. It exposes you to currency risk. When the Indian Rupee (INR) depreciates against the US Dollar, you benefit as an investor. Historically, over the years, the Indian Rupee has depreciated and, thus, benefitted Indian investors with exposure to US assets.

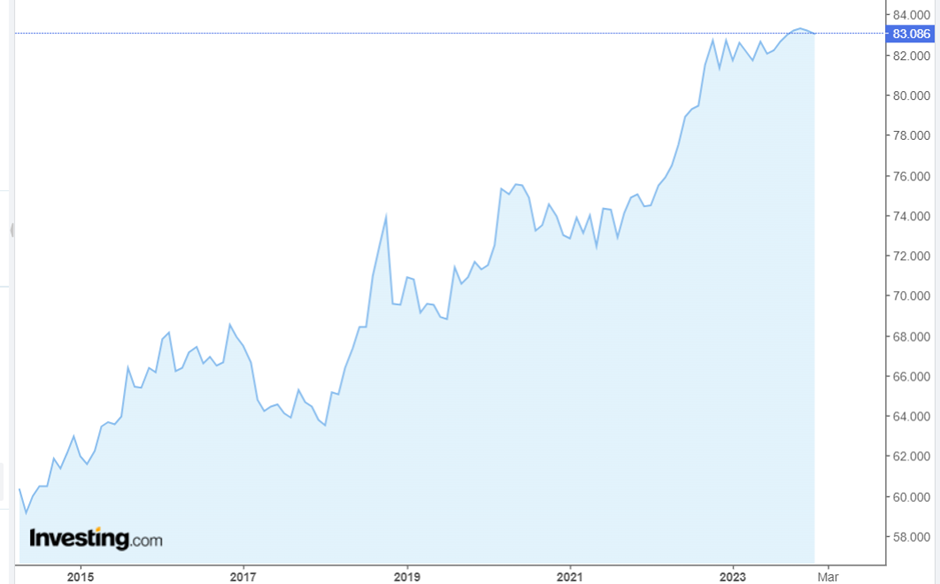

For example, in the last decade (Jan 2014 – Jan 2024), the INR depreciated from a level of around Rs. 60.36 to the current level of around Rs. 83 against the USD. That is an annual depreciation of 3.24% CAGR over a decade. Indian investors derived these additional gains just from the INR depreciation against the USD.

Chart: 10-year INR depreciation against USD

While the INR has depreciated against the USD in the past, there is no guarantee it may continue to do so. On the contrary, if the INR appreciates against the USD, it will eat into the returns of Indian investors.

Some of the factors that may work in favour of the Indian currency in the coming years include the following.

- India imports a lot of crude oil and coal used for transportation, electricity generation, etc. These imports are paid for in US Dollars. The transition to electric vehicles and greater adoption of renewable energy may reduce these imports, resulting in lower demand for the USD.

- The de-dollarisation trend has been picking up across the globe. India is also getting into arrangements with countries to pay for imports in Indian currency or other non-USD currencies which, may lower the demand for USD.

- The Government is encouraging the manufacturing of many products in India through the Make in India campaign and PLI schemes. These products were earlier imported. At the same time, the Government is also pushing exports, which will bring in foreign currencies, including USD. These initiatives will boost the Indian Rupee.

- In the last few years, the RBI has built up forex reserves, majorly in US Dollars. The current forex reserves are above $600 billion, which provides comfort for the Indian currency.

All the above initiatives are favourable for the Indian Rupee. Whether these will lead to continued depreciation of the INR as in the past or lead to appreciation is not easy to predict. If it leads to the appreciation of the INR against the USD, it will eat into your Dollar returns from US assets.

NASDAQ Index Fund Mutual Funds Has a Higher Concentration of the Technology Sector

The NASDAQ 100 Index has a majority of the companies from the technology sector. The cumulative weightage of the technology companies is far higher than the cumulative weightage of all other companies from all other sectors. So, it is a concentrated index, and its returns depend on the technology sector's performance.

For example, the shares of technology companies fared poorly in 2022, resulting in the NASDAQ 100 Index crashing 32% in that year. Similarly, the shares of technology companies outperformed in 2023, resulting in the NASDAQ 100 Index giving stellar returns of 55.13% in that year.

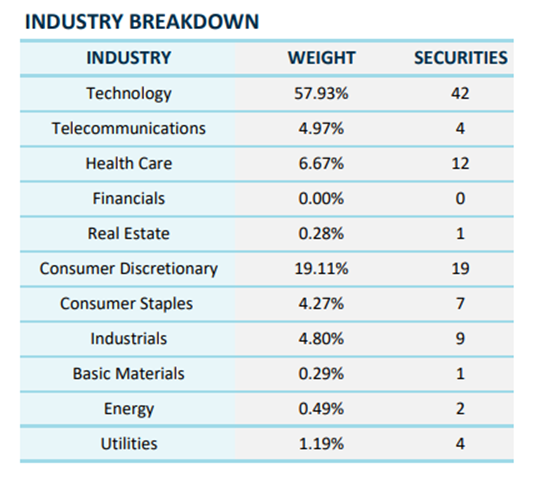

Table: Nasdaq 100 Index – Sectoral Weights

Note: The above information is as of 29th December 2023.

The above table shows the NASDAQ 100 Index has 42 companies from the technology sector. The sector has a huge 57.93% weightage in the index. Thus, the index returns are heavily dependent on the performance of shares of technology companies.

On the other hand, India's Nifty 50 Index is more diversified. The financial services sector has the highest weightage of 35.26% (as of 29th December 2023) compared to the technology sector's 57.93% weightage in the NASDAQ 100 Index. The other sectors with decent weightage in the Nifty 50 Index include IT (13.63%), oil & gas (11.40%), FMCG (9.16%), etc. Hence, you may consider investing in the diversified Nifty 50 Index rather than technology concentrated NASDAQ 100 Index.

Should You Invest in International Mutual Funds?

In the last few years, Indians have warmed up to international mutual funds due to good returns from international indices such as NASDAQ 100, S&P 500, etc. However, when investing in these indices, you need to bear in mind that you are taking exposure to a mature US economy with low economic growth, currency risks (if the INR appreciates), technology-concentrated indices such as NASDAQ 100, etc.

Do you still want to go ahead for reasons like geographical diversification beyond India, exposure to global MNCs not available in India, etc.? In that case, you may allocate a small part of your portfolio to it.

Your Investing Experts

Relevant Articles

When Is the Right Time to Start Investing for Your Goals?

When is the right time to start investing for your goals? Many believe the answer depends on market stability, income comfort, or economic certainty. In reality, the right time is when your goals are clear and you are prepared to act with discipline. Wealth is rarely created by waiting. It is built through consistent participation guided by a defined investment process.

How to Adjust Your Investments After a Salary Raise

A salary hike is more than a pay revision, it is an opportunity to realign your financial direction. The smartest response to higher income is not immediate lifestyle expansion, but a structured review of your goals, debt position, and investment contributions. When handled thoughtfully, each raise can accelerate wealth creation rather than simply increase monthly expenses.

Why Mid-Cap Allocation Needs More Discipline Than Large Cap

Mid-cap allocation demands more discipline than large cap because it comes with sharper market swings. While mid caps offer higher long-term growth potential, they also test investor patience during downturns. The key is not choosing one over the other, but understanding how each behaves across market cycles.

.png)