How a Financial Advisor in Agra Can Help Investors Secure Their Future

Agra is more than just a city; it’s a legacy of history, culture, and architectural brilliance. Agra is best known for the iconic Taj Mahal, but it is also home to two other UNESCO World Heritage Sites—the majestic Agra Fort and the historic city of Fatehpur Sikri.

Beyond its historical marvels, Agra thrives as a major commercial hub, renowned for its leather goods, cut stone industry, and handwoven carpets. While tourism drives much of Agra’s economy, the city has a vast industrial and entrepreneurial base. It is also rapidly modernizing, with projects like the Agra Metro and the Yamuna Expressway, which have boosted infrastructure and connectivity, making the city even more dynamic.

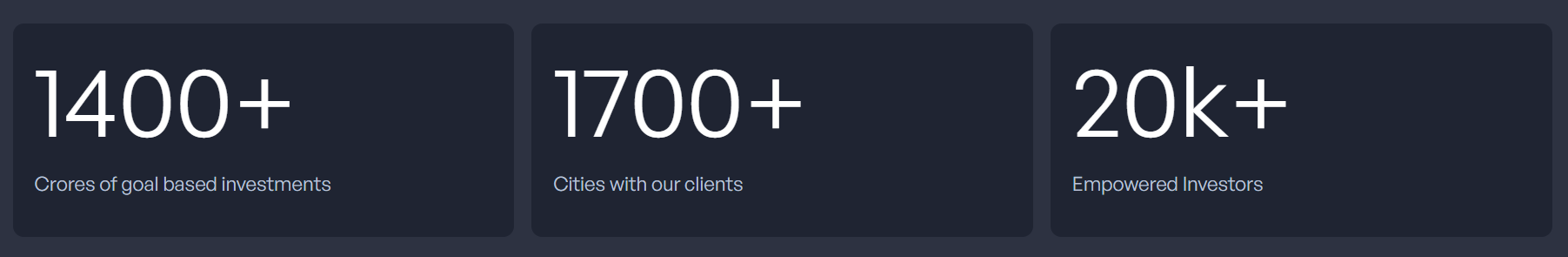

Why FinEdge is the Preferred Investing Platform for Agra's Investors

Why FinEdge | Customised Investment Plan | Best Financial Advisor

Investment Planning in Agra

It took Shah Jahan 22 years to build the Taj Mahal, a masterpiece created through meticulous planning, patience, and long-term vision. Similarly, a successful financial journey requires the same principles.

Let’s explore the investment process that helps investors in Agra achieve their financial goals:

• Long-Term Approach: Wealth is built over time by staying invested for the long term. While markets can be volatile, understanding short-term volatility and maintaining a long-term perspective is crucial. The Taj Mahal is celebrated as one of the Seven Wonders of the World, but as Albert Einstein famously said, compounding is the eighth wonder. To truly benefit from the power of compounding, a disciplined, long-term investment approach is essential.

• Goal-Focused Approach: Many investors make the mistake of chasing high returns, often switching investments based on short-term performance. However, true financial success comes from aligning investments with meaningful life goals like retirement or purchasing a home rather than focusing on returns.

• Discipline: Beyond setting goals and maintaining a long-term perspective, staying consistent with investments and preventing biases from hampering decisions is crucial. Market fluctuations can tempt investors to react impulsively, but a disciplined approach, investing regularly and committing to the plan, ensures steady progress toward financial goals.

• Expertise: Just as skilled artisans crafted Agra’s iconic monuments with precision, a financial advisor in Agra can ensure investments are well-planned and personalized. A guided approach helps investors navigate uncertain times, stay resilient, and achieve their financial goals.

Your Investing Experts

The Role of a Financial Advisor in Agra

A financial advisor in Agra can act as a guide, helping investors cut through the noise and make informed, and goal-aligned decisions.

Here’s why expert guidance in Agra is essential:

• Information Clutter: In today’s world, investors are bombarded with advice, market trends, and endless investment options, from equities and debt to approaches like SIPs and lump sum investments. Additionally, insurance-linked products like ULIPs are widely promoted. Ad-hoc investing driven by FOMO can derail an investor’s journey toward financial goals. A financial advisor in Agra ensures that every decision is well-aligned with the investor’s objectives, creating a structured and purpose-driven investment plan.

• Managing Investing Behaviour: Market volatility often triggers panic, leading to impulsive decisions that can harm long-term wealth creation. A drop in the market today will not impact your retirement goal which is 20 years away. A financial advisor in Agra helps investors stay disciplined, ensuring that every decision is well thought out rather than driven by speculation.

• Informed Risk: Sometimes, avoiding risk can be the biggest risk. While savings accounts and fixed deposits offer stability, they may not outpace inflation in the long run. A good financial advisor in Agra ensures that inflation and long-term growth are factored into investment decisions.

• Personalization: Every investor’s journey is unique, and a one-size-fits-all approach doesn’t work. A financial advisor in Agra can tailor investments based on goals, risk tolerance, and financial situation, ensuring a personalized and structured roadmap for long-term growth.

Leveraging Technology For Investment Planning With Dreams into Action (DiA)

There are many tech-based DIY investing platforms available, but they often lead to impulsive decisions and chasing past returns, which can be detrimental to long-term wealth creation. DiA, FinEdge’s tech-enabled platform, seamlessly integrates cutting-edge technology with expert guidance, providing investors with a structured and goal-driven investment experience.By blending human expertise with state-of-the-art technology, DiA empowers investors to make informed decisions, build resilience, and stay committed to their financial goals.

DiA combines convenience and efficiency with personalization and collaboration, making investing accessible regardless of a busy schedule or travel commitments. Whether at home or on the move, it ensures seamless access to your investment roadmap anytime, anywhere.

Also Read: Financial Advisor in Dehradun

A Strong Investment Plan for a Secure Future

Achieving financial goals, much like Agra’s legacy, requires careful planning, discipline, and a long-term perspective. With expert-driven decisions, and a tech-enabled roadmap, investors in Agra can secure their financial future and turn their financial dreams into reality.

Looking to build a structured, goal-oriented investment plan?

Start today with expert guidance and take control of your financial future!

Attain Financial Freedom

FAQs

Are SIPs a good choice for long-term investing?

While every investment decision should be based on a personalized process aligned with your goals, SIPs (Systematic Investment Plans) are a strong approach for long-term investing. They promote consistency and discipline by allowing you to invest at regular intervals, reducing the impact of market fluctuations through rupee cost averaging. Additionally, the power of compounding helps grow wealth over time. You can also step-up your investments to accelerate progress toward your financial goals, making SIPs a flexible and effective strategy for long-term wealth creation.

Are ULIP plans a good investment choice?

Insurance and investments serve distinct purposes—insurance provides financial protection while investing focuses on growing wealth. Combining the two can result in insufficient protection or hindered wealth growth. Insurance-linked products are often mis-sold due to high commissions, leading investors to unknowingly compromise on both protection and returns. This is where expert guidance makes a difference—a financial advisor ensures that products are aligned with the investor’s best interest, that is, they are adequately protected and can achieve financial goals.

What Our Clients Say About Us

Related Articles

How to Choose the Best Financial Advisor

With a multitude of options available, such as DIY platforms, understand how to identify an approach that is truly "client-centric" and "goal-focused".

Why Kolkata Professionals Need Investment Experts to Manage Their Portfolio

Consult with the best Portfolio Managers in Kolkata for investment planning. Invest for your goals through experts.