How the Right Financial Advisor in Lucknow Can Help You Create Wealth

Lucknow, the capital of India’s most populous state, Uttar Pradesh, is known as the City of Nawabs. It is a food lover’s paradise, a hub of cultural excellence, and a key economic center driving Uttar Pradesh’s ambitious $1 trillion economy goal. It’s a place where history meets rapid progress. From its rich cultural heritage to its booming IT and retail sectors, Lucknow is evolving into a major economic powerhouse. It is also home to thriving businesses and the regional headquarters of major corporations like Reliance Retail and Sony Corporation.

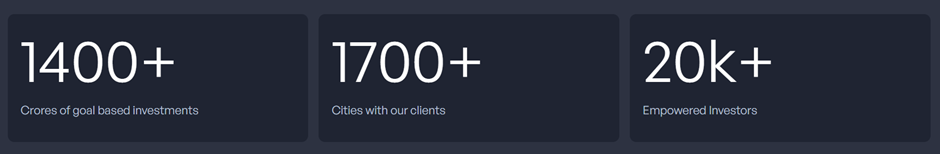

Why FinEdge is the Preferred Investing Platform for Investors in Lucknow

Why FinEdge | Customized Investment Plan | Best Financial Advisor

Goal-Based Investing for the Residents of Lucknow

Investing without a goal is like stitching without having a pattern in mind—you might put in effort, but the end result may not be what you expected. Just like Lucknow’s famous Chikankari embroidery, where each stitch is placed with precision to create a beautiful garment, an investment plan should be created carefully to align with your unique aspirations.

Whether you’re saving for your child’s education, planning your dream home, or securing a comfortable retirement, your investment strategy should be tailored to your needs. A structured investment plan ensures that every financial decision contributes to a larger goal rather than being driven by short-term market movements or trends.

Your Investing Experts

Importance of a Financial Advisor

Personalized Investments

Just like Lucknow’s famous kebabs—where you have Galawati, Kakori, Shami, Seekh, and many more varieties—investing, too, comes with multiple options. From equity and debt to fixed deposits, there is no shortage of choices. But just as every kebab has a unique recipe, every investment option serves a different purpose. A financial advisor can help align your investments with your personal financial goals rather than picking what looks appealing at the moment.

Cut Through the Noise

Investing is easy, but wealth creation is not. While information about investing is readily available, not everyone ends up creating wealth. It is easy to get overwhelmed by the options or fall into the FOMO trap and chase returns. A financial advisor helps you focus on what really matters: your financial goals. Instead of running after the latest stock tip or high-return scheme, you get a structured plan that works for you.

Staying Calm During Volatility

Investing isn’t just about picking the right funds—it’s about following a disciplined process for the long term. Many people try to time the market with the intention of booking profits, but this approach can be detrimental to one’s goal-achievement journey. A trusted financial advisor helps you stay focused on the long-term picture by avoiding emotional decisions that may hamper your important goals.

Leveraging Technology for a Smart Investment Plan – Dreams into Action

Just as Lucknow is modernizing with its growing IT and retail sectors, investing has also evolved. Our tech-enabled platform, Dreams into Action (DiA) combines technology with expert guidance to make investment planning easy, structured, and effective.

Hyper-customization

Every investor is different. DiA helps create a customized plan based on income, expenses, goals, and risk tolerance to ensure smart, goal-focused investing.

Client Centricity

Unlike sales-driven models, we focus only on what’s best for the investor. Every recommendation is made to help achieve financial goals.

Scenario Analysis

Factors like inflation are always considered. Investors can understand their progress, adjust their investments, and use strategies like step-ups to stay on track.

Lucknow is Growing—So Should Your Wealth!

The city is on an exciting journey of growth and transformation. Your money should be on the same path. The key is to invest with purpose, have patience, and stay resilient.

If you're ready to start planning for your long-term financial goals, take the first step today. Smart investing isn’t about luck—it’s about following the right process with the right guidance!

Also Read: Financial Advisor in Bhopal

Attain Financial Freedom

FAQs

Are mutual funds a good investment option?

Mutual funds can be a great option for long-term investing as you can opt for approaches like SIPs to benefit from the principle of accumulation and the power of compounding. SIPs in Mutual Funds help accumulate a corpus for your goals over a long investing journey. Mutual Funds rely on the expertise of a fund management team and follow principles of diversification to mitigate risk. However, to invest in a Mutual Fund, you must take help from an Investment expert who has the ability to create a customised investment plan and is by your side to see through your long term investment journey. Make sure that the expert is credible, reputable and has good reviews from clients. A great way to check on this would be to go through Google reviews of any entity you are aligned with.

How can the residents of Lucknow create a good investment plan?

The most important factor that investors should keep in mind is to be aligned to investment experts who can create an investment plan that is highly customised to their requirements. A good investment plan is the outcome of a great investing process and helps you achieve your financial goals—like buying a home, funding your child's education or planning for retirement. Investments should be aligned with these goals and a highly disciplined approach is key to achieving them. Seeking guidance from an expert is important as they would not only help create an effective investment plan but would also help navigate market volatility and ensuring that investments stay on track towards long term objectives.

Is a financial advisor in Lucknow important?

In today’s age of technology, geographies do not matter, so an advisor does not have to be physically present in Lucknow or any other city. DIY or ‘transaction only’ platforms do not help create long term wealth as these platforms do not have an expert guiding investors throughout the investing journey of an investor. Residents of Lucknow can benefit from investment experts who are available online and follow a high-tech, human interface bionic model. A financial advisor adds immense value by helping investors stay focused and disciplined, ensuring they follow a structured approach rather than making emotional or impulsive investment decisions. During market fluctuations, expert guidance can provide clarity and prevent panic-driven actions that may derail financial goals.

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

What Our Clients Say About Us

Related Articles

Top Tips for Successful Investment Portfolio Management

Learn what investment portfolio management is and how to build and manage an investment portfolio.

Why Mumbai Professionals Need Investment Experts to Manage Their Portfolio

Consult with the best Portfolio Managers in Mumbai for investment planning. Invest for your goals through experts.