Investing Insights

Should you invest into NFO’s (New Fund Offers)?

AMFI's ad campaign boosts mutual fund interest, but investors must cautiously assess NFOs amidst SEBI's re-categorization.

Indian Fathers Prioritize Daughters' Education Over Early Marriage as Per FinEdge Study

At 30, the highest priority goal for fathers is to buy a home (26%), with only 6% of them actively planning for their children's futures at this stage. Only 1 in 5 respondents prioritize their retirement over their child's education; proclivity for retirement planning is slightly more pronounced in the south zone

How FinEdge is leveraging Tech during the COVID-19 pandemic

We are currently in the midst of unprecedented times. As the COVID-19 pandemic brings the world to a literal standstill, Financial Advisors are scrambling to find their feet and continue serving their customers. To add fuel to the fire, equity markets witnessed a selloff of unrivalled proportions as fear and panic took over right after the lockdown began. During the past month of the crisis, FinEdge has proudly continued to deliver high quality Financial Advice to customers, while ensuring the complete safety of its employees. Here are some ways in which leveraging on technology has helped us in our endeavours.

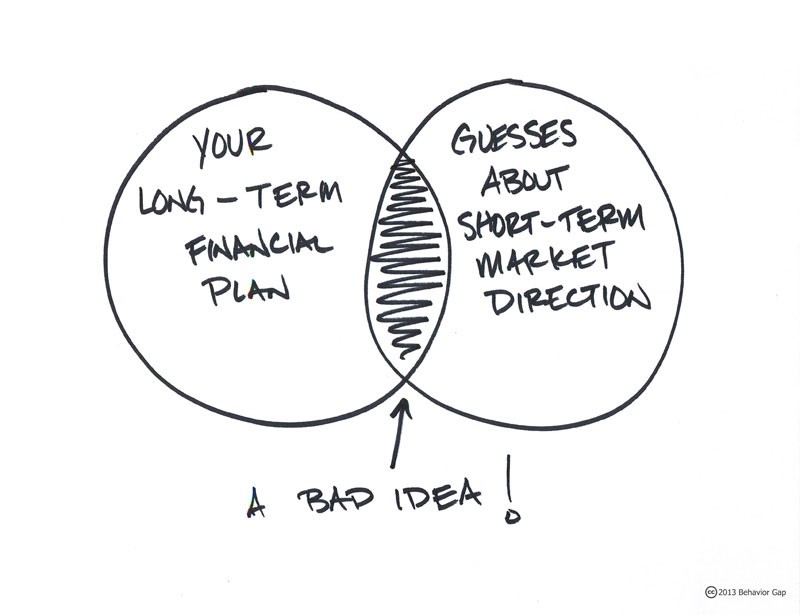

5 Behavioural Traps That Could Hurt Your Mutual Fund Investments

Learn 5 key biases impacting long-term mutual fund returns to boost your investment success.

Maintaining Your Financial Health With a Financial Advisor

Financial health is essential to an individual’s well-being and stability. Unfortunately, many people lack the knowledge and skills to properly manage their finances. This is where a financial advisor can help. A financial advisor is a professional who provides financial advice and services to clients. They are knowledgeable in the areas of budgeting, investments, taxes, retirement planning, and estate planning. An advisor can help you develop a plan to manage your money and reach your financial goals.

Financial Planner vs Financial Advisor: What's the Difference?

Financial planning is a crucial part of a person’s overall financial health. People often use the terms “financial planner” and “financial advisor” interchangeably, but they are not the same. Although they both help people manage their finances, they offer different services and specialize in different areas of financial planning.

Factors To Consider Before Investing in ELSS

Investing in equity linked savings schemes (ELSS) is a popular way to save money and grow wealth. ELSS Mutual Funds provide tax saving benefits, along with the potential to earn higher returns than some other investment options. However, before investing in ELSS fund, there are several factors that should be considered.

Here's Why ELSS Investment is Better Than PPF & NSC

Read this blog to learn why ELSS is better investment option than PPF & NSC. Besides tax savings, it offers capital appreciation. To know more ELSS mutual funds, visit FinEdge now!

Are You Saving Enough For Your Child’s Education?

Working with a financial planner to save for your child’s education is one of the most important things you can do as a parent. It can be difficult to decide how much you should be saving and where to put your money, but it’s essential to have a solid child education plan in place Here we look at the importance of saving for your child’s education, how to go about it, and what to consider when planning for their future.

How To Calculate And How Much To Save For Your Child's Wedding

Planning for your child’s wedding is a significant financial goal for many Indian parents. With strategic investment planning and the power of compounding, you can systematically build a wedding fund without financial strain. This guide will help you determine how much to save and how a SIP return calculator can simplify the process.

Why is Financial Independence Important for a Woman

Women and financial independence have become increasingly important topics in recent years, as women continue to strive for more recognition and autonomy in the workplace, and in society at large.

The Importance Of Financial Independence For Women

Women and financial independence have become increasingly important topics in recent years, as women continue to strive for more recognition and autonomy in the workplace, and in society at large. Financial independence is a key part of gaining power and control in all aspects of life. With more women in positions of leadership and financial responsibility, the importance of financial independence is becoming increasingly clear.

Latest Posts

Does High Income Make You Wealthy?

Feb 27, 2026

Retirement Planning in India: A Practical Framework for Long-Term Security

Feb 25, 2026

When Is the Right Time to Start Investing for Your Goals?

Feb 23, 2026

How to Adjust Your Investments After a Salary Raise

Feb 20, 2026

Why Mid-Cap Allocation Needs More Discipline Than Large Cap

Feb 18, 2026

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

Investing Stories

.jpg)

.jpg)

_(1)1.jpg)

.jpg)

.jpg)

.jpg)